Global markets plunged Monday following last week’s two-day meltdown on Wall Street, and President Donald Trump said he won’t back down on his sweeping new tariffs, which have roiled global trade.

Countries are scrambling to figure out how to respond to the tariffs, with China and others retaliating quickly.

Trump’s tariff blitz fulfilled a key campaign promise as he acted without Congress to redraw the rules of the international trading system. It was a move decades in the making for Trump, who has long denounced foreign trade deals as unfair to the US

The higher rates are set to be collected beginning Wednesday, ushering in a new era of economic uncertainty with no clear end in sight.

Here’s the latest:

Chinese officials meet business representatives from Tesla and other US companies.

Chinese government officials met business representatives from Tesla, GE Healthcare and other US companies on Sunday. It called on them to issue “reasonable” statements and take “concrete actions” on addressing the issue of tariffs.

“The United States in recent days has used all sorts of excuses to announce indiscriminate tariffs on all trading partners, including China, severely harming the rules-based multilateral trade system,” said Ling Ji, a vice minister of commerce, at the meeting with 20 US companies.

“China’s countermeasures are not only a way to protect the rights and interests of companies, including American ones, but are also to urge the US to return to the right path of the multilateral trading system,” Ling added.

A man looks at a screen showing Chinese stock market movements as he uses his mobile phone in Beijing on April 7, 2025. (AFP)

Ling also promised that China would remain open to foreign investment, according to a readout of the meeting from the Ministry of Commerce.

Malaysia wants Southeast Asia to present a united response to tariffs

Malaysia’s Trade Minister Zafrul Abdul Aziz said his country wants to forge a united response from Southeast Asia to the sweeping US tariffs.

Malaysia, which is the chair of the Association of Southeast Asian Nations this year, will lead the regional bloc’s special Economic Ministers’ Meeting on April 10 in Kuala Lumpur to discuss the broader implication of the tariff measures on regional trade and investment, Zafrul told a news conference on Monday.

“We are looking at the investment flow, macroeconomic stability and ASEAN’s coordinated response to this tariff issue,” Zafrul said.

ASEAN leaders will also meet to discuss member states’ strategies and to mitigate potential disruptions to regional supply chain networks.

Pakistan plans to send a government delegation to Washington this month to discuss how to avoid the 29% tariffs imposed by the US on imports from Pakistan, officials said Monday.

The development came two days after Pakistan’s prime minister asked its finance minister to send him recommendations for resolving the issue. The US imports around $5 billion worth of textiles and other products from Pakistan, which heavily relies on loans from the International Monetary Fund and others.

The Pakistan Stock Exchange fell rapidly on Monday. The exchange suspended trading for an hour after a 5% drop in its main KSE-30 index.

Mideast markets follow oil prices lower

Middle East stock markets tumbled as they struggled with the dual hit of the new US tariffs and a sharp decline in oil prices, squeezing energy-producing nations that rely on those sales to power their economies and government spending.

Benchmark Brent crude is down by nearly 15% over the last five days of trading, with a barrel of oil costing just over $63. That’s down nearly 30% from a year ago, when a barrel cost over $90.

That cost per barrel is far lower than the estimated break-even price for producers. That’s coupled with the new tariffs, which saw the Gulf Cooperation Council states of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates hit with 10% tariffs. Other Mideast nations face higher tariffs, like Iraq at 39% and Syria at 41%.

The Dubai Financial Market exchange fell 5% as it opened for the week. The Abu Dhabi Securities Exchange fell 4%.

Markets that opened Sunday saw losses as well. Saudi Arabia’s Tadawul stock exchange fell over 6% in trading. The giant of the exchange, Saudi Arabia’s state-owned oil company Aramco, fell over 5% on its own, wiping away billions in market capitalization for the world’s sixth-most-valuable company.

Beijing struck a note of confidence on Monday even as markets in Hong Kong and Shanghai tumbled.

“The sky won’t fall. Faced with the indiscriminate punches of US taxes, we know what we are doing and we have tools at our disposal,” wrote The People’s Daily, the Communist Party’s official mouthpiece.

China announced a slew of countermeasures on Friday evening aimed at Trump’s tariffs, including its own 34% tariffs on all goods from the US set to go in effect on Wednesday.

Australian dollar drops to levels last seen early in pandemic

The Australian dollar fell below 60 US cents on Monday for the first time since the early months of the COVID-19 pandemic.

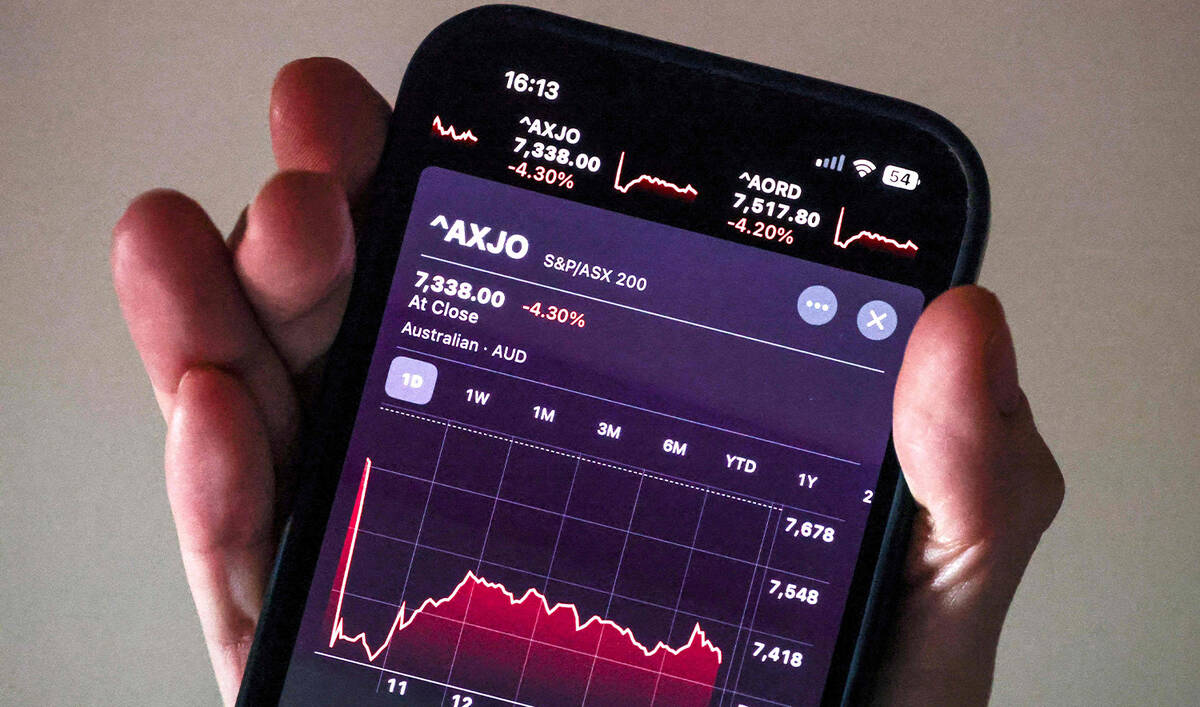

A photo illustration shows a mobile phone displaying a graph of the Australian stock market figures at the close of trading, in Sydney on April 7, 2025. (AFP)

The drop reflected concerns over the Chinese economy and market expectations for four interest rate cuts in Australia this calendar year, Australian Treasurer Jim Chalmers said.

“What our modeling shows is that we expect there to be big hits to American growth and Chinese growth and a spike in American inflation as well,” Chalmers said.

“We expect more manageable impacts on the Australian economy, but we still do expect Australian GDP to take a hit and we expect there to be an impact on prices here as well,” he added.

The Trump administration assigned Australia the minimum baseline 10% tariff on imports in the United States. The US has enjoyed a trade surplus with Australia for decades.

Indian stocks fell sharply on Monday, seeing their biggest single-day drop in percentage terms since March 2020 amid the pandemic.

The benchmark BSE Sensex and the Nifty 50 index both dropped about 5% after trading opened but then recovered slightly. Both were later trading down about 4 percent.

President Donald Trump said Sunday that he won’t back down on his sweeping tariffs on imports from most of the world unless countries even out their trade with the US, digging in on his plans to implement the taxes that have sent financial markets reeling, raised fears of a recession and upended the global trading system.

Speaking to reporters aboard Air Force One, Trump said he didn’t want global markets to fall, but also that he wasn’t concerned about the massive sell-off either, adding, “sometimes you have to take medicine to fix something.”

His comments came as global financial markets appeared on track to continue sharp declines once trading resumes Monday, and after Trump’s aides sought to soothe market concerns by saying more than 50 nations had reached out about launching negotiations to lift the tariffs.

“I spoke to a lot of leaders, European, Asian, from all over the world,” Trump said. “They’re dying to make a deal. And I said, we’re not going to have deficits with your country. We’re not going to do that, because to me a deficit is a loss. We’re going to have surpluses or at worst, going to be breaking even.”

Asian markets plunged on Monday following last week’s two-day meltdown on Wall Street, and US President Donald Trump said he won’t back down on his sweeping tariffs on imports from most of the world unless countries even out their trade with the US

Tokyo’s Nikkei 225 index lost nearly 8% shortly after the market opened on Monday. By midday, it was down 6%. Hong Kong’s Hang Seng dropped 9.4%, while the Shanghai Composite index was down 6.2%, and South Korea’s Kospi lost 4.1%

US futures also signaled further weakness.

Market observers expect investors will face more wild swings in the days and weeks to come, with a short-term resolution to the trade war appearing unlikely.