KARACHI: The Executive Board of the International Monetary Fund (IMF) is scheduled to meet today, Thursday, in Washington for the first review of a $3 billion short-term financing package and to consider the release of the $700 million second tranche to Pakistan.

The board had approved a much-needed, 9-month Stand-By Arrangement (SBA) for the country last year in July to support the government’s economic stabilization program. Pakistan also received the first tranche of $1.2 billion along with the endorsement for the loan program.

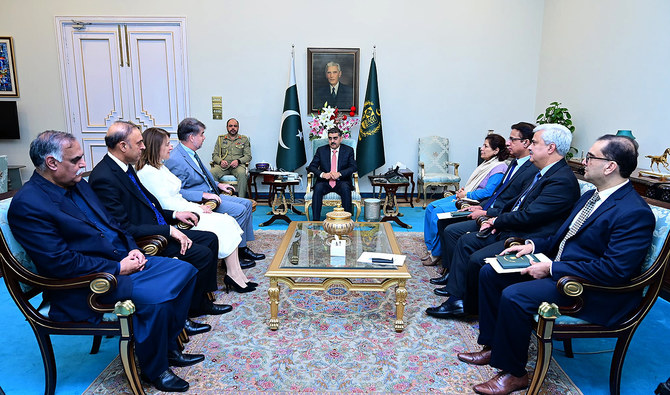

A visiting IMF delegation and Pakistani authorities reached a staff-level agreement (SLA) over the first review under the SBA in November, which was subject to the executive board’s approval to unlock the $700 million disbursement. Pakistani economists said they were hopeful the country would comfortably get access to the money after the SLA.

“There are big chances that the IMF board will easily grant approval for the disbursement of the funds to Pakistan because the country has successfully implemented the reforms and reached an SLA,” Dr. Sajid Amin, Deputy Executive Director at the Sustainable Development Policy Institute (SDPI), told Arab News.

Amin hoped the IMF board’s approval would help Pakistan’s national currency to regain some of its lost value, adding it would also have a positive impact on the country’s overall economic landscape.

Pakistan cleared the first review under the SBA after taking painful economic measures, including increases in energy prices and tax burden, which led to spiraling inflation that hit 38 percent in May last year. The prices of essential commodities still remain quite elevated.

As Pakistan prepares for the national election on Feb. 8, experts say it will have to chart a clear roadmap to run the economy.

“The next review of the program is important for Pakistan since it will lay down the foundation for the next IMF facility which the country will require,” Amin said.

Timely national elections and a well-thought-out economic gameplan by the next elected government will help secure the fresh IMF program and avoid any economic panic situation in the future, Amin argued.

Preparations for a follow-on program are likely to start after the conclusion of the current SBA in April 2024, as the country is scheduled to elect its new political leaders in the coming month.

Pakistan’s economic landscape has weathered a storm in recent years with fluctuating commodity prices, political turmoil and harsh blows dealt by floods.

The nation has been grappling with trade and current account deficits, mounting inflation and low foreign exchange reserves that exerted pressure on the currency that also hit historic lows against the United States dollar.

IMF board expected to approve $700 million disbursement for Pakistan later today

https://arab.news/rwxhn

IMF board expected to approve $700 million disbursement for Pakistan later today

- The board approved a much-needed, 9-month loan amounting to $3 billion in July to support economic stabilization program

- Experts say a clear economic roadmap can set the foundation for the next IMF program for Pakistan after the general elections

Pakistan issues over $7 billion sukuk in 2025, nears 20 percent Shariah-compliant debt target

- Finance Adviser Khurram Schehzad says this was the highest-ever Sukuk issuance in a single calendar year since 2008

- Pakistan’s Federal Shariat Court ordered in 2022 the entire banking system to transition to Islamic principles by 2027

ISLAMABAD: Pakistan’s Finance Adviser Khurram Schehzad on Monday said the country achieved a landmark breakthrough in Islamic finance by issuing over Rs2 trillion ($7 billion) sukuk this year, bringing it closer to its 20 percent Shariah-compliant debt target by Fiscal Year 2027-28.

A sukuk is an Islamic financial certificate, similar to a bond, but it complies with Shariah law, which forbids interest. Pakistan’s Federal Shariat Court (FSC) had directed the government in April 2022 to eliminate interest and align the country’s entire banking system with Islamic principles by 2027.

Following the ruling, the government and the State Bank of Pakistan (SBP) have undertaken a series of measures, including legal reforms and the issuance of sukuk to replace interest-based treasury bills and investment bonds.

“In 2025, the Ministry of Finance (MoF) through its Debt Management Office, together with its Joint Financial Advisers (JFAs), successfully issued over PKR 2 trillion in Sukuk,” Schehzad said on X, describing it as “the highest-ever Sukuk issuance in a single calendar year since 2008 by Pakistan.”

Pakistan made a total of 61 issuances across one-, three-, five- and 10-year tenors, according to the finance adviser. The country also successfully launched its first Green Sukuk, a Shariah-compliant bond designed to fund environment-friendly projects.

He said the Green Sukuk was 5.4 times oversubscribed, indicating investor demand was more than five times higher than the amount the government planned to raise, which showed strong market confidence.

“The rising share of Islamic instruments in the government’s domestic securities portfolio (domestic debt) underscores strong momentum, growing from 12.6 percent in June 2025 to around 14.5 percent by December 2025, clearly positioning the MoF to achieve its 20 percent Shariah-compliant debt target by FY28,” Schehzad said.

“This milestone also reflects the structural deepening of Pakistan’s Islamic capital market, sustained investor confidence, and the strengthening of sovereign debt management.”

He said Pakistan was strengthening its government securities market by making it more resilient, diversified, and future-ready, supported by a stabilizing macroeconomic environment, a disciplined debt strategy, and a clear roadmap for Islamic finance.