Airbnb is requiring most professional hosts outside North America to include all service fees in the rate presented to guests, a move that mirrors how rival platforms operate.

Airbnb will require hosts who use third-party software to manage bookings to eliminate the “service fee” paid by guests that is traditionally tacked on to the listing price. Instead hosts will pay a standard fee of 15 percent, up from the typical 3 percent they are assessed now.

Hosts interviewed by Reuters said they expect most will raise their listed prices to account for the larger host fee, making the change cost-neutral for most guests and for Airbnb. But hosts with fewer properties expressed some concerns.

The new fee structure comes as the San Francisco-based home rental platform prepares to sell shares in its initial public offering this week. Airbnb said early tests show the simplified pricing helped drive 17 percent more bookings.

“Following feedback from hosts we recently introduced a simplified host-only fee structure for professional hosts who connect to our API in certain countries,” said Airbnb spokesperson Christopher Nulty. “Our fee structure for individual hosts remains unchanged.”

But Airbnb declined to comment on some of the negative feedback from hosts about the change, citing a quiet period before its IPO.

The fee change has been communicated to professional hosts but not reported widely.

Airbnb began with hosts renting out air mattresses in their homes. A former Airbnb host acquisition specialist told Reuters “individual hosts are good for PR.” But hosts managing hundreds or thousands of properties drive an outsized portion of revenue. As of end-September, 10 percent of Airbnb’s hosts were professional managers, and they accounted for 28 percent of nights booked, according to Airbnb’s IPO filings.

Management software platform Uplisting’s CEO Vincent Breslin said hotels and professional managers of multiple properties have asked for the change to make it easier to list across different platforms with one sticker price.

“Having fee parity across all platforms is a benefit to all,” said Ryan Danz, CEO of Air Concierge Inc., which manages about 500 properties. “It makes a better apples-to-apples comparison for the traveler if they find the same home listed on various websites.”

But some smaller property managers are worried the change could hurt them if they can’t raise prices enough to cover the increased host fee.

Airbnb already gave itself a black eye with many hosts when it made them issue refunds for cancelations caused by the global pandemic. It now faces a class action suit and hundreds of arbitration cases stemming from that.

Johnny Buckingham, who manages nine listings on Airbnb across the US, said he would not want to raise his listing price to cover the increased host fee and believed Airbnb was discouraging hosts from using software to cross-list on other platforms.

“They’ve made their message clear. Stick exclusively with us or pay us 5x as much,” he said.

Sarah DuPre, sales director at AirDNA, an analytics firm specializing in vacation rentals, said that they will have a minimal impact on host retention but could impact Airbnb’s “ability to be seen as the most economical source of accommodation.”

Rowan Clifford, who helps Airbnb hosts improve visibility of their listings and is also a host, predicted in a blog post two years ago that host fees would go up as hosts become reliant on Airbnb. He expects individual hosts will eventually also see a fee hike and said smaller hosts could face price competition from professionally managed listings that don’t raise prices to cover the increased host fee. “They don’t need us as much anymore, basically.”

Airbnb streamlines fees as it tilts toward biggest hosts

https://arab.news/894rr

Airbnb streamlines fees as it tilts toward biggest hosts

- Airbnb will require hosts who use third-party software to manage bookings to eliminate the ‘service fee’ paid by guests

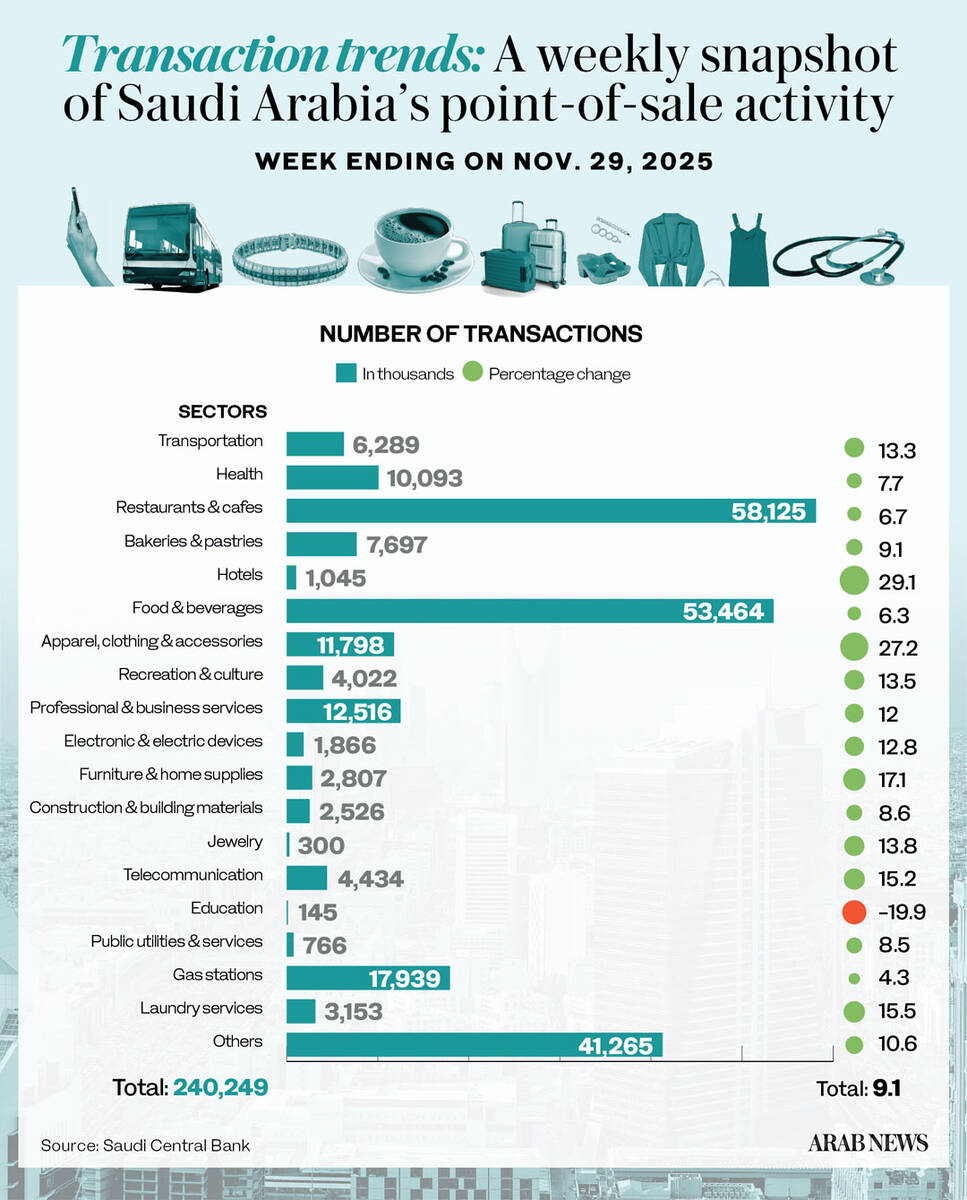

Saudi POS transactions see 20% surge to hit $4bn: SAMA

RIYADH: Saudi Arabia’s total point-of-sale transactions surged by 20.4 percent in the week ending Nov. 29, to reach SR15.1 billion ($4 billion).

According to the latest data from the Saudi Central Bank, the number of POS transactions represented a 9.1 percent week-on-week increase to 240.25 million compared to 220.15 million the week before.

Most categories saw positive change across the period, with spending on laundry services registering the biggest uptick at 36 percent to SR65.1 million. Recreation followed, with a 35.3 percent increase to SR255.99 million.

Expenditure on apparel and clothing saw an increase of 34.6 percent, followed by a 27.8 percent increase in spending on telecommunication. Jewelry outlays rose 5.6 percent to SR354.45 million.

Data revealed decreases across only three sectors, led by education, which saw the largest dip at 40.4 percent to reach SR62.26 million.

Spending on airlines in Saudi Arabia fell by 25.2 percent, coinciding with major global flight disruptions. This followed an urgent Airbus recall of 6,000 A320-family aircraft after solar radiation was linked to potential flight-control data corruption. Saudi carriers moved swiftly to implement the mandatory fixes.

Flyadeal completed all updates and rebooked affected passengers, while flynas updated 20 aircraft with no schedule impact. Their rapid response contained the disruption, allowing operations to return to normal quickly.

Expenditure on food and beverages saw a 28.4 percent increase to SR2.31 billion, claiming the largest share of the POS. Spending on restaurants and cafes followed with an uptick of 22.3 percent to SR1.90 billion.

The Kingdom’s key urban centers mirrored the national decline. Riyadh, which accounted for the largest share of total POS spending, saw a 14.1 percent surge to SR5.08 billion, up from SR4.46 billion the previous week. The number of transactions in the capital reached 75.2 million, up 4.4 percent week-on-week.

In Jeddah, transaction values increased by 18.1 percent to SR2.03 billion, while Dammam reported a 14 percent surge to SR708.08 million.

POS data, tracked weekly by SAMA, provides an indicator of consumer spending trends and the ongoing growth of digital payments in Saudi Arabia.

The data also highlights the expanding reach of POS infrastructure, extending beyond major retail hubs to smaller cities and service sectors, supporting broader digital inclusion initiatives.

The growth of digital payment technologies aligns with the Kingdom’s Vision 2030 objectives, promoting electronic transactions and contributing to the nation’s broader digital economy.