DUBAI: Saudi startup Red Sea Farms is preparing for a global launch of its saltwater farming technology — after a key partnership with the University of Arizona — that may open doors to North America’s massive agriculture market and beyond, said one of its founders.

The startup, spun out of the King Abdullah University of Science and Technology in 2018 by engineer Ryan Lefers and plant scientist Mark Tester, has invented a technology that grows crops without using freshwater in humidity-controlled greenhouses.

Although the technology is already being used in the Kingdom and other parts of the Middle East, CEO Lefers said the firm is looking to bring its system to other parts of the world where water is scarce.

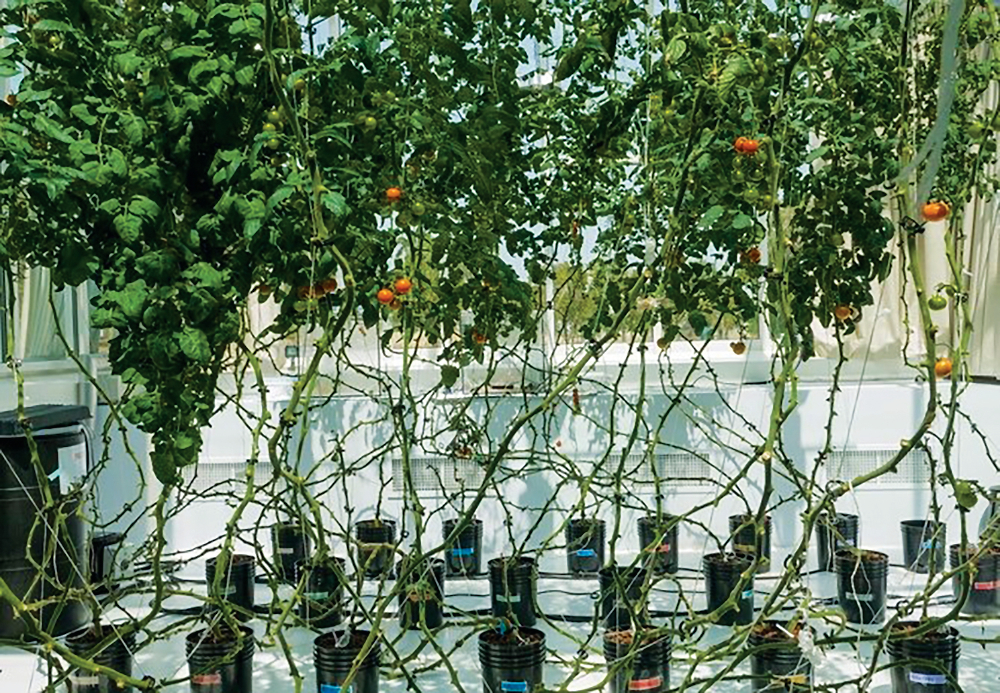

Red Sea Farms is also working to sell this method of farming to growers around the world. (An photo by Huda Bashatah)

The firm uses saltwater to cool greenhouses and irrigate crops, such as tomatoes, that it, or its partner farms, sell into the market. It also provides technical advice to other firms on how to grow crops in arid climates.

“Initial deployment is already happening in the Middle East, but we are looking at the US as a pathway into North America, and then globally,” he told Arab News.

Last month, Red Sea Farms announced a partnership with the University of Arizona’s College of Life and Sciences’ Controlled Environment Agriculture Center.

Under the deal, the Arizona center will combine Red Farms’ technology with its existing farming programs in a yearlong study to assess the results before deciding on a further rollout.

FASTFACTS

• Last month, Red Sea Farms announced a partnership with the University of Arizona’s College of Life and Sciences’ Controlled Environment Agriculture Center.

• Under the deal, the Arizona center will combine Red Farms’ technology with its existing farming programs in a yearlong study to assess the results before deciding on a further rollout.

• The controlled-environment agriculture market is projected to jump from $74.5 billion (SR279.5 billion) to $172.1 billion by 2025.

“We have a four-phase plan for our deployment, and right now we’re in phase three, which is around commercial-scale testing,” Lefers said, adding they expect to reach actual deployment by the end of 2022.

Aside from solving long-standing agricultural issues in parts of the US, the move is also seen to take advantage of a growing demand for greenhouse technologies in the country to boost food security.

The controlled-environment agriculture market is projected to jump from $74.5 billion (SR279.5 billion) to $172.1 billion by 2025, Lefers said, citing their market research. But he said profits are still out of the question as the startup continues to discuss the pricing of its system. “We’re still working on our pricing models around the technology and what price gets charged to the end consumer,” Lefers noted, adding this will also come by the end of the year.

Global rollout

Red Sea Farms is also working to sell this method of farming to growers around the world.

“We have a strong interest in Southeast Asia. We see that as a growing global market with a lot of demand, and with a lot of the challenges that we see on the coast of the Red Sea,” Lefers said.

“We are also looking at South Europe, North Africa — there’s a lot of agriculture in the Mediterranean zone that happens to fall in arid regions,” Lefers said.

The partnership with the University of Arizona comes after a $16 million funding round last August from Wa’ed, Aramco’s entrepreneurship arm, as well as US investors AppHarvest and Bonaventure Capital.

Lefers said future investors will play a crucial role in scaling the technology globally — not just in cash, but through business “connections and synergies.”

He noted: “Our ideal investor at this stage of the company is really around an investor who is not ‘just money,’ but someone who has connections, or those who we see strong synergy with from a business perspective.” The Saudi startup is expected to close a Series A round funding in the second half of this year, and Lefers said they are already receiving expressions of interest for participation in the next important step of this young firm’s growth.