RIYADH:The International Monetary Fund expects Saudi economy to grow by more than double in 2022 as oil prices are hitting multi-year high.

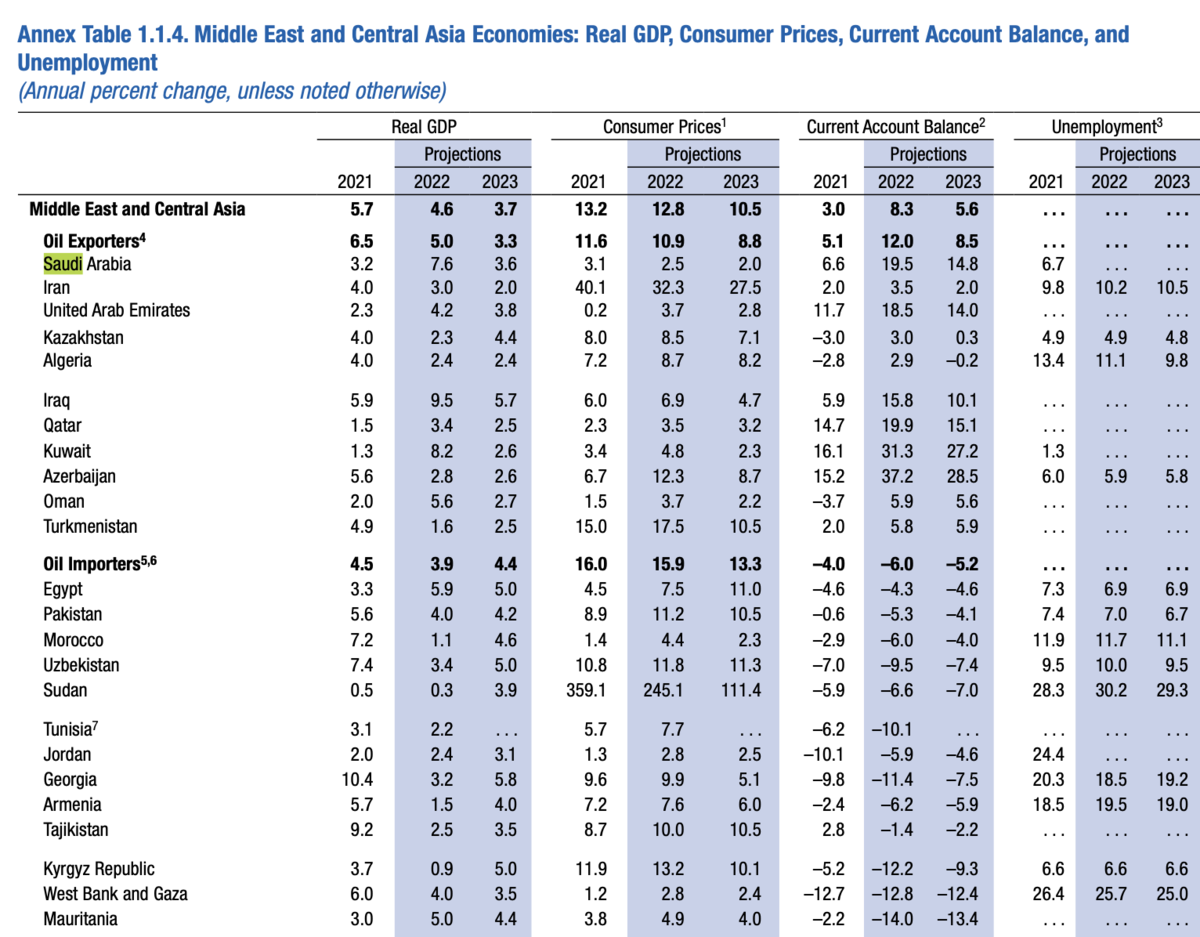

The Fund, known as IMF, has raised its forecast for the growth of the Saudi GDP by 2.8 percent from last time to 7.6 percent this year.

In its World Economic Outlook published today, the IMF expects the GDP to fall to 3.6 percent in 2023, after raising this up from an earlier estimate of 2.8 percent.

“We raised our estimates of the growth rate of the Saudi economy by 2.8 percentage points, which reflects the increase in oil production in accordance with the OPEC+ agreement, in conjunction with the more non-oil output growth exceeding expectations,” the report pointed out.

The IMF also forecasted Saudi inflation to be around 2.5 percent in 2022 down from last year, a trend that will continue in 2023 as well.

War-induced commodity price increases and broadening price pressures have led to 2022 inflation projections of 5.7 percent in advanced economies and 8.7 percent in emerging market and developing economies — 1.8 and 2.8 percentage points higher than projected last January, the report pointed out.