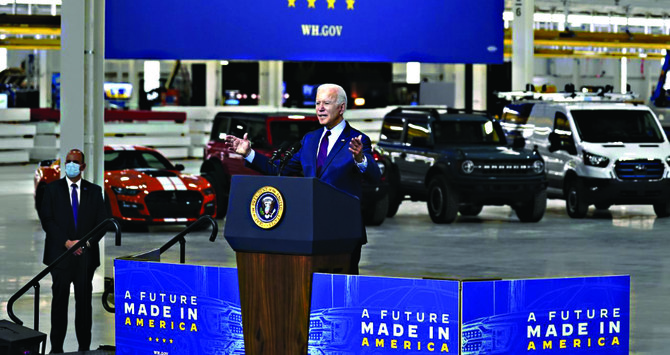

NEW YORK: President Joe Biden’s strategy to make the US a powerhouse in electric vehicles will include boosting domestic recycling of batteries to reuse lithium and other metals, according to government officials.

As Biden makes fighting climate change and competing with China centerpieces of his agenda, the administration is set to wrap up a 100-day review of gaps in supply chains in key areas, including electric vehicles (EV).

These gaps include the minerals used in EV batteries and consumer electronics. The administration is also looking for ways to reduce metal usage in new battery chemistries.

Reports from various government agencies will be submitted to the White House, a process Biden ordered in an executive order earlier this year. Parts of the reports could be released publicly as soon as next week.

Democrats are pushing aggressive climate goals to have a majority of US-manufactured cars be electric by 2030 and every car on the road to be electric by 2040.

Securing enough cobalt, lithium and other raw materials to make EV batteries is a major obstacle, with domestic mines facing extensive regulatory hurdles and environmental opposition.

Reuters reported on May 25 that Biden plans to rely on mines in ally countries to supply much of the metals needed to build EVs.

The administration’s options to spur domestic recycling include direct investment in projects and scientific research, as well as spending funds approved by Congress.

Boosting domestic recycling would help the administration further that goal by breaking down older EVs into component parts for new vehicles and thus relying less on mining.

“When you look at the way the US has approached the recycling opportunity, what’s very evident is we need to invest in that capacity, we need to take a more proactive approach,” said one of the administration officials.

“A big part of the lithium opportunity is really recycling, and being a global leader in recycling the lithium from existing batteries and driving that into these new batteries.”

The White House would like to see more recycling plants open in the US, one of the officials said, noting the announcement last fall by China’s Ganfeng Lithium Co. of plans to build a battery recycling plant in Mexico to supply the US EV market.

The administration’s emerging strategy will also include a heavy emphasis on research and development intended to boost the use of already-mined metals, the officials said.

That plan would effectively expand on ongoing research at the US Department of Energy’s Argonne National Laboratory, which has been the focal point for much of the government’s battery recycling research.

Extracting the various mineral components of a battery has proven difficult and costly in the past, and new research focuses on ways to reuse cathodes and other battery parts, according to Argonne researchers.

Washington’s recycling focus comes as other regions are doing the same. The EU is considering clamping down on exports of metal waste to encourage more regional recycling, part of an effort to become climate neutral by 2050.

Global EV sales topped 2.5 million last year, a figure that’s projected to jump 70 percent for 2021 and continue to rise through 2040, according to IHS Markit forecasts.

Biden’s electric vehicle plan includes battery recycling push

https://arab.news/53e3z

Biden’s electric vehicle plan includes battery recycling push

- The White House would like to see more recycling plants open in the US: official

- The administration is also looking for ways to reduce metal usage in new battery chemistries

Closing Bell: Saudi main market ends week in red at 11,189

RIYADH: Saudi Arabia’s Tadawul All Share Index closed lower at the end of the trading week on Thursday, falling 1.34 percent, or 152.54 points, to finish at 11,188.73.

The benchmark index opened at 11,320.52 and trended lower throughout the session, finishing well below its previous close of 11,341.27.

Market breadth was sharply negative, with only 28 gainers compared with 236 decliners. Trading activity saw a volume of 239 million shares exchanged, with total turnover reaching SR5.5 billion ($1.47 billion).

In the parallel market, Nomu closed higher, rising 0.23 percent to 23,865.95, although decliners continued to outnumber advancers. The MT30 index closed at 1,508.60, down 1.46 percent, shedding 22.38 points by the end of the session.

Among the session’s top gainers, Dar Al Majed Real Estate Co. led advances, rising 5.43 percent to close at SR9.91.

Al Aziziah REIT Fund added 4.67 percent to SR4.48, while Al Majed Oud Co. gained 2.81 percent to SR161.20. AFG International Co. advanced 2.45 percent to SR17.17, and Al Mawarid Manpower Co. rose 1.37 percent to SR125.70.

On the losing side, Saudi Research and Media Group posted the steepest decline, falling 6.88 percent to SR107. Cherry Trading Co. dropped 6.23 percent to SR28.88, while Saudi Arabian Mining Co. slipped 5.41 percent to SR72.55.

Almasane Alkobra Mining Co. declined 5.38 percent to SR102, and Power and Water Utility Co. for Jubail and Yanbu ended 4.56 percent lower at SR31.36.

On the announcements front, Saudi Industrial Investment Group released its interim financial results for the twelve-month period ended Dec. 31, 2025, reporting a return to profitability on an annual basis despite posting a quarterly loss.

The company recorded a net loss of SR104 million in the fourth quarter, compared with a net profit of SR201 million in the same quarter of the previous year, which it attributed mainly to lower selling prices, higher operating costs, and increased general and administrative expenses.

For the full year, however, the group posted a net profit attributable to shareholders of SR197 million, compared with SR161 million a year earlier, supported by higher sales volumes and improved operational performance at several subsidiaries. The stock last traded at SR14.77, down 3.59 percent.

Separately, Saudi Exchange Co. announced the approval of a request by Merrill Lynch Kingdom of Saudi Arabia to terminate its market-making activities for Saudi Arabian Oil Co., effective Feb. 8.

The exchange said the termination relates specifically to the market-making agreement for Saudi Aramco shares and was approved in line with applicable market-making regulations.