ISLAMABAD: An ordinance signed by the Pakistani president this week to curtail the jurisdiction of the country’s anti-corruption watchdog by excluding key government entities from the ambit of investigations and enabling the president to reappoint the body’s chief or extend their tenure has been challenged in the Lahore High Court, local media reported on Sunday.

The government and the opposition in Pakistan have been at loggerheads in recent weeks over the legislation which allows key changes in the National Accountability Bureau (NAB). The opposition says the amendments will allow the government to use NAB to go after political opponents.

The opposition’s biggest contention is that the ordinance paves the way for incumbent NAB Chairman Justice (retd) Javed Iqbal to continue holding his post until the appointment of his successor.

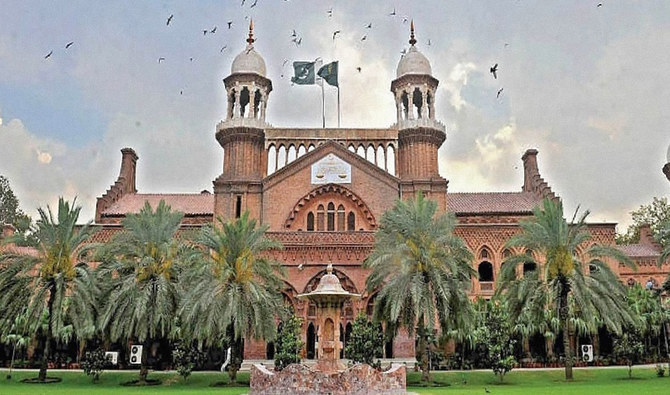

A petition filed in the Lahore High Court on Saturday said changing the law to accommodate or benefit a single individual was “patently illegal, mala fide, and unconstitutional.”

In Pakistan, an ordinance is a law promulgated by the president, when parliament is not in session, in exercise of the powers vested in him by Article 89 of the Constitution, for a limited time only.

“An ordinance cannot be allowed to override the parliament since assembly is there, and a session can be called at any time,” the petitioner’s counsel, Ishtiaq A. Chaudhary, said.

“Any attempt to subvert, bypass or nullify the effect of any provision of the constitution by parliament or the executive is liable to be struck down by this court which being the custodian of the constitutional mandate to interpret the Constitution.”

The lawyer contended that the recent amendment was “a mockery of parliament.”

He asked the court that the writ petition be accepted on the ground that the amendment made to the NAB ordinance was “person-specific,” referring to the current NAB chief, and promulgated to favor a single individual.

As per the new ordinance, signed on Wednesday, its provision will not be applicable to the following persons or transactions:

“All matters pertaining to Federal, Provincial or Local taxation, other levies or imposts, including concealments, refunds, criminality, criminal intention or loss of exchequer pertaining to taxation; decisions of Federal or Provincial Cabinet, their Committees or Sub-Committees, Council of Common Interests (CCI), National Economic Council (NEC), National Finance Commission (NFC), Executive Committee of the National Economic Council (ECNEC), Central Development Working Party (CDWP), Provincial Development Working Party (PDWP) and Departmental Development Working Party (DDWP), or decisions of the Boards of the State Bank of Pakistan,” a copy of the document seen by Arab News says.

The ordinance’s provisions will also not apply to any “person or entity, which are not directly or indirectly connected with the holder of a public office; procedural lapses in any public or governmental work, project or scheme, unless it is shown that a holder of public office or any other person has been conferred or has received any monetary or other material benefit from that particular public or governmental work, whether directly or indirectly on account of such procedural lapses, which the said recipient was otherwise not entitled to receive; an advice, report or opinion rendered or given by a public office holder or any other person in the course of his duty, unless there is sufficient evidence to show that the holder of public office or any other person received or gained any monetary or other material benefit, whether directly or indirectly, on account of such advise, opinion or report, which the said recipient was otherwise not entitled to receive.”

To grant extension in the tenure of the NAB chairman, sub-section b of Section 6 of the National Accountability Ordinance (NAO) has been amended by excluding the word “non-extendable” from the statute.

The amended ordinance has retained the provision that requires consultation between the opposition leader and the leader of the house in the National Assembly for the appointment of the NAB chairman. But the section states that the president would consult both of them.

“There shall be a Chairman, National Accountability Bureau to be appointed by the President in consultation with the Leader of the House and the Leader of the Opposition in the National Assembly. The Chairman shall hold office for a period of four years on such terms and conditions as may be determined by the President and shall not be removed from office except on grounds provided for the removal of a Judge of Supreme Court in the manner and by the forum provided under Article 209 of the Constitution of Pakistan,” the document reads.

“Provided that on expiry of the period of four years, the incumbent Chairman may be appointed for another period of four years by the President...”

The ordinance has enhanced the authority of the NAB prosecutor general, empowering him to play a crucial role in advising the chairman to file or withdraw any reference from a court.

It has also allowed the accountability court to grant bail to any accused. Under the NAB law previously, there was no provision of granting bail to the accused as an under-custody suspect could only apply for bail after the expiry of his 90-day remand and that too under the extraordinary jurisdiction of the high court, under Article 199 of the Constitution of Pakistan, which empowers the court to enforce fundamental rights.

The ordinance also allows the appointment of retired judges of high courts as accountability judges. In addition, it provides that a district and sessions judge and an additional district and sessions judge may also be designated as the judge of an accountability court with the consent of the chief justice of the concerned high court.