KARACHI: Having established themselves in Punjab, ostriches are returning to Sindh, a decade after their first lackluster attempt to settle in the province.

“We imported chicks from South Africa and Australia and kept them at farmhouses in Karachi’s outskirts. But extreme violence and gangs disrupted the process,” Raja Tahir Latif, president of the Pakistan Ostrich Association, told Arab News as he recalled the first attempts to introduce the bird in Sindh in 2008.

Native to the deserts of Africa, the exotic species was initially brought to Pakistan for zoological gardens in 1989.

Six years later, he said, farmers found an enabling environment in Punjab. “Punjab livestock secretary Naeem Sadiq offered a package of Rs10,000 per bird to farmers who had more than 30 chicks as part of his several initiatives to promote the livestock in the province.”

Following Punjab’s success, the largest bird species is finally making a comeback in Sindh, which according to officials offers very favorable climate conditions and business potential.

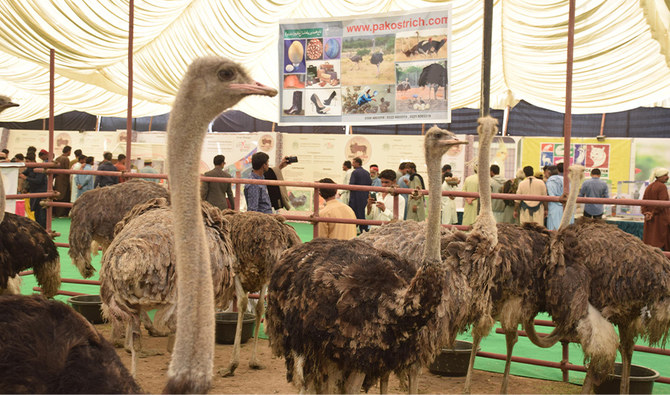

An ostrich from a farmhouse in Tando Adam is on display at Sindh’s first livestock expo held in Hyderabad on Feb. 9, 2020. (AN photo by S.A. Babar)

“Local farmer Taj Muhammad Waryah has set up a farm with 30 breeders in Tando Adam and if the government of Sindh extends help like Punjab did in 2014, many people would join,” Latif said.

Waryah too is hoping that to encourage more breeders Sindh will introduce regulations making the ostrich part of the province’s poultry livestock to allow slaughter. “Those who visit my farm say they will also start farming,” he told Arab News.

Waryah’s farm is going to be officially opened next week.

Taj Muhammad Waryah poses for a photo at his ostrich ranch in Tando Adam, Sindh, Feb. 13, 2020. (Photo courtesy: Taj Muhammad Waryah)

“We will also hold a seminar in Karachi to introduce other people (to ostrich farming),” said Dr. Nazeer Hussain Kalhoro, director general of the Sindh Livestock and Fisheries Department.

He added that efforts to promote the farming of ostriches are not only aimed at providing an alternative source of meat, but “will also help the economy grow.”

An imported ostrich chick costs about Rs18,000. Ostrich meat is currently sold for between Rs1,200 and Rs1,800 per kilogram.

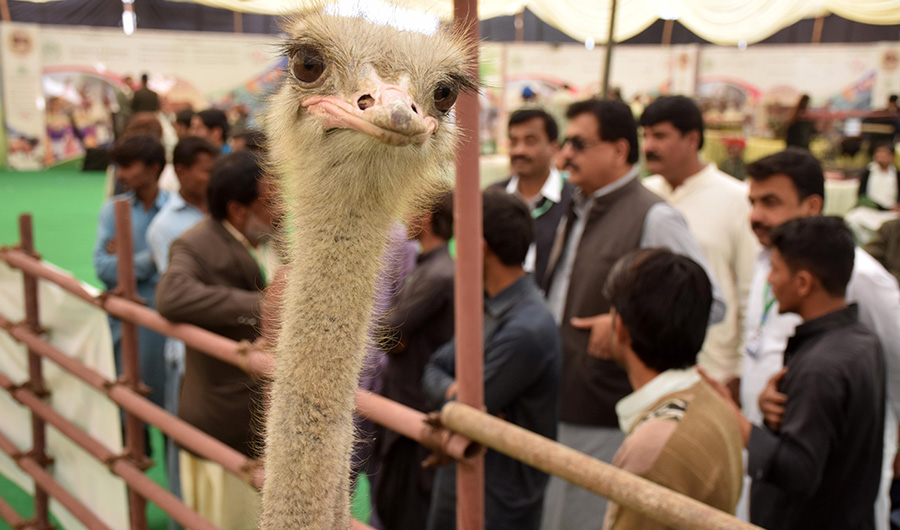

A man takes a photo of an ostrich at the first livestock expo in Hyderabad, Sindh, on Feb. 9, 2020. (AN photo by S.A. Babar)

As countries in the Far East are not suitable for the bird, Sindh can answer their demand, according to Latif from the ostrich association.

“In coming days, ostrich farming will be huge. A big source of healthy meat at home as well as a source of export (revenue),” he said, explaining that it takes about a year for the bird to reach a weight of 100 kilograms.

Ostrich meat is lower in fat and cholesterol than chicken or beef. It is also halal. During last year’s Ramadan, ostrich curry was offered by a Karachi charity for communal pre-dawn meals.