Consumer spending in Saudi Arabia during Ramadan 2022 is on course to exceed last year as the Kingdom bounces back from the COVID-19 pandemic, new data shows.

Saudi central bank data analysed by Arab News, shows that, including the Shaaban peak week and the following two weeks, Saudi consumers spent SR33.7 billion this year, up 13.7 percent when compared to the same period last year.

Research carried out by consumer sentiment firm Toluna also revealed that one in two people in Saudi planned to spend more during Ramadan compared to the same month last year.

Spending performance during Ramadan 2022

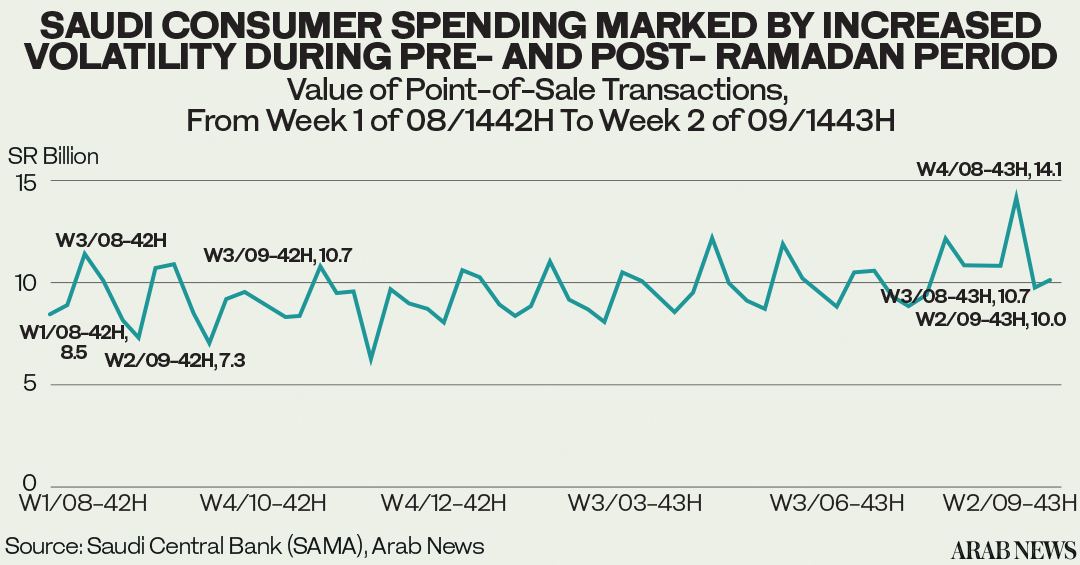

Looking at data for the last Hijri year 1442, spending activity peaked during the third week of Shaaban - the week ending April 42021, that is two weeks before the start of the fasting. Spending during the week grew 29 percent week-on-week to hit SR11.4 billion ($3.04 billion), the highest weekly level on record at the time.

Consumer spending then was seen falling over the next three weeks in a row to hit the month of Ramadan’s lowest point during the second week.

Growth resumed by an almost 47-percent week-on-week spike during the third week of the month.

The value of spending however remained below the peak of Shaaban, and remained muted for the next few months, with weekly values averaging at SR9 billion, clearly below the peak of Shaaban.

Arab News has analyzed point-of-sale transaction data from the Saudi Central Bank (Getty)

This year, 1443, the value of consumer spending hit a new all-time high of SR14.1 billion during the fourth week of Shaaban (week ending 2 April 2022), having surged 31.7 percent, compared to the previous week.

It then plunged 31.4 percent in the next week — that is the first week of Ramadan — to SR9.6 billion, but managed to bounce back to SR10.0 billion already during the second week of Ramadan (week ending 9 April 2022).

It remains to be seen whether the pattern of Saudi consumer spending of last year will also be seen this year.

Data on spending for the third week of Ramadan (week ending April 23) from the central bank is scheduled for the release this Tuesday, April 25.

Interestingly, Saudi consumer spending goes up and down in waves during months of the Hijri year, as evidenced by the weekly data from SAMA.

Spending usually peaks during the second or — which is less often — the third week of the month, while the first and the last week of the month is usually marked with muted activity and declines in spending.

Saudi consumer spending consumer activity is marked by higher volatility during pre-Ramadan and Ramadan periods.

Read more: The fashion brands giving back this Ramadan

Ramadan spending expectations: Survey

One in two people in Saudi is planning to spend more during the current month of Ramadan, compared to the same month last year, according to a study conducted by consumer sentiment firm Toluna.

The results of its poll reveal that 46 percent of respondents in Saudi Arabia intend to spend more this Ramadan, when compared to Ramadan 2021.

Nevertheless, 29 percent of the respondents intend to have the same spending habits as last year’s Ramadan.

Out of those in the 46-percent group who indicated plans for more Ramadan spending this year, 35 percent said they would be spending somewhat more than the last year, while the remaining 11 percent said "a lot more."

Spending expectations by category:

- 41 percent of respondents are planning to spend more this year on entertainment.

- 39 percent of respondents will spend more this year than last year on ordering food.

- 90 percent plan to buy Eid gifts for their families and friends.

Among the most popular gift options are sweets, money, toys, games, and perfumes.

When it comes to consumer spending habits on Eid gifts, the study revealed that 57 percent of respondents are planning to spend more this year on gifts, when compared to last year.

People are more willing to spend more on gifts this year, as life goes back to normal after two years of the pandemic, social distancing, and disruptions in traditional social gatherings.

Moreover, the study indicates that one in two individuals – an estimated 53 percent - intend to travel domestically during Eid Al-Fitr, with the most popular destinations being Jeddah and Mekkah, the results of the study disclosed.

Some 35 percent of respondents plan on travelling abroad to foreign destinations including the UAE and Egypt.

At the same time, while 37 percent of the respondents said they will spend more on travelling this year during the festive period than last year, 29 percent indicated their spending will remain the same, and the other 20 percent said they will spend less.

Read more: Four health tips to practice beyond Ramadan

Shopping channels

While fashion-related shopping is shifting towards e-commerce, shopping for categories like groceries, chocolates, and sweets is expected to be done more offline during Ramadan, when compared to other periods of the year.

The shopping channel for most of the remaining categories is projected to remain the same during Ramadan and the rest of the year.