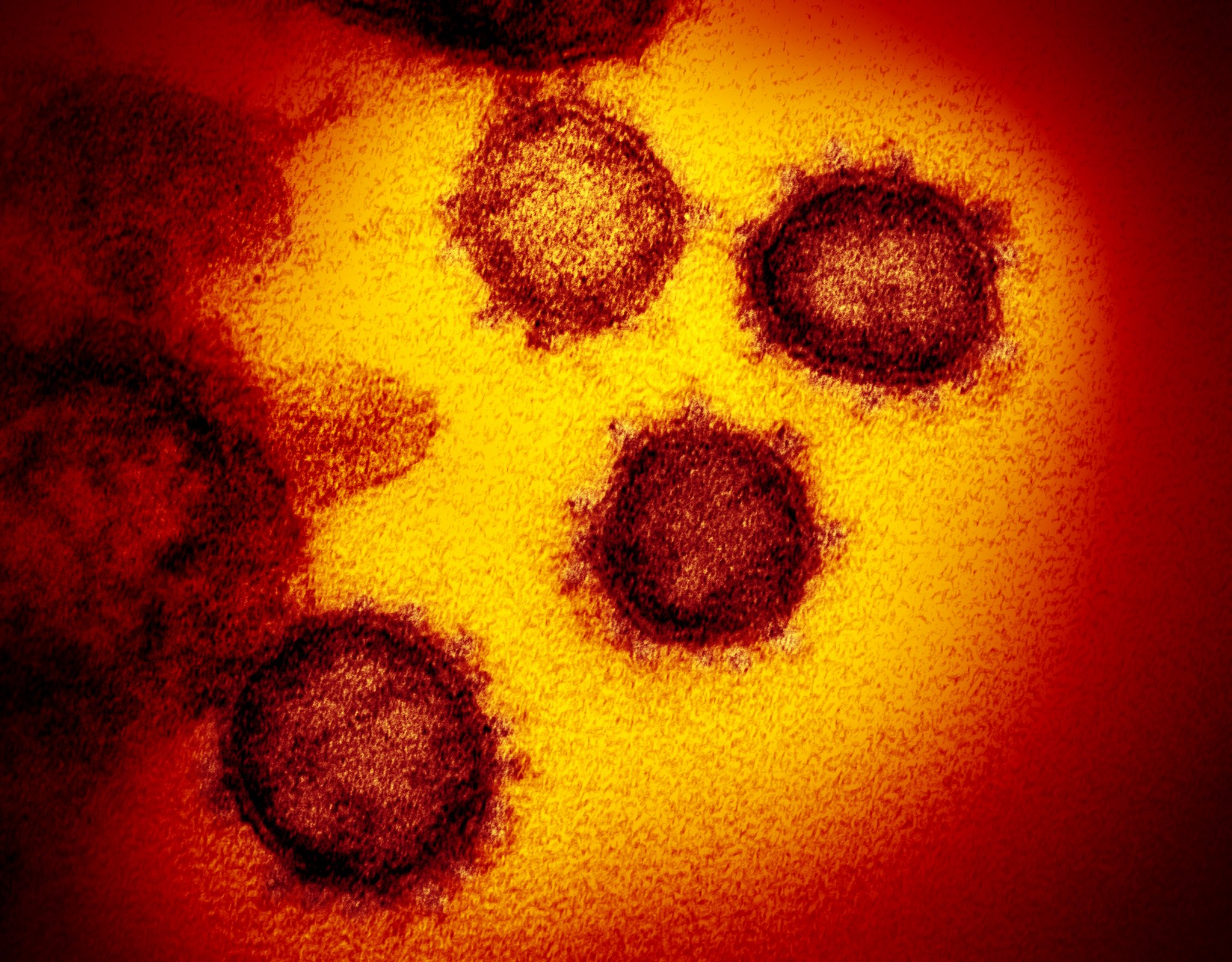

PARIS: Global oil demand will suffer its first quarterly drop in a decade as the COVID-19 virus lashes the economy in China and its impact ripples throughout the world, the IEA said.

“Global oil demand has been hit hard by the novel coronavirus (COVID-19) and the widespread shutdown of China’s economy,” the International Energy Agency said in its latest monthly report.

“Demand is now expected to fall by 435,000 barrels year-on-year in the first quarter of 2020, the first quarterly contraction in more than 10 years” when it dropped during the global economic crisis, it added.

While the IEA still expects demand for oil to grow for this year as the outbreak is contained, it slashed its forecast for the increase in global consumption by nearly a third to 825,000 barrels per day, the smallest increase since 2011.

The outbreak of the new coronavirus spurred China to take drastic measures such as placing in quarantine over a dozen cities and extending the Lunar New Year holidays in order to try to stem its spread, nearly shutting down key parts of its economy.

Opinion

This section contains relevant reference points, placed in (Opinion field)

Although markets have rebounded in recent days as investors grew confident that China could quickly contain the virus and its economic impact would be short lived, the IEA warned against complacency by comparing today’s crisis to the 2003 SARS outbreak.

“While steps taken in China to reduce its spread were adopted earlier than in the SARS crisis and have been far more extensive, the profound transformation of the world economy since 2003 means China’s slowdown today is bound to have a stronger global impact,” it said in the report.

The IEA noted that since 2003 China has become more integrated in global supply chains, its tourism sector has dramatically expanded and Chinese are the largest contingent of world tourists, and the country’s share of global GDP has jumped from 4 to 16 percent.

With it estimating that China’s international air travel having fallen by 70 percent and domestic travel by half in the early part of the crisis, the IEA expects double digit drops in jet fuel demand in the country.

A similar drop in diesel demand is expected due to other travel restrictions.

The IEA chopped its forecast for China’s GDP growth in the first quarter of this year by 1.5 percentage points to 4.5 percent. It also made large cuts of over 0.5 percentage points to its forecasts for China’s trading partners in the region, as well as the US and Russia.

The IEA doesn’t forecast changes in oil prices, but said consumers were unlikely to get much of a boost from cheaper petrol and diesel at the end of the day.

“The effect of the Covid-19 crisis on the wider economy means that it will be difficult for consumers to feel the benefit of lower oil prices,” it said.

With China being a big consumer of oil and the source of most of the growth in oil demand in recent years, the crisis will have a major impact on oil producers.

At the end of last year, OPEC and its allies including Russia, called OPEC+, agreed to further cuts in oil production in order to compensate for rising production in the US and avoid excess supplies that would depress prices.

They are now considering an additional cut of 600,000 barrels per day to compensate for the drop in demand due to COVID-19.

The IEA estimates that the demand for OPEC crude has dropped from 29.4 million barrels per day (mbd) in the final quarter of 2019 to 27.2 mbd in the first three months of this year.

It noted that this is 1.7 mbd below what what OPEC produced in January when the new production cuts came into force.