BERLIN: Europe’s unemployment rate ticked up modestly last month, contained by use of labor programs that have kept millions of workers on payrolls, official data showed Wednesday.

The jobless rate in the 19 countries that use the euro rose to 7.3 percent in April, the first full month when pandemic lockdowns hit the continent, from 7.1 percent in March, statistics agency Eurostat said Wednesday.

Europe’s rise in unemployment has been moderate by international standards because employers are making extensive use of government-backed short-time work programs that allows them to keep employees on the payroll while they await better times.

In Germany, Europe’s largest economy, the federal labor agency pays at least 60 percent of the salary of employees who are on reduced or zero hours. Some 10.66 million people were registered for that program in March and April, and 1.06 million followed in May, the labor agency said — though it stressed that this doesn’t mean all of them were put on short-time work. Germany has a population of 83 million.

In the US, which has fewer automatic furlough schemes than Europe, the jobless rate has rocketed to almost 15 percent from 4 percent before the crisis.

The European jobless figures, however, also appear flattered by the fact that some unemployed people likely stopped looking for work and stopped counting as jobseekers.

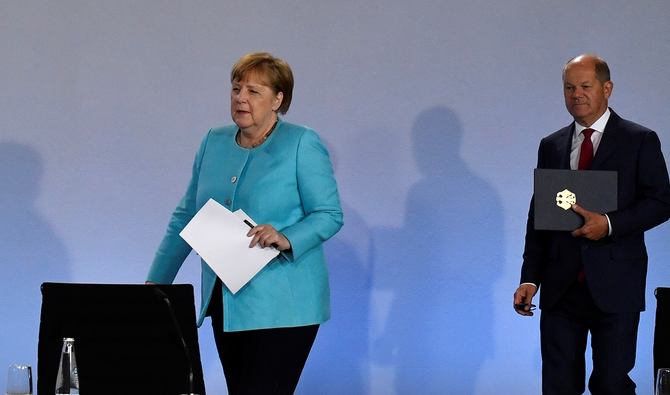

On Wednesday, Chancellor Angela Merkel’s coalition was spending a second day hammering out a stimulus package meant to help kick-start the economy. It’s expected to be worth as much as €80-€100 billion ($89-112 billion).

Germany started loosening coronavirus restrictions on April 20, about a month after they were introduced, and the easing has gathered pace since. However, the economy went into a recession in the first quarter and that is expected to deepen in the current quarter.