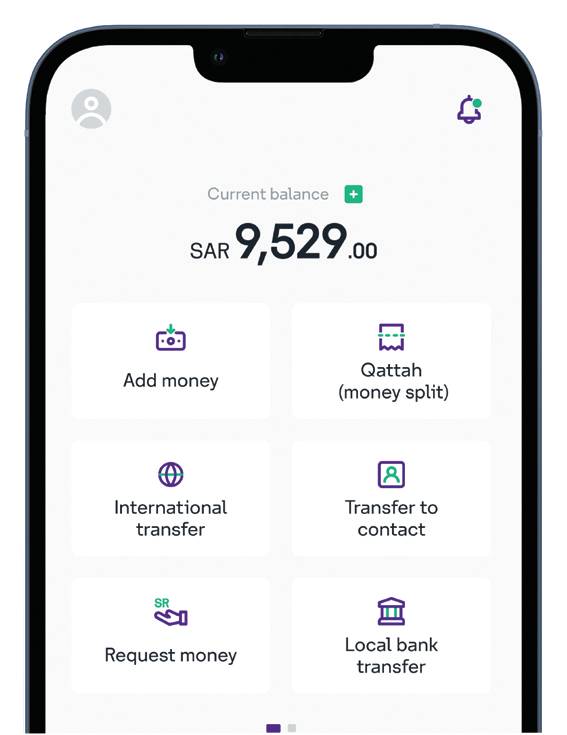

stc pay has launched the “Qattah” service as part of its efforts to enrich the experience of its customers and provide distinctive services that keep pace with their changing needs.

Qattah is an integrated service that allows customers to easily share and track expenses with multiple people, removing the stress from splitting bills.

Through the application, users can equally divide the amount to be collected by specifying a percentage for each person, or by allocating the amount paid by each person separately.

This way of sharing expenses is in line with the goals of Vision 2030, which aims to increase digital financial transactions in the Kingdom to 70 percent by 2030.

The new in-app feature can be found on the list of main services. It allows users to create groups with relatives or friends to buy a joint gift or split a bill.

The Qattah amounts will be automatically processed via the application, providing contactless transactions in line with the Kingdom’s aim of creating a cashless society.

stc pay seeks to build a distinguished mobile digital banking experience for its customers, who number more than 7.4 million, by focusing on a customer-centric approach.

It aims to transform all financial services into contactless digital services, enabling its customers to complete their financial operations conveniently.

Innovation in digital technologies is at the heart of stc pay, ensuring customers have the smartest and most efficient digital banking services at their fingertips.

stc pay is constantly working to provide the best services and products for its customers, offering services that are characterized by ease-of-use, security, and innovation, ensuring stc pay’s position as a major player in driving the Kingdom’s financial digital transformation.

stc Qattah service lets users share payments with friends, family

https://arab.news/w5khu

stc Qattah service lets users share payments with friends, family

25,000 attend Social Development Bank’s DeveGO25 forum

The Social Development Bank concluded the second edition of the Entrepreneurship and Modern Business Practices Forum — DeveGo 2025 — announcing the achievement of high-impact outcomes that further reinforced the forum’s position as the largest national platform in the region dedicated to entrepreneurship, innovation, and freelance work in Saudi Arabia and beyond.

The forum witnessed broad participation from local and international experts, investors, entrepreneurs, and representatives of local, regional, and international institutions.

Over three days at the King Abdulaziz International Conference Center, the forum drew 25,000 participants and visitors, who benefited from over 45 specialized workshops and over 2500 advisory sessions delivered by more than 70 consultants and experts.

The sessions covered key areas including entrepreneurial planning, business models, venture capital, digital platforms, freelancing, and emerging technologies.

The forum also featured 20 panel discussions with leading local and international speakers, addressing major global trends in entrepreneurship, including the future of artificial intelligence, the creative economy, digital transformation, and venture investment.

The forum saw the launch of the Saudi Empretec Fellowship, in the presence of Rebeca Grynspan, secretary-general of the UN Conference on Trade and Development.

The partners in success within the Social Responsibility Portfolio supporting entrepreneurs were honored.

It also saw the honoring of 13 winners of the Handicrafts Competition, representing various regions of the Kingdom, the announcement of winners of the Salam Award for Promising Projects, and the recognition of leading entrepreneurial projects fund under the Enterprises Track.

In addition, the NEXT UP Challenge concluded on the third day of the forum with 20 startups presenting their projects to more than 500 investors, enhancing opportunities for networking and partnership building.

As part of efforts to strengthen the support ecosystem, the forum witnessed the signing of 51 agreements, along with the launch of a suite of new financing products. These included the Capital Expansion Product with a ceiling of up to SR10 million, the Payroll Product with a ceiling of SR2 million, and the Rental Product with a ceiling of SR1.5 million, aimed at supporting enterprises in asset development and covering operational costs.

This reflects the bank’s direction toward offering more specialized financing tools that respond effectively to market needs.

The forum concluded by reaffirming its role as a unifying national platform for entrepreneurship, where accompanying activities and events provided direct engagement opportunities between entrepreneurs, investors, and experts.

The forum also highlighted success stories and practical experiences that reflect the scale of entrepreneurial momentum in the Kingdom and the growing role of the Social Development Bank in supporting a national economy driven by innovation and knowledge.