BADIN, SINDH: Shabnam Pitafi has never lived in a place she could call her own and never dreamt that one day she would, until last month, when she received a brick house under a scheme to empower some of Pakistan’s poorest women.

The 30-year-old farmer comes from Tando Bago area in the Badin district of southern Sindh province, where the local government is helping poor rural women build homes with ownership rights.

The Low-Cost Houses (LHC) program was launched in the districts of Sukkur, Shikarpur, Kashmore and Jacobabad in 2009, and later extended also to Badin, Ghotki, Khairpur, Mirpurkhas, Sanghar, Thatta, Tharparkar and Umerkot.

The government pays each beneficiary Rs165,000 ($880) for the construction of a two-room brick home.

“This lifetime achievement of owning a house brings very special feelings to me and my family,” Pitafi told Arab News.

It also changed her status not only among the immediate, but also extended relative.

“Since I own a house now, I can influence my husband in decision-making,” she said. “I have planned a party this Eid and invited my parents and relatives.”

Authorities say the women selected for the housing program all fall under the “poorest of the poor” category.

Ninety-five percent of them work on farms, according to the Sindh Rural Support Organization, which implements the project.

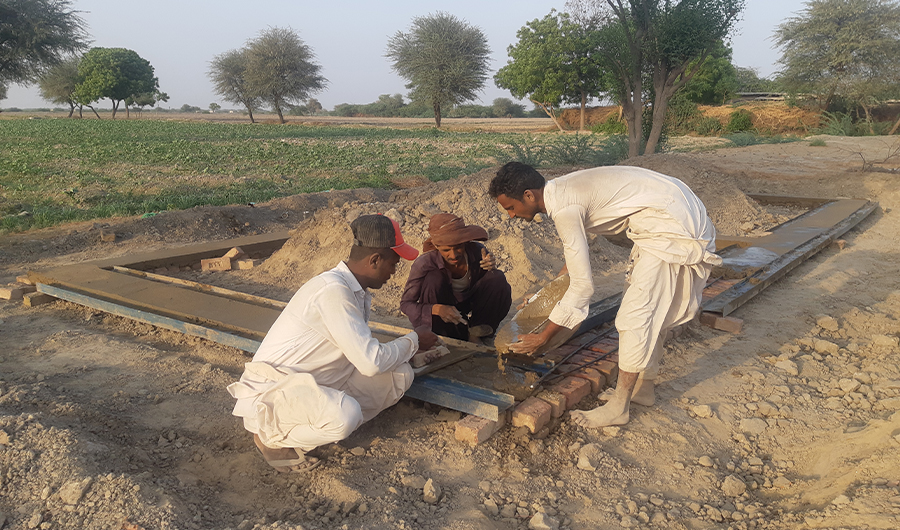

Workers construct a brick house under the Low-Cost Houses program in Tando Bago area, Badin district of Sindh province, southern Pakistan on April 18, 2022. (AN Photo/Zulfiqar Kunbhar)

“For generations, most of these women were living along with their families at landlords’ lands or slums,” said Ghulam Rasool Samejo, the organization’s regional general manager.

To acquire land for construction — which costs around $430 — some of the women have sold their livestock, while some others were lucky to receive small plots from their employers. In Badin, 500 houses under the LCH program were built on land donated by 30 local landlords.

One of them was Ishrat Ali Pitafi, who gave a plot with ownership rights to a family that had worked for him for over a decade.

“This landless family has worked as farmers on my agricultural lands for 15 years,” he told Arab News. “I am glad that finally they will get a new house.”

Each of the houses built under the program has two rooms, a toilet, veranda and drainage.

For Pummy Kohli, this means security her family had not known before, as they used to live in a mud house on their landlord’s land in Tando Bego. The hut was regularly washed off by rains during the monsoon season.

A newly constructed house under the Low-Cost Houses program in Badin district of Sindh province, southern Pakistan on April 20, 2022. (Photo courtesy: Sindh Rural Support Organization)

“In the past, rains damaged my mud house, forcing me and my family to migrate,” the 35-year-old mother of five said. “Moving to a permanent place will benefit my children. It will ensure the continuity of their education and improve their health.”

So far, 16,000 houses have been built out of the 27,000 planned under the program, Pervez Ahmed Chandio, director general at the Sindh People’s Poverty Reduction, Planning and Development Department, told Arab News.

While lifechanging for thousands of families who otherwise might never have afforded this kind of security, it is still a drop in the ocean of needs in Pakistan, a country that lacks 10 million housing units — 60 percent of which are needed for low-income families.

“The government needs to increase the number of such houses. In a country which needs 10 million houses, provision of houses in thousands is not enough,” Dr. Kaiser Bengali, economist and former development adviser to the Sindh chief minister, told Arab News.

But he admitted that the program was already a “revolutionary step” and one that also improved women’s chances of earning, as having their own place they could start small businesses.

“This will work for women’s empowerment, as owning a house means a sense of security,” he told Arab News. “Nobody will throw the owner out of her house now.”