DUBAI: The financial world has welcomed Saudi Arabia’s ambitious new economic strategy, as analysts digested details of the bold plan to invest SR12 trillion ($3.2 trillion) in the Kingdom over the coming decade.

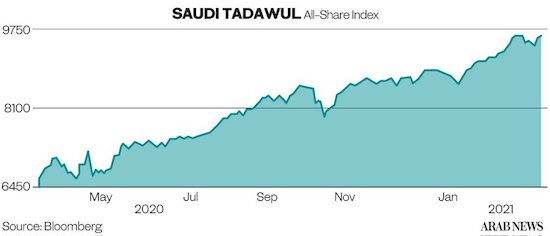

The Tadawul stock market in Riyadh leapt to a five-year high, while Brent crude, the oil benchmark, clawed back some of its recent losses. Saudi Aramco shares were trading close to an all-time high as the implications of the new Shareek strategy sank in.

Crown Prince Mohammed bin Salman announced late on Tuesday night that the Kingdom would boost economic activity by means of a plan to increase private sector investment, as well as via further investment by the Public Investment Fund, the Kingdom’s sovereign wealth fund. There would also be the stimulus from a new national investment strategy to be announced soon.

Economists and business leaders welcomed the strategy. Nasser Saidi, a Middle East economics expert, said the intention was to “jump start” the Saudi economy in the wake of the recession caused by the COVID-19 pandemic.

“This would be a massive increase in investment that will likely modernize and upscale infrastructure, including digital. As proposed, it should be strongly supportive of non-oil growth, increase overall productivity and lead to job creation for Saudi’s young population,” he added.

The plan involves incentives for publicly quoted companies to channel dividend payments into long-term investment in the Saudi economy. Amin Nasser, the chief executive of Saudi Aramco, which pays the biggest dividend on the Tadawul, said that the new strategy would not prevent the company from meeting its dividend pledges.

“We support this initiative, which is very much aligned with Vision 2030. It promotes GDP growth through new investment and will have a multiplier effect for the Saudi economy,” he told CNBC television.

Yousef Al Benyan, chief executive of petrochemicals giant SABIC, 70 percent of which is owned by Aramco, said the strategy would help it double its capacity. “It will enhance the company’s competitive position on the local, regional and global levels,” he said.

Saidi added that the move from dividends to investment could be a positive one: “This switch is likely to increase the efficiency of investment since SABIC, Aramco and other entities would aim to earn a market return on their investment. This would cut waste and inefficiencies, an overall gain to the economy.”

He also highlighted the impact the Shakeel strategy could have on persuading Saudi citizens to invest directly at home. “This revival of investment and successful program would attract back a fraction of the Saudi private wealth held offshore.”

Other financial experts were also impressed by the scale of the plan, which, along with government and consumer spending, amounts to a SR27 trillion stimulus over the coming decade, the biggest economic boost in the Kingdom’s history.

“Saudi Arabia is in a race against time to diversify its economy away from fossil fuels and is taking bold steps. The targets appear ambitious, but aiming high is what may be required at this juncture,” said Tarek Fadlallah, chief executive of Nomura Asset Management in the Middle East.