RIYADH: Saudi Arabia’s ACWA Power has teamed up with Energy China Group Corp. to develop a solar power project in Uzbekistan.

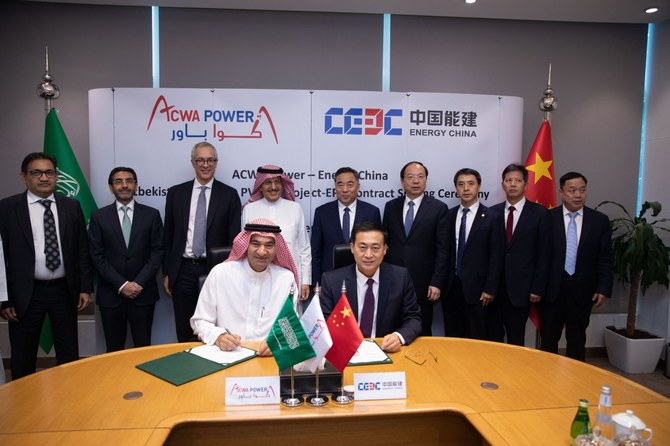

The two companies signed an engineering, procurement, and construction contract during a meeting in Riyadh, according to a press release. Raad Al-Saady, vice chairman and managing director of ACWA Power, and Lyu Zexiang, chairman of the China Energy International Group Co. signed the agreement.

The power purchase deal for the project was signed in March 2023 between ACWA Power, National Electric Grid of Uzbekistan, and the Central Asian country’s Ministry of Investment, Industry, and Trade.

The project will form part of Uzbekistan’s ambitious targets to transition to a low-carbon economy as well as diversify its energy sources.

This deal further consolidates ACWA Power’s ties with Uzbekistan, with the country now the firm’s second most-valuable market after Saudi Arabia.

The company currently has a range of active projects in Uzbekistan, including four wind projects and a combined gas cycle turbine facility.

In May, the firm signed a hydrogen purchase deal with Uzkimyosanoat, the state-owned chemical company, focusing on decarbonizing the sector through green hydrogen projects, with construction being executed in two phases.

“Uzbekistan has emerged as one of the most exciting growth countries for ACWA Power in recent years and is our biggest investment geography outside of the Kingdom. We are proud that our giga scale development experience in green hydrogen is making us the preferred choice of partners across the world,” Mohammad Abunayyan, chairman of ACWA Power, said in January.

The latest deal also strengthens ties between the firm and Chinese companies.

In December 2022, ACWA Power signed memorandums of understanding with nine Chinese entities during the first Riyadh Arab-China Summit for Cooperation and Development, which also coincided with the state visit of Chinese President Xi Jinping to Saudi Arabia.