KARACHI: Two Pakistani music artists who shot to fame with a major hit last year have featured in a new song released on Friday, putting their “classical energy” on display once again.

Ali Sethi and Shae Gill made waves with their Coke Studio 14 song, “Pasoori,” which made it to the 53rd spot on YouTube’s global music video charts.

The single, “Left Right,” is a collaborative effort between musicians Abdullah Siddiqui, who also produced the previous song, along with Sethi, Gill, and Rehman Afshar, more popularly known as Maanu in the music circles. It is available on Spotify and will be released on other music streaming services later today.

The image posted on April 25, 2023, shows musicians (Right to Left) Ali Sethi, Maanu, Abdullah Siddiqui, and Shae Gill in characters from their newest single, Left Right. (Photo courtesy: Instagram/ @shaegilll).

Speaking of Sethi and Gill’s presence, Siddiqui said the two artists had “creative synergy” and made good music together.

“Their vocals are unparalleled,” he told Arab News on Friday. “They once again came together in a beautiful way in the new song. But it is very different from Pasoori.”

Siddiqui said there was “undeniable” chemistry between Sethi and Gill.

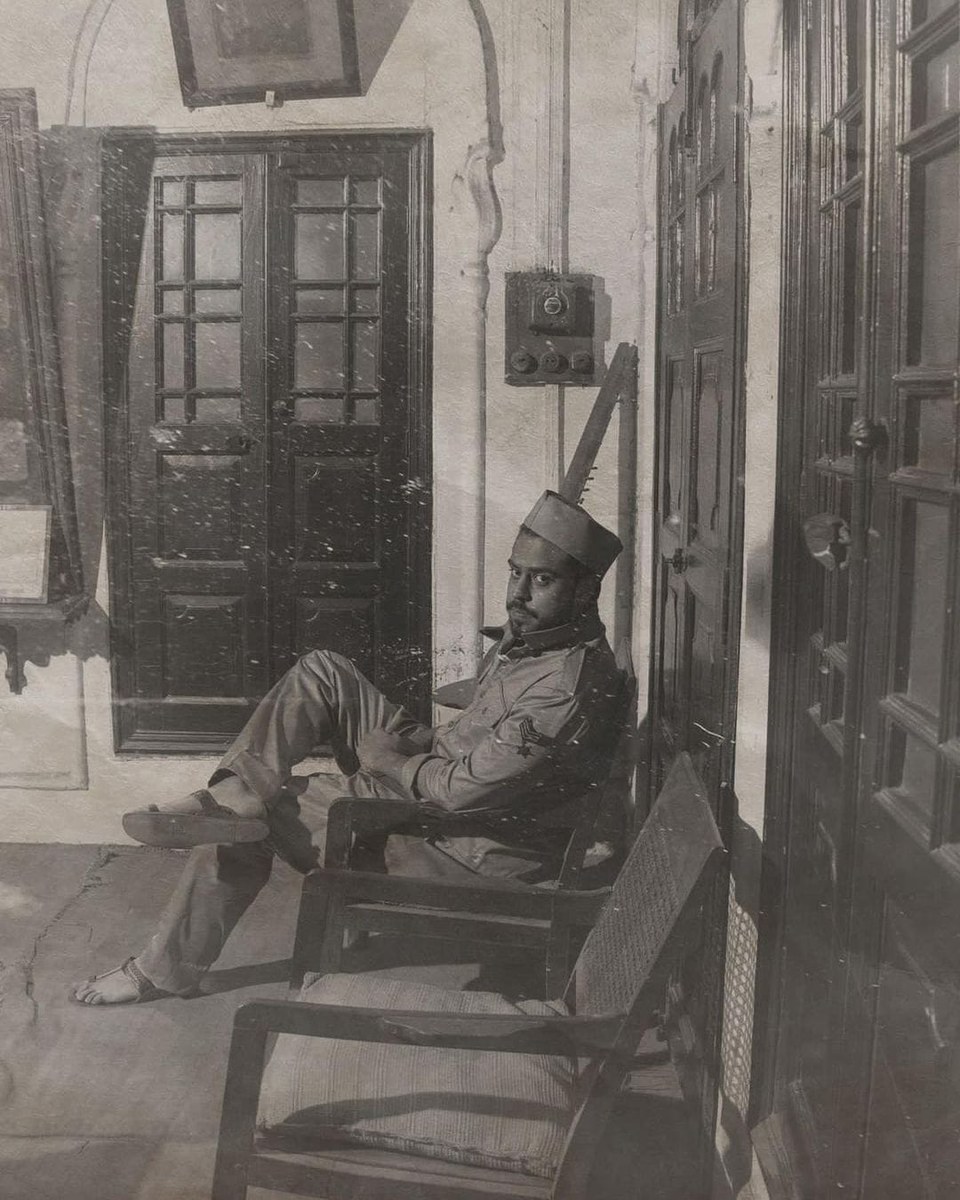

The image posted on April 20, 2023, shows musician Abdullah Siddiqui in character from his newest single, Left Right. (Photo courtesy: Instagram/ @abdullah.s.siddiqui).

“Not only are they both very talented, but also very similar in the way they are talented,” he continued. “They are also very fresh in what they represent in their image and their energy. It’s all so refreshing. Together, I feel like they always manage to bring the best out of each other.”

Siddiqui shared that all four artists brought their vibe to the new track.

“Ali and Shae kind of bring this more classical energy, while Maanu brings his hip hop space,” he said. “I have more pop sensibility. The song is structured in a way where we are all coming in and out of our desperate vibes and our styles.”

He added that “Left Right” primarily explored themes of romance in a fun way, though it also had a clear undertone of mystery, intrigue, mistrust, and deception.

Speaking to Arab News, Maanu shared that the collaboration happened by chance when all the artists went to a studio together last year.

The image posted on April 20, 2023, shows musician Rehman Afshar aka Maanu in character from his newest single, Left Right. (Photo courtesy: Instagram/ @maanusmusic)

A Lahore-based rapper known for his hip-hop music, who carved a niche for himself after producing his first song “Baad ki Baatein” in 2019, he said the idea of the newly released song was conceived “within a few hours.”

“Most of what the song sounds like right now was decided on that day [when we went to the studio], but we only executed things more recently,” he said.

The artists recorded the final vocals and shot a small visualizer in December when Sethi was in town. Since they did not shoot a music video for the new song, they wanted to do a photoshoot and the cover art.

“It [the song] does have a very rooted, desi influence, but at the same time, we wanted an image and sort of make it look like it’s pre-partition,” Maanu added.

The shoot took place at a Haveli in Lahore, he continued, adding that “Left Right” was a bilingual song with lyrics in English and Urdu.

“It was a great experience working with them [Ali Sethi and Shae Gill] because both of them are insanely talented vocalists,” he said. “What we made does not really feel like Pasoori 2. This may or may not work for us because obviously Pasoori’s audience wants to see them in that element again.”