Murabaha and Tawarruq contracts prompted a 19 percent annual rise in total financing provided by Saudi Islamic banks as of Sep. 30 2021.

The total financing provided to that date by the Saudi Islamic banks reached SR1.67 trillion ($444 billion), according to a monthly report published by SAMA.

Murabaha is a Shariah-compliant structure of financing which stipulates a profit markup for the lender rather than interest.

Tawarruq is a structure by which a buyer can obtain cash immediately.

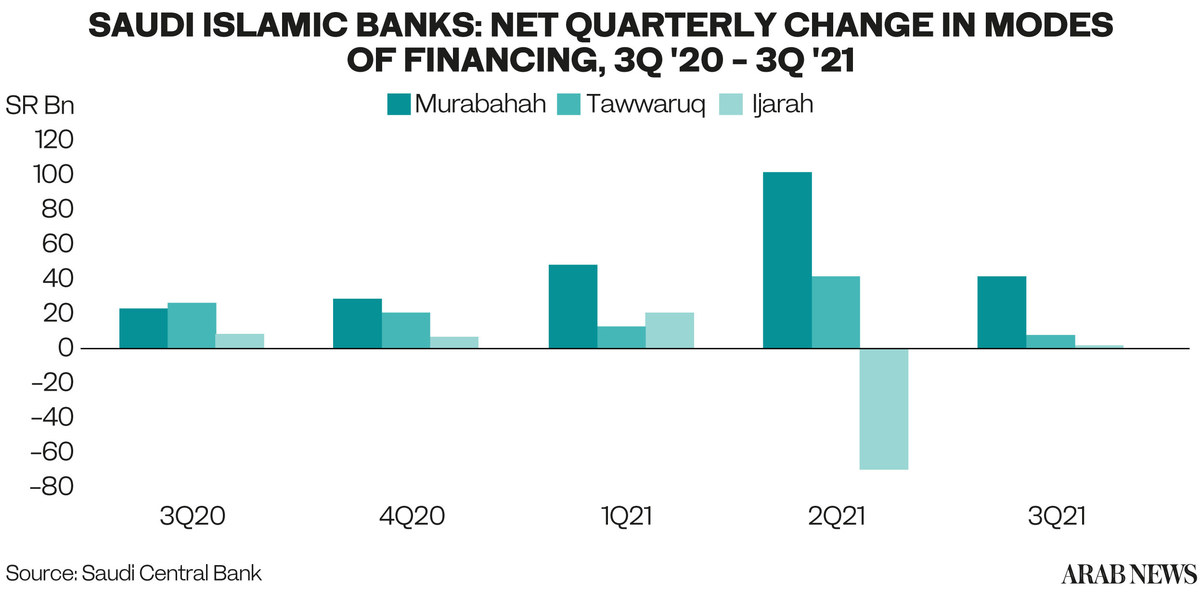

The value of these two types of financing contracts at the end of the third quarter saw the fastest annual rates of growth compared to other modes of financing.

The annual growth rate in total value of Murabaha contracts by the end of third quarter accelerated to 40 percent from 19 percent in the same period last year.

It was followed by Tawarruq contracts as the total value of these at the end of the third quarter increased by 13 percent on a year-on-year basis.

Most noticeable is the slowdown in Ijarah financing as the total value of this mode of the Shariah-compliant financing provided by Saudi Islamic banks at the end of the third quarter fell 18 percent year-on-year. The total value of Ijarah contracts also saw a 16-percent annual fall in the second quarter after the 22-percent increase in the first quarter of 2021.

The share of Murabaha financing in total value of financing provided by Saudi Islamic banks as of the end of the third quarter 2021 grew to 45 percent, up from 38 percent as at the end of the same quarter a year ago.

The Murabaha mode is usually meant for a short-term Shariah-compliant financing while Ijara is used more for a longer-term financing.

Tawarruq is where the bank or the financial institution buys an asset and sells it to the customer on a deferred payment basis. The buyer will, in turn, sell this asset to a third party in exchange for instant cash. In this way, this customer will have obtained the needed cash but will be required to repay the financial institution a deferred, marked-up price.

Ijarah is another Shariah-compliant structure of financing which is similar to a leasing contract under which one party transfers the right to use the property to another party for a specified period, in exchange for a specified consideration.

Islamic banks use finance leases as a mode of financing after having amended the structure to meet Shariah principles.