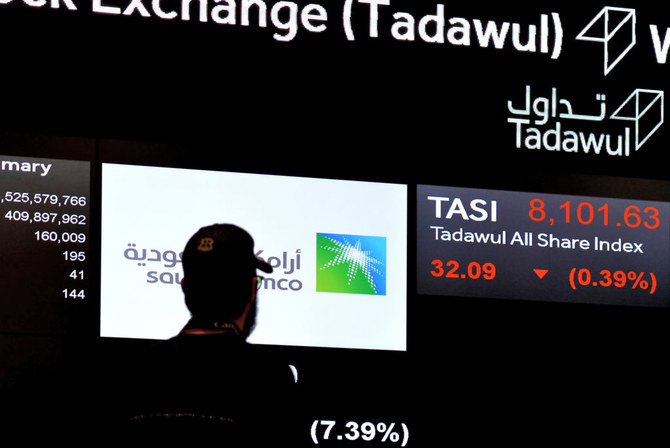

RIYADH: Saudi oil giant Aramco is weighing an initial public offering of its trading arm that could potentially raise over $30 billion, slated to become one of the world’s biggest listings this year.

The move comes as the oil major is benefiting from oil prices rising to record levels in the wake of the Russian-Ukraine war.

As it is considering the potential listing of Aramco Trading Co., the oil giant is working with banks including Goldman Sachs, JPMorgan Chase & Co. and Morgan Stanley, Bloomberg reported citing people familiar with the matter.

It could also sell a 30 percent stake in the division, which could make it one of the world’s largest IPOs in 2022, Bloomberg reported citing the unnamed people.

Most recently Saudi Aramco’s profit has surged 82 percent in the first quarter of 2022, beating the median of analysts’ expectations with the highest quarterly profit since it went public in 2019.