RIYADH: As artificial intelligence gains global attention and becomes a buzzword, Saudi Arabia is positioned for accelerated adoption to enhance efficiency across its industries.

Over the years, AI has evolved into a transformative technology revolutionizing numerous industries and domains. Its development and adoption across sectors have spurred significant advancements, already reshaping how people live and work globally.

According to a recent report by the professional services firm PwC, the projected economic impact of AI in the Middle East by 2030 is $320 billion, with an estimated $135.2 billion attributed to Saudi Arabia.

The report also highlights an annual growth rate in AI contribution ranging between 20 percent and 34 percent across the region, with the UAE experiencing the fastest growth, followed by Saudi Arabia.

“Such growth and demand for AI demonstrated that the impact on industries can be substantial and wide-ranging both in Saudi Arabia and the wider region,” said Slava Bogdan, CEO & co-founder at Flowwow, to Arab News.

Flowwow, a global gifting marketplace, simplifies gift-giving and connects local brands with customers. It hosts over 14,000 local brands from 1,000 cities and operates in over 30 countries, including the UAE, Spain, the UK, and Brazil.

“Whether it’s hospitality, manufacturing, telecommunication, or business technologies, where Flowwow sits, I could say that AI solutions, firstly, could automate repetitive tasks, allowing employees to focus on more strategic and creative work, especially in data analysis, customer service, and marketing,” Bogdan said.

The CEO further explained how the firm’s marketers frequently utilize AI to target audiences, enhance creatives, or conduct competitive analysis, particularly in global markets like the Middle East and North Africa. This reduces decision-making time and allows for more strategic tasks that necessitate a tailored approach.

“Moreover, AI algorithms can analyze large amounts of data to identify patterns and trends, helping businesses make more informed decisions,” Bogdan explained.

“This attribute can lead to better forecasting, resource allocation, and risk management, especially in the financial sector, having had 25 percent of all regional AI investments,” he added.

Speaking to Arab News, Brahim Laaidi, partner at Bain & Co., emphasized that AI adoption in sectors like energy and healthcare aids “the Kingdom’s economic diversification and fosters a knowledge-based economy, enhancing efficiency and driving growth.”

Moreover, AI is recognized for enhancing customer experience and reducing costs for firms in various ways.

DID YOU KNOW?

• Saudi Arabia was one of the first nations to utilize data and artificial intelligence technologies to achieve its Vision 2030 goals.

• There are five prominent types of AI: machine learning, natural language processing, computer vision, speech recognition and robots.

• The Saudi Data and AI Authority has created AI ethics principles in accordance with the Kingdom’s commitment to human rights.

• SDAIA estimates SR412.5 billion ($109.96 billion) in global spending on AI by 2024 end.

“AI chatbots and virtual assistants provide 24/7 customer support, reducing costs. Multiple Saudi firms and banks use chatbots for customer service,” highlighted Laaidi.

He also illustrated how AI analyzes customer behavior to create personalized experiences, citing examples like Netflix and Spotify, which utilize AI to tailor content based on user preferences and listening habits.

Laaidi also highlighted how “AI facilitates segmentation based on behavior and profitability for targeted marketing. Coca-Cola utilizes AI for consumer segmentation.”

“In a nutshell, for most enterprises, the focus remains on leveraging narrow or vertical AI solutions to enhance specific business processes, improve customer experiences, or optimize operations,” he added.

According to Jad Haddad, head of Digital IMEA at management consulting firm Oliver Wyman, AI essentially democratizes access to intelligence, making it cheaper and more widely available.

This can generate significant efficiencies by augmenting employee capabilities, enabling them to complete tasks faster, and automating certain processes without human intervention.

Oliver Wyman estimates that up to 35 percent of tasks globally may be augmented or automated by AI in the next three years.

“In Saudi Arabia, considering the current economic structure, Oliver Wyman estimates that up to 17 percent of tasks may be affected within that time frame,” Haddad told Arab News.

AI projects and employment

It is evident that the Kingdom has been significantly investing in AI in recent years.

Key initiatives, according to Laaidi, include the National Strategy for Data and AI, aiming to establish Saudi Arabia as a global AI leader by 2030. Additionally, Neom, a planned smart city, is poised to leverage AI in urban planning and environmental management.

“The Saudi Data and Artificial Intelligence Authority was established in 2020 to regulate AI development, and Tonomous collaborates with global tech leaders to enhance the city’s projects,” he added.

Laaidi continued by stating that AI and Robotics Centers, formed through partnerships with universities and international entities, are advancing AI in the Kingdom. From a technology industry perspective, it offers diverse applications and significant benefits.

According to Cristina Carranza, global head of business development at GGTech Entertainment, AI stands as a powerful tool with vast potential to enhance operational efficiency across various domains.

“We use AI selectively, focusing on specific areas where it can augment human skills and improve processes,” Carranza told Arab News.

She gives examples of how AI algorithms are utilized to analyze player data and preferences, enabling them to tailor game experiences and enhance player engagement. “In addition, AI-driven predictive analytics help us anticipate market trends and make informed decisions.”

However, Carranza emphasized the importance of acknowledging that while AI is embraced as a tool for progress, there is a recognition of the necessity of human oversight and control.

“We believe in a symbiotic relationship between humans and AI, where the technology enhances our capabilities but is always subject to human direction and control,” she added,

New dimensions

From GGTech Entertainment’s perspective, AI opens up exciting new dimensions in gaming and entertainment.

Carranza revealed that one significant area involves the optimization of game design processes, where AI algorithms analyze player feedback and behavior data to inform the creation of more engaging and immersive gaming experiences.

“Additionally, AI-powered tools enhance player interaction through personalized recommendations and real-time assistance, fostering deeper engagement and loyalty,” she explained.

The global head further addressed how AI-driven analytics offer valuable insights into player behavior and market trends, empowering GGTech to make data-driven decisions and maintain a competitive edge in the industry.

Bridging skill gaps

The Kingdom’s journey to become an AI leader involves challenges encompassing ethical and legal aspects, data availability and quality, as well as skill gaps, infrastructure requirements, public trust, and the need for international collaborations.

“To navigate these dilemmas, the SDAIA and the National Data Management Office have been established to construct ethical guidelines and improve data governance,” Laaidi explained.

Similarly, the National Cybersecurity Authority continues to safeguard Saudi Arabia's digital infrastructure, including AI systems.

Laaidi emphasized Saudi Arabia’s prioritization of STEM education and training to bridge skill gaps, citing initiatives like the Prince Mohammed bin Salman College of Cyber Security aimed at fostering local talent in AI-related fields.

He highlighted the importance of focusing on STEM disciplines for developing a workforce equipped with the necessary skills for an AI-driven future.

Opinion

This section contains relevant reference points, placed in (Opinion field)

“Substantial investments are being made in infrastructure, with emphasis on high-performance computing and cloud computing capabilities to support AI development and deployment. Building public trust is also a key venture for the Kingdom,” the partner stressed.

In addition, the Kingdom seeks international collaborations with leading AI research entities worldwide to expedite AI capabilities. “By addressing these challenges strategically, Saudi Arabia aims to create a conducive environment for AI development and adoption,” he emphasized.

From a technological perspective, the adoption of AI can present challenges in navigating ethical considerations and ensuring human control.

“At GGTech, we recognize the importance of maintaining human oversight and ethical standards while leveraging AI technologies. To address this challenge, we prioritize transparency and accountability in our AI algorithms and processes, ensuring they are aligned with our values and ethical guidelines,” Carranza described.

She further added that they invest in ongoing training and education for team members to enhance their understanding of AI and its implications, enabling them to make informed decisions and mitigate potential risks.

Reskilling Saudi workforce

Undoubtedly, marketers and creative leaders should prepare for the changes in their professional field resulting from AI adoption.

Bogdan explained that one of the crucial skills is the ability to ask AI the right questions and write clear prompts. He emphasized that it is necessary to understand, at least at a basic level, how AI algorithms work.

“At Flowwow, we acquaint employees with the different instruments to make AI a helpful assistant that allows us to analyze competitors’ websites, fact-check and edit texts, test tasks, and answers,” he continued.

The CEO highlighted that as the Kingdom invests resources to integrate AI into every sector, it creates more opportunities for entrepreneurs to establish their businesses and startups equipped with AI tools.

“Hence, apps and services developed with AI solutions will be on the edge. In this case, product managers and programmers should gain a thorough understanding of machine learning to create up-to-date apps,” Bogdan highlighted.

The CEO stressed that it will mostly be up to companies to invest in continuous learning and upskilling through educational short courses for their workers. “This investment is crucial to ensure that the workforce remains competitive and competent in leveraging advancements in AI effectively.”

Saudi Vision 2030

AI is a driving force behind Saudi Arabia’s Vision 2030, fueling economic diversification, smart cities, and public service transformation.

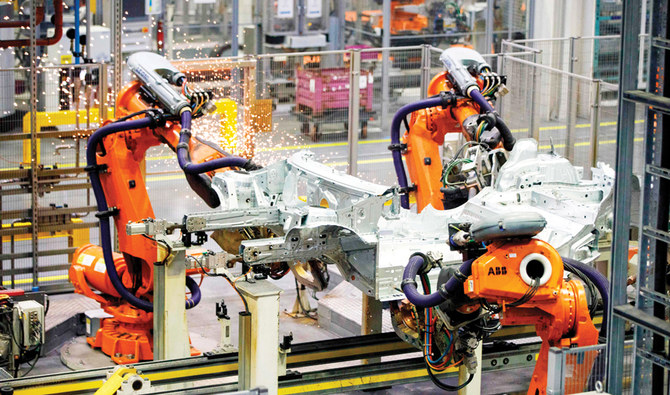

According to Laaidi, “AI boosts innovation across non-oil sectors, enables intelligent urban planning in projects like NEOM, and promotes Industry 4.0 through automation and predictive maintenance.”

“AI also improves government services via chatbots, automation, and analytics. In healthcare, AI enhances medical imaging, drug discovery, and personalized medicine,” he highlighted.

On top of that, Laaidi emphasized how AI educational tools prepare the workforce and optimize resource allocation, while support for clean energy promotes sustainability.

“Vision 2030 powered by AI seamlessly connects economic domains, accelerating progress and innovation across the Kingdom,” he affirmed.

On another note, GGTech Entertainment's use of AI aligns with the goals of Saudi Vision 2030 by driving innovation, promoting economic diversification, and empowering Saudi youth with advanced skills and capabilities, according to the firm's global head.

“One way AI contributes to this vision is by enhancing gaming experiences and promoting the Kingdom as a global hub for entertainment and technology,” said Carranza.

By utilizing AI-powered tools for game design, player interaction, and analytics, GGTech Entertainment is delivering cutting-edge gaming experiences that showcase Saudi Arabia’s technological prowess and creativity to a global audience, she emphasized.

“In addition, the use of AI creates opportunities for job creation and economic growth in the Kingdom. As GGTech expands its AI capabilities, it is investing in the development of a skilled workforce with expertise in AI technologies and data analytics,” the company’s global head said.

She concluded by highlighting how this not only aligns with the goals of Saudi Vision 2030 to foster a knowledge-based economy but also equips Saudi youth with the skills they need to thrive in the digital age.