ISLAMABAD: The risks associated with cryptocurrencies “far outweigh” the benefits, the Pakistani central bank governor has said, weeks after a mega crypto scam hit the country and the State Bank recommended banning virtual payment systems.

Thousands of Pakistanis lost life savings in a $100 million cryptocurrency scam, Pakistan’s Federal Investigation Agency (FIA) said last month, with investigators estimating that some 37,000 people, mostly from middle-class households in Punjab’s Faisalabad, had been defrauded after investing money in a scheme which promised to multiply funds.

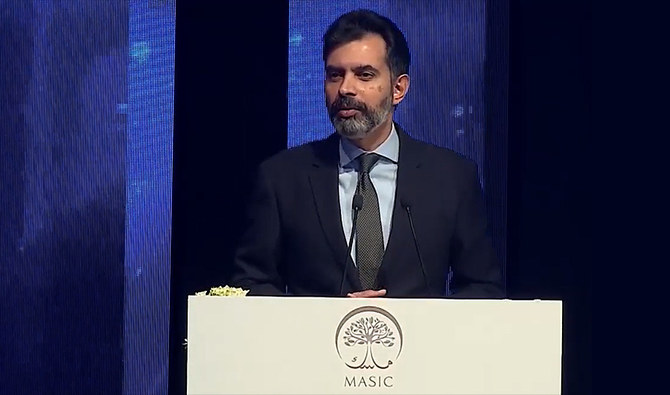

Speaking at the recent MASIC Annual Investment Forum in Riyadh, Pakistan central bank chief Reza Baqir said cryptocurrencies posed a risk to financial and monetary stability due to acute price fluctuations and their distributed and decentralized nature.

“In Pakistan, we as the central bank have reached the conclusion as of now that, for us and in terms of the core objectives of the central bank, the potential risks far outweigh the benefits,” Baqir said, according to a transcript of the speech released by the State Bank of Pakistan (SBP) this week.

“As many of you would be aware, we are not alone in reaching this conclusion. Many large emerging markets, including China, India, Russia, among others have reached similar conclusions.”

Virtual currencies were prone to be used for illegal economic activities and posed the risk of widening the gray economy, capital flight and consumer protection issues, the SBP governor added.

Speaking about why advanced economies had a more “permissive” attitude toward virtual currencies, the governor said: “One reason may be that in many of the advanced economies there is little practical threat that their currency, in many cases one of the major currencies of the world in which trade and finance is denominated, would be replaced by a new virtual currency.”

Another valid concern, according to him, was the impact of virtual currencies on promoting capital outflows, and more generally, capital volatility.

“Since by definition such currencies cannot be monitored, regulators are at a loss to determine the impact on the balance of payments, representing another key risk,” he added.

Pakistan’s central bank declared in 2018 that virtual currencies like Bitcoin were not legal tenders issued or guaranteed by the country’s government.

But despite not being recognized by the SBP, interest in cryptocurrencies has been on the rise. The country ranked third in the global crypto adoption index in 2020-21, after India and Vietnam. The federal chamber of commerce said in a report last year Pakistan had recorded around $20 billion in cryptocurrency value in 2020-21, showing an abnormal increase of 711 percent.

The central bank has not commented on FPPCI’s findings so far but in January recommended banning cryptocurrency, arguing that allowing it would cause capital flight. A committee formed by the Sindh High Court to deliberate on virtual currencies also urged imposing a “complete ban.”

The recommendations came as the court last year heard a constitutional petition filed in 2019, which sought to overturn the central bank’s guidance from 2018 advising banks and payment system operators against processing and investing in virtual currencies.

But proponents of cryptocurrency trade in Pakistan argue that the risks, and scams such as the one unearthed last year, are caused by the absence of a legal framework.

Waqar Zaka, a Pakistani TV host and activist who has filed a court petition in favor of allowing digital currencies, said regulation would help keep fraud at bay.

“I pleaded with the court that people have invested billions of rupees in crypto trade and the government should not declare it illegal,” he told Arab News in an interview last year. “Instead, it should devise a mechanism to legalize the business, and keep a check on transactions.”

Cryptocurrency risks ‘far outweigh’ benefits, Pakistan central bank chief says at Riyadh forum

https://arab.news/6w65u

Cryptocurrency risks ‘far outweigh’ benefits, Pakistan central bank chief says at Riyadh forum

- Thousands of Pakistanis recently lost life savings in $100 million cryptocurrency scam

- In the wake of the scam, State Bank has recommended banning virtual currencies in Pakistan

Babar Azam dropped for scoring too slowly, says Pakistan coach Hesson

- Shaheen Shah Afridi was left out after conceding 101 runs in three matches

- Pakistan will now face New Zealand in the opening match of the second phase

COLOMBO: Batting great Babar Azam was dropped for Pakistan’s final T20 World Cup group game against Namibia for scoring too slowly, said head coach Mike Hesson on Friday.

Azam, who is the highest run-scorer in T20 international history with 4,571 runs, was left out for the must-win game against Namibia as Pakistan racked up 199-3 and secured a place in the Super Eights by 102 runs.

The 2009 champions face New Zealand in Colombo on Saturday in the opening match of the second phase.

“I think Babar is well aware that his strike rate in the power play in the World Cup is less than 100 and that’s clearly not the role we think we need,” Hesson told reporters after Pakistan’s final practice session on Friday was washed out by rain.

Pakistan left out Azam for the same reason at last year’s Asia Cup and even after dismal showing in the Big Bash League, he was still selected for the T20 World Cup.

“We brought Babar back in for a specific role post the Asia Cup,” said Hesson.

“We’ve got plenty of other options who can come in and perform that role toward the end.

“Babar is actually the first to acknowledge that.

“He knows that he’s got a certain set of skills that the team requires and there are certain times where other players can perform that role more efficiently.”

Hesson also defended dropping pace spearhead Shaheen Shah Afridi after he conceded 101 runs in three matches, including 31 in two overs against India.

“We made a call that Salman Mirza was coming in for Shaheen, and he bowled incredibly well,” said Hesson.

“To be fair, he was probably really unlucky to not be playing the second and third games.”

Hesson was wary of Pakistan’s opponents on Saturday.

“New Zealand have played a huge amount in the subcontinent in recent times so we have to play at our best.”