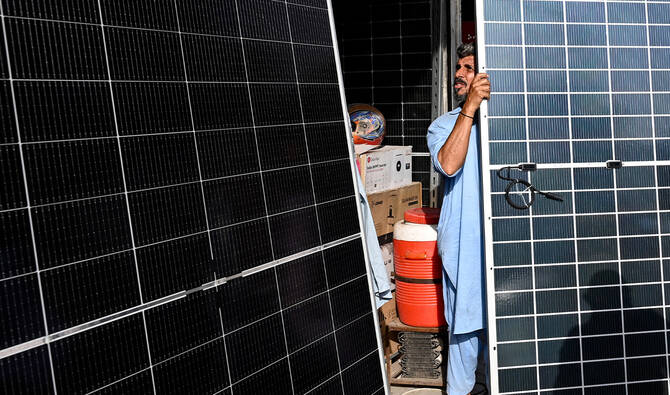

ISLAMABAD: Pakistan’s Senate Standing Committee on Finance and Revenue this week urged the government to withdraw a proposed 18 percent general sales tax (GST) on imported solar panels, saying some stakeholders were stockpiling equipment ahead of the federal budget to avoid the new levy.

Under the proposed federal budget for fiscal year 2025–26, the government has included the 18 percent GST on the import and local supply of solar panels and related equipment. The plan has raised concerns among industry players and clean energy advocates who warn that higher costs could slow the rapid uptake of household and commercial rooftop solar systems and undermine national targets for increasing renewable energy’s share in Pakistan’s power mix.

So far this year, solar has provided 25 percent of Pakistan’s grid electricity, placing the country among fewer than 20 worldwide that generate at least a quarter of their monthly power from solar farms.

Pakistan imported 17 gigawatts (GW) of solar panels in 2024 — double the previous year’s volume — to meet surging consumer demand, according to the Global Electricity Review 2025.

“The committee strongly recommended withdrawing the proposed 18 percent GST on solar panels,” the Senate secretariat said in a statement released on Tuesday after the standing committee’s fifth session to review the budget for fiscal year 2025–26.

“Members observed that ahead of the budget, certain stakeholders had imported and dumped solar equipment in anticipation of the tax hike.”

Senator Saleem Mandviwalla, the chairman of the committee, called the government’s move “discriminatory” in nature.

“The committee rejects the sudden imposition of GST on solar imports and urges immediate withdrawal,” the statement quoted him as saying.

Sharmila Faruqui, a member of the National Assembly’s finance committee, also echoed the Senate panel’s call to scrap the proposed tax.

“I’m in the finance committee and the members have unanimously rejected this tax,” she told Arab News.

Pakistan increased its solar electricity generation at a rate more than three times the global average in 2025, driven by a surge in solar capacity imports that were over five times higher than in 2022, according to data from Ember, a UK-based energy think tank.

This rapid growth in both capacity and output has propelled solar energy from being the country’s fifth-largest power source in 2023 to the top spot in 2025.

With inputs from Reuters