DUBAI: Global tourism received a significant boost as international tourist arrivals registered a 182 percent increase to an estimated 117 million in the first quarter of 2022 from about 41 million in the year-ago period.

Out of the roughly 76 million new additions in international arrivals, 47 million were booked in March 2022, revealed a UN World Tourism Organization study.

According to UNWTO World Tourism Barometer, Europe led the pack with a 280 percent rise in tourist arrivals between the first quarter of 2022 and the corresponding duration last year.

The barometer, which periodically monitors short-term international tourism trends, further revealed that the Middle East came a close second with a 132 percent growth, followed by the Americas, which recorded a 117 percent rise during the period under study.

However, international arrivals in Europe, the Middle East, and the Americas remained 43 percent, 59 percent, and 46 percent below 2019 levels.

Inbound tourist arrivals in Africa remained encouraging, with 96 percent year-on-year growth in the first quarter of 2022, but they are still 61 percent below the 2019 levels.

The Asia-Pacific region has also witnessed a moderate growth of 64 percent despite a sizable number of destinations closed for non-essential travel.

Off the beaten track

The prospects, however, look brighter with destinations relaxing or lifting travel restrictions. The UNWTO report augured that international tourism is expected to recover gradually in 2022 even though it remained 61 percent below 2019 levels.

As of June 2, 45 destinations, including 31 in Europe, did not have any COVID-19 restrictions. In addition, a growing number of Asian destinations have also begun to ease curbs, the UNWTO report stated.

However, the only snag in the joyride is the challenging economic scenario followed by the ongoing military offensive of the Russian Federation in Ukraine, the data stated.

The Russian offensive also disrupted travel throughout Eastern Europe but, to date, seems to have had a little direct effect.

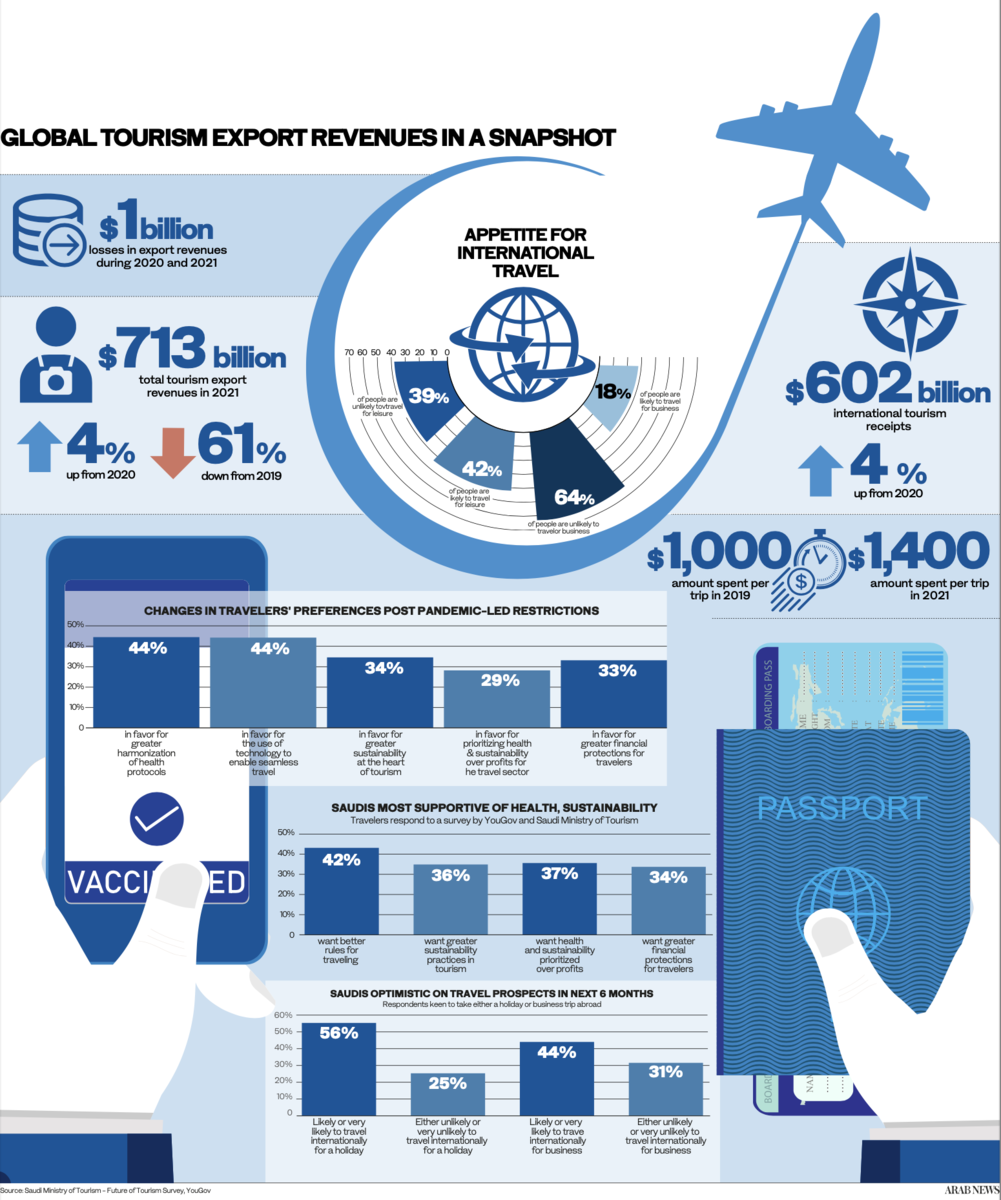

The report also estimated that $2 billion was lost in export revenues from international tourism since the first year of the pandemic.

Reinventing the wheel

The data showed that revenue from tourism, including passenger transport, reached SR2.67 trillion ($713 billion) in 2021, a 4 percent increase in real terms from 2020 but still 61 percent below the 2019 level.

In the Middle East and Europe, earnings climbed to about 50 percent of pre-pandemic levels, according to the UNWTO.

The data said that spending per trip also rose from SR3,750.66 in 2019 to SR5,250.93 in 2021.

What’s also upbeat about the global travel trends is the UNWTO Confidence Index which showed a marked improvement. For the first time since the pandemic, the index returned to levels of 2019, reflecting rising optimism among tourism experts worldwide.

Much of the solid pent-up demand was driven by intra-European travel and US travel to Europe.

Hope for a better tomorrow

According to the latest UNWTO Panel of Experts survey, 83 percent of the tourism professionals see better prospects for 2022 than 2021, as long as the virus is contained and destinations continue to ease or lift travel restrictions.

Also, 48 percent of the professionals see a potential return of international arrivals to 2019 levels in 2023 compared to the 32 percent of the participants in the January survey.

However, 44 percent of the people surveyed believed that the turnaround would only happen in 2024, compared to the 64 percent polled in January this year.

Meanwhile, by the end of April, international air capacity across the Americas, Africa, Europe, North Atlantic and the Middle East has reached close to 80 percent of pre-crisis levels, and demand is following.

These numbers are a sea change from the January report of WTO, which reported a 4 percent upturn in 2021 to 415 million international tourist arrivals compared to the 400 million in 2020.

In January 2022, international tourist arrivals were still 72 percent below the pre-pandemic year of 2019, according to the estimates by UNWTO. And this was a follow-up over 2020, the worst year on record for tourism when international arrivals decreased by 73 percent.