JEDDAH: Saudi Arabia and the UAE will provide $70 million in financial support to Yemeni teachers, in cooperation with the United Nations Children’s Fund (UNICEF).

The initiative announced Wednesday comes as many Yemeni teachers have not received their salaries.

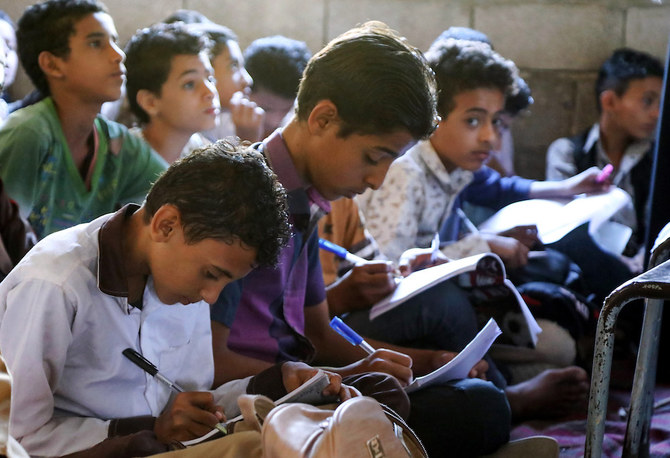

Dr. Abdullah Al-Rabiah, General Supervisor of the King Salman Humanitarian Aid and Relief Center, said the money would boost the salaries of 135,000 teaching staff and ensure schools continue to provide education for Yemeni children.

“The project benefits 136,799 people in the governorates of Ibb, Amanah, Al-Bayda, Hajja, Dhamar, Saada, Sanaa, Amran, Mahweet and Rima,” he said.

The $70 million will be provided equally by the Kingdom and the UAE.

The program was announced in Riyadh at a ceremony attended by Sultan Mohammed Al-Shamsi, Assistant Minister for International Development, and Al Tayeb Adam, UNICEF representative to the Gulf States.

Adam said the agreement would help 3.7 million Yemeni children to complete their studies within their country.

“Since last year, these countries have contributed $300 million to UNICEF in support of nutrition, health, education and the cholera epidemic in Yemen,” Adam said.