RIYADH: Saudi Arabia’s industrial output climbed 7.1 percent year on year in August, driven by strong gains in the manufacturing and mining sectors, official data showed.

According to preliminary figures from the General Authority for Statistics, the Kingdom’s Industrial Production Index rose to 114.2 during the month, reflecting a 1.42 percent increase from July.

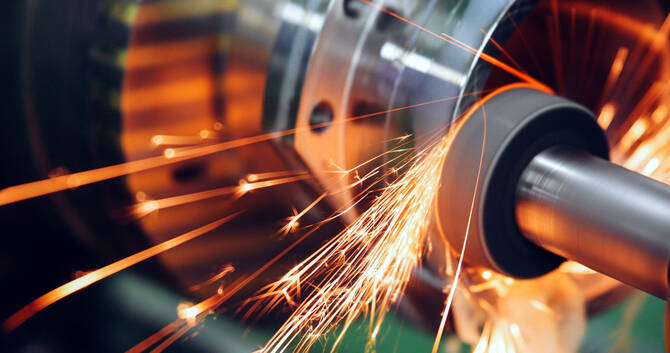

Manufacturing activities increased by 5.6 percent year on year in August, primarily propelled by an 8.9 percent rise in the production of coke and petroleum products.

Mining and quarrying output advanced 8.1 percent, supported by higher oil production, which averaged 9.72 million barrels per day, up from 8.99 million bpd a year earlier.

Strengthening the manufacturing sector is a key objective under Saudi Arabia’s Vision 2030 agenda, as the Kingdom continues to diversify its economy and reduce dependence on crude revenues.

“Preliminary results indicate a 7.1 percent increase in the Industrial Production Index in August 2025 compared to the same month of the previous year,” said GASTAT.

The authority attributed this growth to rises in key sectors, including mining and quarrying, manufacturing, and electricity, gas, and water supply activities.

The manufacture of chemicals and chemical products also rose 8.6 percent compared with August 2024.

On a month-to-month basis, the manufacturing sub-index advanced 0.3 percent, driven by a 0.4 percent increase in the production of coke and refined petroleum products.

Compared to July, mining and manufacturing activities rose 2.1 percent in August.

GASTAT reported that electricity, gas, steam, and air conditioning supply activities recorded an annual increase of 8.7 percent, while water supply, sewerage, waste management, and remediation operations rose 6 percent.

In August, oil-related activities expanded 8.3 percent year on year and 1.7 percent month on month, while non-oil activities grew 4.4 percent annually and 0.7 percent from the previous month — underscoring Saudi Arabia’s ongoing efforts to diversify its industrial base under Vision 2030.

In a separate report released in September, GASTAT said Saudi Arabia’s real gross domestic product grew 3.9 percent in the second quarter, fueled by robust non-oil activity that extended its growth streak to 18 consecutive quarters.