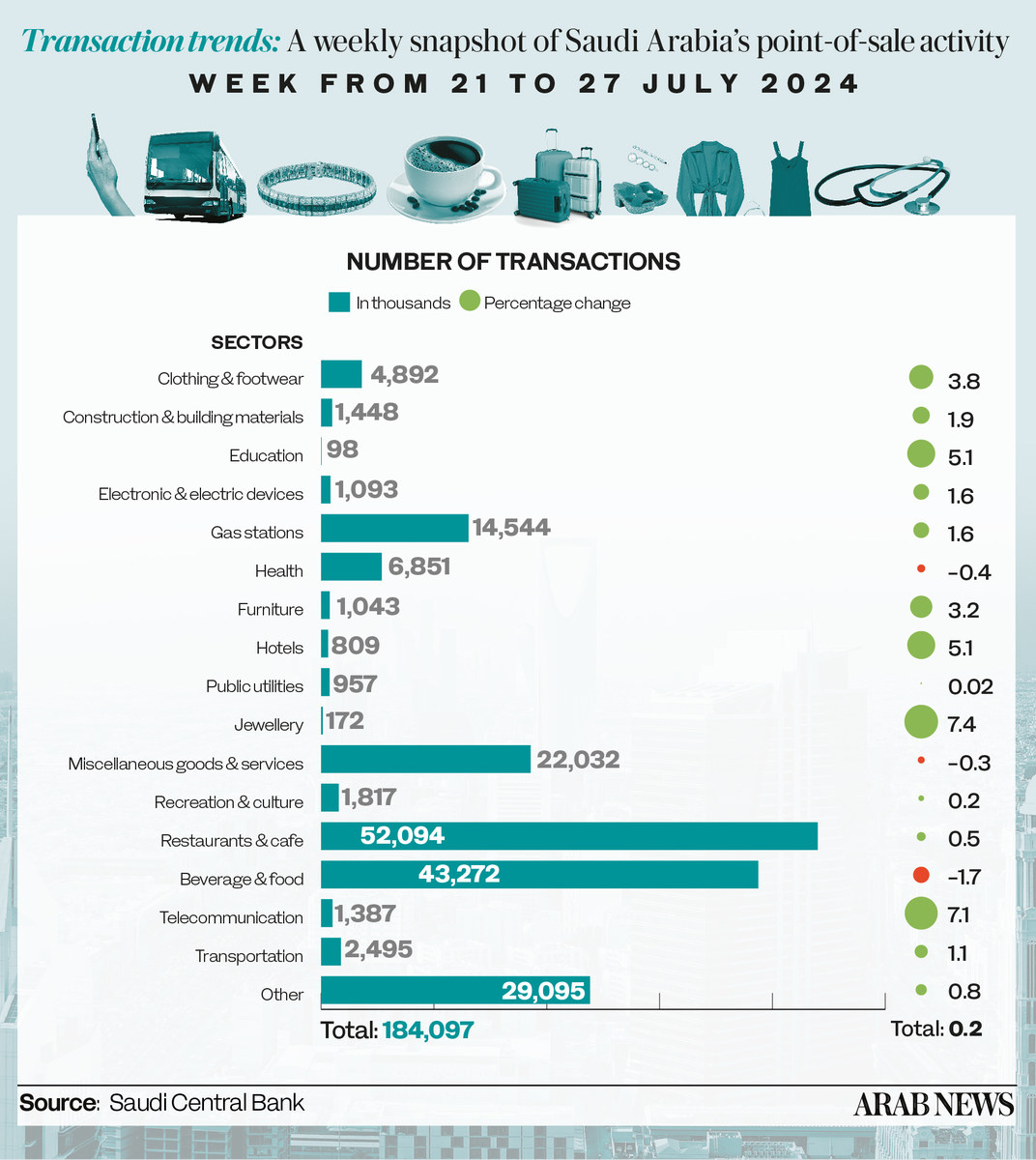

RIYADH: Point-of-sale spending in Saudi Arabia reached SR11.2 billion ($2.99 billion) from July 21 to 27, marking a weekly increase of 2.8 percent, according to official data.

The latest figures from the Saudi Central Bank, also known as SAMA, revealed that the education sector saw the biggest increase of 23.4 percent during the week, with the total value of transactions surging to SR116.1 million, up from SR94.1 million in the previous seven-day period.

From July 20 to 27, POS spending in the Kingdom regained its positive direction after decreasing by 8.8 percent the week before.

Data from SAMA for this week showed that Saudis spent SR209.9 million on jewelry, a rise of 18.8 percent, the second-biggest increase this week.

Hotel spending also advanced and came in third place, registering an 8.6 percent surge and a value of SR293.6 million.

This week’s POS transactions have shown no negative figures in terms of purchase values. The smallest increase, at 0.4 percent, was observed in spending on food and beverages, which accounted for the second-biggest share of POS transactions, bringing the total expenditure to SR1.65 billion.

The second-smallest increase, at 0.8 percent, was observed in gas stations, with transaction values reaching SR782.4 million during the monitored period.

For the second consecutive week, restaurant and cafe outlays dominated POS spending, reaching SR1.69 billion. Both this sector and the health sector, which reached SR706.3 million, shared the third-smallest rise of 1.4 percent.

The third-largest share, amounting to SR14.2 billion, was spent on miscellaneous goods and services. Spending on the top three largest categories accounted for 42.45 percent of this week’s total POS value.

According to data from SAMA, 33.1 percent of POS spending occurred in Riyadh, with the total transaction value reaching SR3.72 billion, representing a 2.5 percent rise from the previous week.

Spending in Jeddah followed, accounting for 14.4 percent of the total and reaching SR1.62 billion, marking a 2.9 percent weekly positive change.

Expenditures in Dammam came in third place, accounting for SR534.3 million, marking a 4.7 percent increase — the second-largest surge in terms of transaction values.

The largest increase, at 4.9 percent, was observed in Madinah, with spending reaching SR441.6 million.

Buraidah registered the only negative weekly change, with transaction values decreasing by 0.2 percent to settle at SR249.2 million.