RIYADH: Saudi microenterprises credit surged 62.2 percent to SR18.1 billion ($4.82 billion) in the second quarter this year compared to SR11.2 billion in the same period last year, revealed the Saudi Central Bank, also known as SAMA.

The SAMA report further pointed out that banks disbursed 82.5 percent of the credit or SR14.9 billion to the microenterprises, while finance companies doled out the remaining SR3.2 billion.

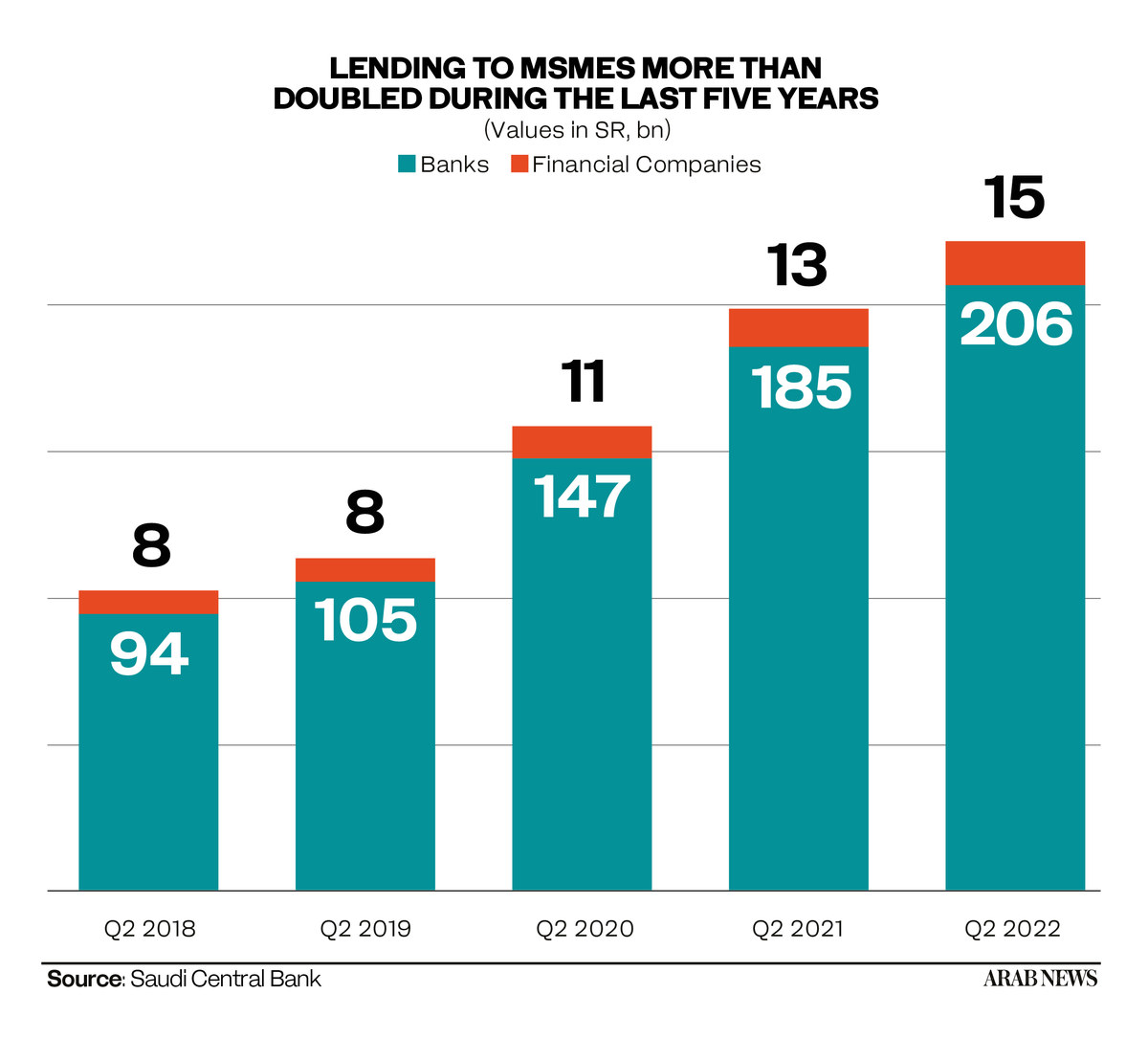

Moreover, the total loans extended to small enterprises increased 25.4 percent to SR63 billion in the April-June quarter compared to SR50.3 billion in the corresponding period in 2021.

Midsize company loans rose 2.26 percent to SR139.9 billion in the second quarter from SR136.8 billion in the same period last year.

Banks were also the predominant lenders to the small and medium enterprises, disbursing SR55.8 billion to small firms and SR134.9 billion to medium-sized companies.

On the other hand, financial institutions lend SR7.3 billion to small companies and SR5 billion to their midsize counterparts.

Saudi Arabia’s startup sector has been booming thanks to the government and the private sector’s efforts to grow this prominent part of the economy.

According to the General Authority for Small and Medium Enterprises or Monsha’at, the Kingdom had 752,560 SMEs by the end of the first quarter of 2022.

The number of SMEs in the Kingdom increased 14.6 percent from 650,550 in the same period last year.

Monsha’at facilitated funding worth SR 64.6 billion in secured loans to entrepreneurs through its Kafalah program, providing bank guarantees that support SMEs by reducing lending risk.

It disbursed SR12.3 billion in loans through its Tamweel platform, an online portal that brought together SMEs and licensed financing agencies.

“SMEs need streamlined bureaucracy, lower fees, and the ability to compete in the market,” said Monsha’at Governor Saleh Ibrahim Al-Rasheed in a press statement.

The Kingdom has also held numerous events to synergize SMEs with the global investment community.

In March 2022, Riyadh hosted the Global Entrepreneurship Congress, a mega event that brought together leading voices in entrepreneurship, including innovators, regulators and financiers.

The four-day event facilitated deals worth SR51.8 billion and over 10 rounds of financing for Saudi startups, the Monshaa’t said in a statement.

“We are ensuring that SMEs get the support they need and that growth is transformed into sustainable business models,” added Al-Rasheed.