NEW YORK: Increasing numbers of New Yorkers are buying cars as they avoid public transport because of the coronavirus disease (COVID-19) pandemic, igniting the second-hand market but undermining hopes of less congestion in the Big Apple.

Julien Genestoux, 35, never owned a car when he lived in Lyon, Rome and San Francisco. And he got through five years in New York without needing one.

“Using a car in the city is a nightmare,” he told AFP. “There’s the traffic jams, going round for hours looking for somewhere to park.”

“For me, it was not practical at all. But here it has become necessary unfortunately.”

A few weeks ago, Genestoux, who has three children, finally took the plunge and bought a family car from a used-car website.

It has allowed his family to escape New York at a time when virtually all its cultural activities are shut down. Genestoux has swapped weekends in Central Park for trips to Rockaway beach.

He was the last of his group of friends to buy a car — none of them had ever owned one before the pandemic.

The Manheim used vehicle value index, which tracks price trends in the US, reached an all-time high of 163.7 in August, against 141.3 a year ago. In early June, second-hand car dealer Chris Stylianou was close to completely emptying his stock, something he had never come close to achieving in his 30-year career.

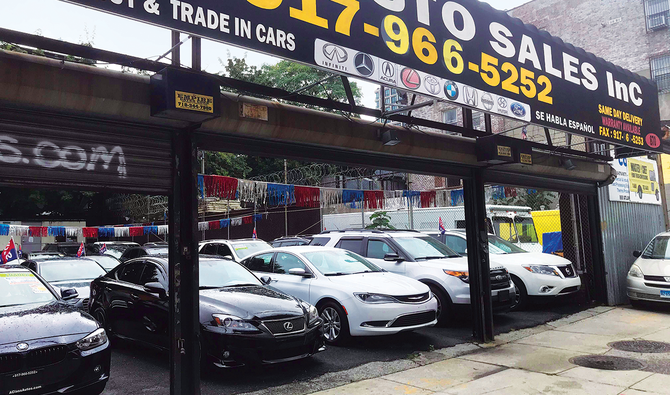

“A car I was buying for $5,000 two years ago, I end up (paying) $5,500 today. Same car, same model, same condition,” said Stylianou, owner of Major Auto Show in Brooklyn. “People were buying just to avoid public transportation. Anything that was good to go would go,” he added.

Rudy Blocker, a used-car salesman at A Class Auto Sales, also in Brooklyn, believes the surge in purchases was helped by weekly $600 checks the government sent to unemployed Americans until the end of July to help stimulate the economy.

“People had a little money and it was burning their pocket,” he said.

Sales of new cars have not soared, however.

While they have picked up since June, they are still significantly down from 2019 for all major makers.

“With a lease, you’d have to commit for three years,” said epidemiologist Magdalena Cerda, who bought a BMW station wagon for $35,000.

“When you buy a new car you are losing so much money just as soon as you drive it out of the parking lot. It seemed like a better investment just to buy a used car,” she added.

Cerda, the mother of a seven-year-old girl, wanted a temporary fix because she hopes New York City will one day return to normal and she’ll be able to safely take the subway again.

“Everyone hopes it is just temporary,” agreed Genestoux.

“If the situation returns to normal, I think we would get rid of the car,” he added.

Neither Genestoux or Cerda use their new vehicles on weekdays, unlike the tens of thousands of New Yorkers who now hit the road every day.

“It’s different people (from before). It’s people who work around here,” said Fernando Bajana, manager of the GGMC Seven Eleven parking lot in Midtown, Manhattan.

“Before they came to work using public transportation but now they are afraid to do so.”

Transportation Alternatives, a nonprofit that works to take cars off New York’s streets, noted in September that despite most New Yorkers working from home “traffic is down only 9 percent compared to last year.”

The group warned that without action the city faces becoming a “gridlocked, exhaust-choked, and crash-laden ‘Carmageddon.’”

Self-proclaimed champion of the fight against pollution Mayor Bill de Blasio has not yet laid out any plan to prevent congestion borne of the pandemic.

A pre-pandemic congestion charge scheme for midtown Manhattan scheduled for January 2021 has been postponed until at least the end of 2021.

“If today people buy cars, I think that shows there is also a failure of public transport policies in the city,” said Genestoux.