LONDON: After some of the biggest losses in emerging markets on record this year the bulls are back, betting that the time has come for a rebound.

With caveats that global interest rates stabilise, China relaxes COVID restrictions and nuclear war is averted, annual investment bank forecasts for 2023 suddenly have some pretty lofty predictions for emerging markets (EM).

UBS, for example, expects EM stocks (.MSCIEF) and fixed income to earn between 8%-15% in total returns after a 15%-25% pummelling this year.

A "bullish" Morgan Stanley expects a near 17% return on EM local currency debt. Credit Suisse "particularly" likes hard currency debt, while BofA's latest global fund manager survey shows "long EM" is the top "contrarian" trade.

"It's a kind of a wholesale de-grossing of risk," said T. Rowe Price EM portfolio manager Samy Muaddi, who has started dipping his toe back into what he describes as "well-anchored" EM countries such as Dominican Republic, Ivory Coast and Morocco.

"Now, I feel the price is sufficiently attractive to warrant a contrarian view".

This year's surge in interest rates, the Ukraine war and China's battle against COVID have combined to be a wrecking ball for EM.

It could be the first time in the asset class's three decade history that 'hard currency' EM debt - the kind usually denominated in dollars - will lose investors more than 20% on a annual total return basis and the first ever 2-year run of losses.

The 15% loss currently racked up by local currency debt would be a record, while EM stocks have only had worse years during the financial crisis in 2008, the dotcom burst of 2000 and the Asian debt blowup in 1998.

"This has been a very rough year," DoubleLine fund manager Bill Campbell said. "If it hasn't been the worst, it is one of the worst".

It is the experience of those past routs that has led to the current wave of optimism.

MSCI's EM equity index soared 64% in 1999 and 75% in 2009 after losing 55% during both the Asian and financial market crashes. EM hard currency debt saw a whopping 30% rebound too after its 12% GFC drop and local debt which had lost just over 5% went on to make 22% and then 16% the year after.

"There is a lot of value at today's current levels," DoubleLine's Campbell added.

"We don't think this is the time to blindly allocate to an emerging market trade, but you can start to piece together a basket (of assets to buy) that does make a lot of sense".

Societe Generale's analysts said on Tuesday that cooling inflation and looming developed market recessions were "supremely conducive for EM local bond outperformance".

Most of the big investment banks were, however, backing emerging markets to rally this time last year. None predicted Russia's invasion of Ukraine or soaring interest rates. There is an almost annual ritual of bankers talking up EMs chances, say those who have followed EM for years.

BofA’s December 2019 investor survey showed ‘shorting’ the dollar was the second most crowded trade. JPMorgan and Goldman Sachs were bullish, while Morgan Stanley’s message at the time was: "Gotta Buy EM All!".

The dollar subsequently surged nearly 7% and the main EM equity and bond indexes lost money.

"You know how it works with a broken clock - at one point it might be right," abrdn EM portfolio manager Viktor Szabo said.

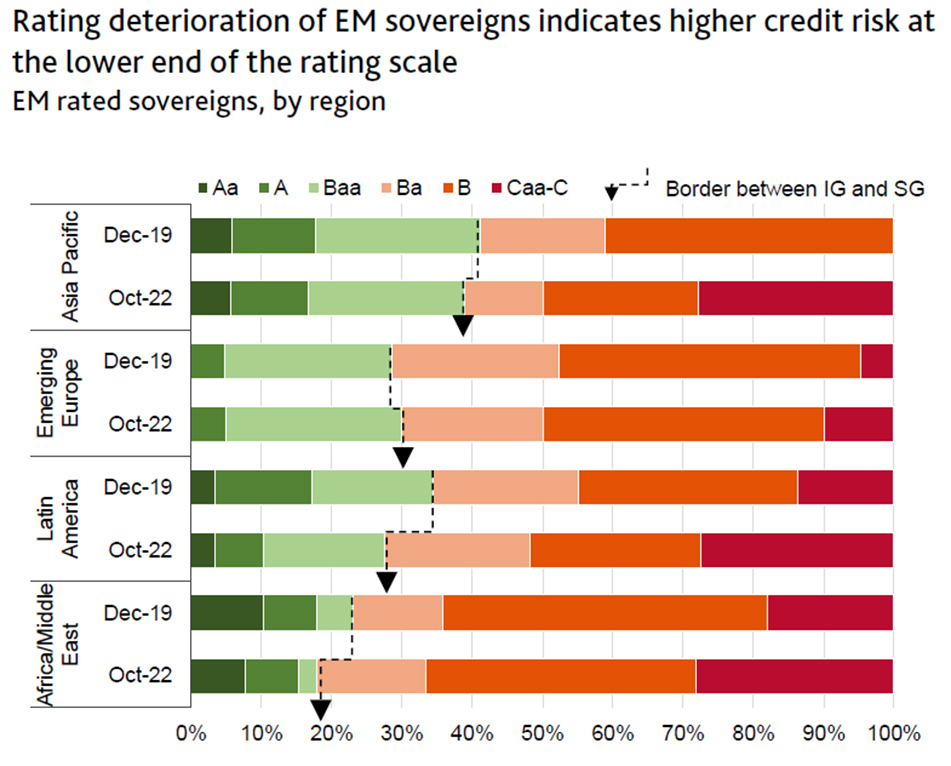

As well as the Ukraine war, stubbornly high inflation and China's lockdowns, rising debts and borrowing costs mean credit rating agencies are warning of rising default risks in countries like Nigeria, Ghana, Kenya, Pakistan and Tunisia.

Nomura sees seven potential currency crises on the cards and even though UBS is bullish on EM assets, it estimates this year has seen the biggest depletion of FX reserves since 1997. Its 2.1% global growth forecast would also be the slowest in 30 years aside from the extreme shocks of 2009 and 2020.

"Our hope is that a looser Federal Reserve combines with a peak in the global inventory cycle/recovery in Asia tech from Q2, creating more fertile ground for EM outperformance at that time," UBS said.

If the outlook does indeed brighten, international investors are well placed to swoop back in, having sold EM heavily in recent years.

JPMorgan estimates some $86 billion of emerging market bonds have been dumped this year alone, which is quadruple the amount sold during the 'taper tantrum' year of 2015.

"EM is swimming to safety," Morgan Stanley summarised. "Though still in deep water".