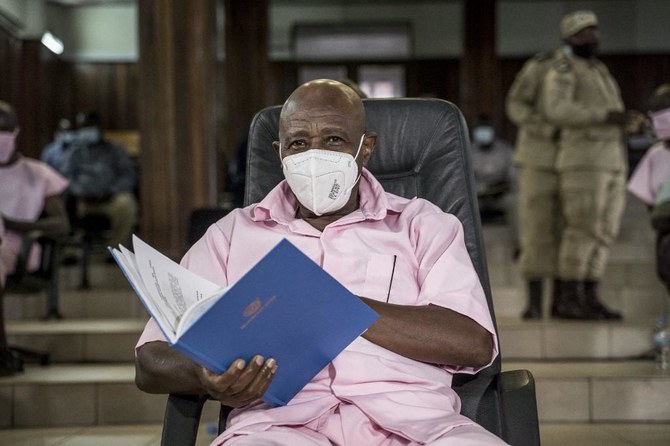

KIGALI: Paul Rusesabagina, the polarizing hero of the hit movie “Hotel Rwanda,” failed to show up for his trial Wednesday, after informing prison authorities he was quitting the process as he did not expect justice.

Rusesabagina, whose actions during Rwanda’s 1994 genocide inspired the movie, has been charged with nine offenses, including terrorism for starting an armed group in recent years that is accused of staging deadly attacks within Rwanda.

The 66-year-old, who had been living in exile in Belgium, has said he was kidnapped, after being tricked into getting onto a plane to Kigali when he thought he was going to Burundi.

Rwandan Justice Minister Johnston Busingye admitted in an interview with Al-Jazeera last month that the government had paid for the flight.

At Wednesday’s hearing, a letter from Nyarugenge Prison where Rusesabagina is being held was read out, saying that he would no longer attend the trial.

“He told Nyarugenge jail that he will never again appear before this court, not just today but even for future hearings. He said that he does not expect any justice from this court,” according to the letter, written by prison director Michel Kamugisha.

Presiding judge Antoine Muhima ruled the trial would continue.

“Rusesabagina chose not to attend this hearing. He has a right to do so but choosing not to appear does not stop the trial from proceeding,” Muhima said.

During his last appearance on March 12, when the court ruled against Rusesabagina’s request to have six months to prepare his defense, he said he was quitting the trial as “my basic rights to defend myself and to have a fair trial were not respected.”

His family insists that he has not been given access to over 5,000 pages of documents in his case file.

He is also being tried alongside 20 others accused of terrorism, “all of whom pled guilty and incriminated him,” said the spokeswoman for the Hotel Rwanda Foundation, Kitty Kurth.

“President (Paul) Kagame has publicly pronounced that Paul is guilty of the charges, effectively obliterating his right to be presumed innocent.”

The plethora of accused has led to chaotic scenes in the courtroom with over 10 lawyers, each arguing for their clients, and multiple witnesses expected to appear.

Rusesabagina is credited with sheltering hundreds of Rwandans inside a hotel he managed during the 1994 genocide, in which 800,000 mostly Tutsis but also moderate Hutus were slaughtered.

But in the years after Hollywood made him an international celebrity, a more complex image emerged of the staunch government critic, whose tirades against Kagame’s regime made him an enemy of the state.

Kagame has been in power since 1994 and is accused by critics of crushing opponents and ruling through fear.

Rusesabagina has admitted to helping form the National Liberation Front (FLN), but denied any roles in its crimes.

Hotel Rwanda ‘hero’ quits trial, says expects no justice

https://arab.news/bgxwt

Hotel Rwanda ‘hero’ quits trial, says expects no justice

- Paul Rusesabagina is being tried alongside 20 others accused of terrorism

- He is credited with sheltering hundreds of Rwandans inside a hotel he managed during the 1994 genocide

Britain needs ‘AI stress tests’ for financial services, lawmakers say

- Lawmakers urge AI-specific stress tests for financial firms

LONDON: Britain’s financial watchdogs are not doing enough to stop artificial intelligence from harming consumers or destabilising markets, a cross-party group of lawmakers said on Tuesday, urging regulators to move away from what it called a “wait and see” approach.

In a report on AI in financial services, the Treasury Committee said the Financial Conduct Authority and the Bank of England should start running AI-specific stress tests to help firms prepare for market shocks triggered by automated systems.

The committee also called on the FCA to publish detailed guidance by the end of 2026 on how consumer protection rules apply to AI, and on the extent to which senior managers should be expected to understand the systems they oversee.

“Based on the evidence I’ve seen, I do not feel confident that our financial system is prepared if there was a major AI-related incident and that is worrying,” committee chair Meg Hillier said in a statement.

TECHNOLOGY CARRIES ‘SIGNIFICANT RISKS’

A race among banks to adopt agentic AI, which unlike generative AI can make decisions and take autonomous action, runs new risks for retail customers, the FCA told Reuters late last year.

About three-quarters of UK financial firms now use AI. Companies are deploying the technology across core functions, from processing insurance claims to performing credit assessments.

While the report acknowledged the benefits of AI, it warned the technology also carried “significant risks” including opaque credit decisions, the potential exclusion of vulnerable consumers through algorithmic tailoring, fraud, and the spread of unregulated financial advice through AI chatbots.

Experts contributing to the report also highlighted threats to financial stability, pointing to the reliance on a small group of US tech giants for AI and cloud services. Some also noted that AI-driven trading systems may amplify herding behavior in markets, risking a financial crisis in a worst-case scenario.

An FCA spokesperson said the regulator welcomed the focus on AI and would review the report. The regulator has previously indicated it does not favor AI-specific rules due to the pace of technological change.

The BoE did not respond to a request for comment.

Hillier told Reuters that increasingly sophisticated forms of generative AI were influencing financial decisions. “If something has gone wrong in the system, that could have a very big impact on the consumer,” she said.

Separately, Britain’s finance ministry appointed Starling Bank CIO Harriet Rees and Lloyds Banking Group ‘s Rohit Dhawan as “AI Champions” to help steer AI adoption in financial services.