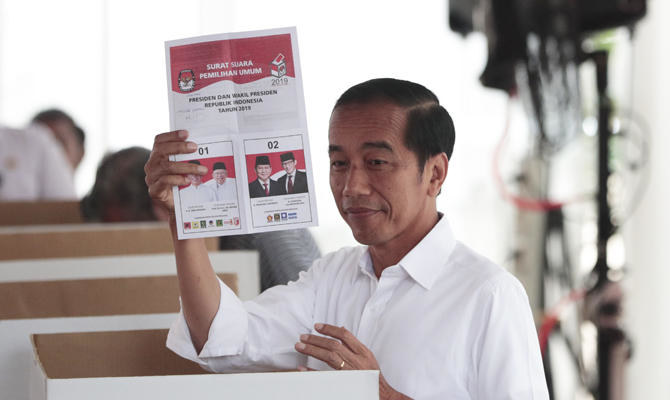

JAKARTA, Indonesia: The official count from last month’s Indonesian presidential election shows President Joko Widodo won 55.5% of the vote, the Election Commission said Tuesday, securing him a second term.

The formal result from the April 17 election was almost the same as the preliminary “quick count” results drawn from a sample of polling stations on election day.

Widodo’s challenger for a second time, former general Prabowo Subianto, has refused to accept defeat and declared himself the winner last month.

Thousands of police and soldiers are on high alert in the capital Jakarta, anticipating protests from Subianto’s supporters.

Subianto has alleged massive election fraud in the world’s third-largest democracy but hasn’t provided any credible evidence. Votes are counted publicly and the commission posts the tabulation form from each polling station on its website, allowing for independent verification.

Counting was completed just before midnight and the Election Commission announced the results early Tuesday before official witnesses from both campaigns.

“We reject the results of the presidential election,” said Azis Subekti, one of the witnesses for Subianto. “This refusal is a moral responsibility for us to not give up the fight against injustice, fraud, arbitrariness, lies, and any actions that will harm democracy.”

Under Indonesia’s election law, Subianto can dispute the results at the Constitutional Court.

He and members of his campaign team have said they will mobilize “people power” for days of street protests rather than appeal to the court because they don’t believe it will provide justice.

In a video released after results were announced, Subianto again refused to concede defeat but called on supporters to refrain from violence.

Police this month have arrested 31 Islamic militants they say planned to set off bombs during expected street protests against the election result.

Official count shows Widodo reelected as Indonesian leader

Official count shows Widodo reelected as Indonesian leader

- Widodo’s challenger for a second time, former general Prabowo Subianto, has refused to accept defeat and declared himself the winner last month

- Police this month have arrested 31 Islamic militants they say planned to set off bombs during expected street protests against the election result

Britain needs ‘AI stress tests’ for financial services, lawmakers say

- Lawmakers urge AI-specific stress tests for financial firms

LONDON: Britain’s financial watchdogs are not doing enough to stop artificial intelligence from harming consumers or destabilising markets, a cross-party group of lawmakers said on Tuesday, urging regulators to move away from what it called a “wait and see” approach.

In a report on AI in financial services, the Treasury Committee said the Financial Conduct Authority and the Bank of England should start running AI-specific stress tests to help firms prepare for market shocks triggered by automated systems.

The committee also called on the FCA to publish detailed guidance by the end of 2026 on how consumer protection rules apply to AI, and on the extent to which senior managers should be expected to understand the systems they oversee.

“Based on the evidence I’ve seen, I do not feel confident that our financial system is prepared if there was a major AI-related incident and that is worrying,” committee chair Meg Hillier said in a statement.

TECHNOLOGY CARRIES ‘SIGNIFICANT RISKS’

A race among banks to adopt agentic AI, which unlike generative AI can make decisions and take autonomous action, runs new risks for retail customers, the FCA told Reuters late last year.

About three-quarters of UK financial firms now use AI. Companies are deploying the technology across core functions, from processing insurance claims to performing credit assessments.

While the report acknowledged the benefits of AI, it warned the technology also carried “significant risks” including opaque credit decisions, the potential exclusion of vulnerable consumers through algorithmic tailoring, fraud, and the spread of unregulated financial advice through AI chatbots.

Experts contributing to the report also highlighted threats to financial stability, pointing to the reliance on a small group of US tech giants for AI and cloud services. Some also noted that AI-driven trading systems may amplify herding behavior in markets, risking a financial crisis in a worst-case scenario.

An FCA spokesperson said the regulator welcomed the focus on AI and would review the report. The regulator has previously indicated it does not favor AI-specific rules due to the pace of technological change.

The BoE did not respond to a request for comment.

Hillier told Reuters that increasingly sophisticated forms of generative AI were influencing financial decisions. “If something has gone wrong in the system, that could have a very big impact on the consumer,” she said.

Separately, Britain’s finance ministry appointed Starling Bank CIO Harriet Rees and Lloyds Banking Group ‘s Rohit Dhawan as “AI Champions” to help steer AI adoption in financial services.