RAWALPINDI: Tea vendor Arshad Khan, who became Pakistan’s hottest celebrity in 2016 when his photo went viral on the Internet, says he is working to open a cafe in the United Kingdom.

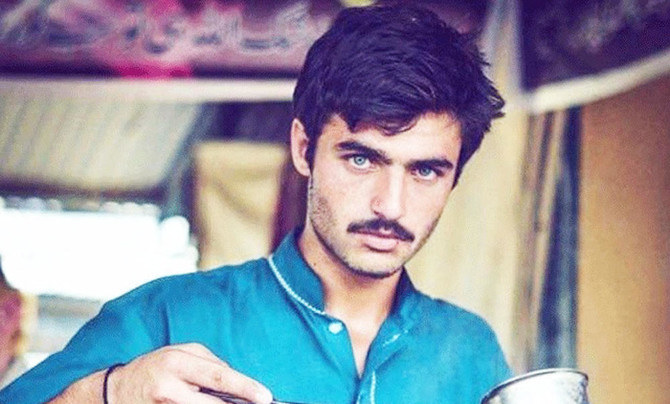

Khan the ‘Chai Wala,’ an ethnic Pashtun, became an overnight sensation when a photographer, Javeria Ali, took a shot of him for Instagram as he worked at his tea-stall-- which was then shared tens of thousands of times.

The fame won the strikingly handsome blue-eyed Khan a number of modelling contracts and last year, he launched his own chain of restaurants called ‘Cafe Chaiwala Rooftop,’ which he is now taking to the UK.

Arshad Khan is making tea at a local stall in Islamabad in October 2016. The photo went viral and shot him to international fame. (Photo courtesy: Social Media)

“We are very excited because there is not any other Pakistani brand which has launched a franchise like this — well maybe there is but we don’t know about them,” Khan told Arab News over the phone on Friday.

“We worked very hard and are focused on what’s to come.”

Khan did not specify a launch date but said he hopes to expand to 10 locations across the UK.

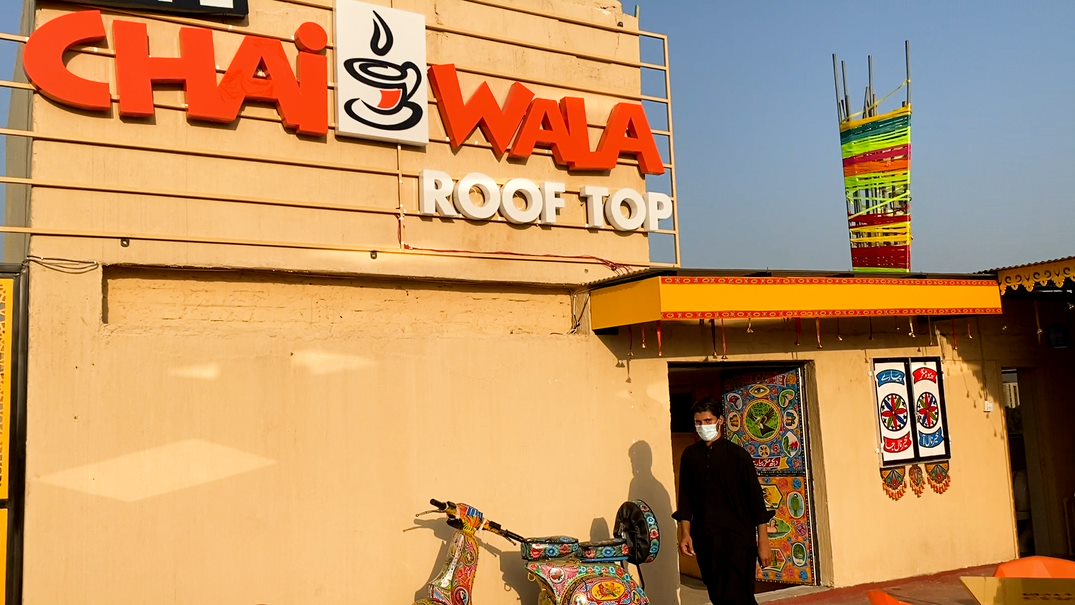

Khan’s first cafe in Pakistan, launched in October 2020 in Islamabad, had seen a “tremendous response,” he said, and he now had two more branches, in Islamabad and the hill station city of Murree, where local tourists throng in the summer months for respite from the weather.

Cafe Chaiwala Rooftop, belonging to Arshad Khan, the world’s most famous tea seller, is seen in Islamabad, Pakistan, on October 8, 2020. (AN photo)

Kazim Hasan, Khan’s partner and mentor told Arab News the duo had signed a “Master Franchise Agreement” for the UK with two seasoned franchise runners-- Nadir Khan Durrani and Yawer Akbar Durrani-- laying the foundations for Café Chaiwala to become a global brand. The Durranis already have a number of Arby’s and Popeyes restaurants under their belt.

“We had great conversations about what we were looking to achieve, and they have great know-how,” Hasan said about the partnership.

“They haven’t worked in the UK before, but we believe in our goal and are are working on this together.”