ISLAMABAD: The Pakistan Electronic Media Regulatory Authority (PEMRA) imposed a ban on a television serial aired by a private entertainment channel on Wednesday after receiving complaints that its story closely resembled a real-life incident involving a woman’s gang rape at a major highway in the country nearly three years ago.

The motorway gang rape in Pakistan eastern Punjab province grabbed international headlines in September 2020 after a woman traveling near Lahore ran out of fuel and was sexually assaulted by two men in front of her children.

There was a major outpouring of anger in the country which intensified after a senior police official criticized the woman for driving at night without a male companion.

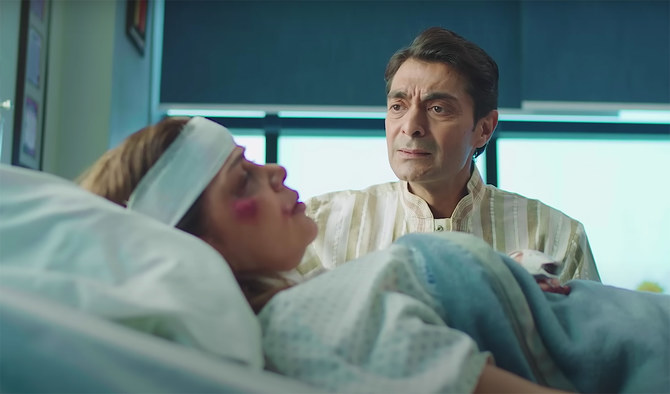

Many people used social media platforms to raise their voice against drama serial “Hadsa,” aired by Geo Entertainment, while pointing out that its story was weaved around the harrowing incident in which two men were sentenced to death last year.

In a notification issued on Wednesday, PEMRA said it had received numerous complaints from viewers and monitored the television production which was “highly inappropriate, disturbing and not depicting true picture of Pakistani society.”

“Broadcast/re-broadcast of drama serial ‘HADSA’ is hereby prohibited immediately under Section 27 of PEMRA Ordinance 2002 as amended by PEMRA (Amendment) Act 2007,” it added. “The matter is further being referred to the Council of Complaints for appropriate recommendations to the Authority for final decision.”

Prior to the PEMRA notification, a Pakistani lawyer, Muhammad Ahmad Pansota, said on social media platform X the survivor of the motorway incident had consulted him to explore legal remedies against the broadcast of the television serial.

He informed that he had lodged a complaint with another lawyer, seeking the immediate suspension of the program.

According to the Karachi-based War on Rape group, less than three percent of sexual assault or rape cases result in a conviction in Pakistan where women rarely speak out after violent sexual assaults, fearing the shame it will bring on them and their families in the conservative Muslim country.