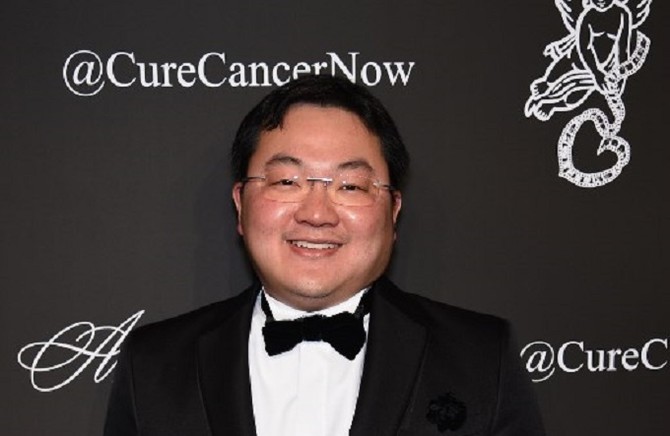

WASHINGTON: The Justice Department announced charges Thursday against a fugitive Malaysian financier and two former Goldman Sachs bankers accused in a money laundering and bribery scheme that pilfered billions of dollars from a Malaysian investment fund created to spur economic development projects in that country.

A three-count indictment charges Low Taek Jho, also known as Jho Low, with misappropriating money from the state-owned fund and using it for bribes and kickbacks to foreign officials, to pay for luxury real estate, art and jewelry in the United States and to help finance Hollywood movies, including “The Wolf of Wall Street.”

Also charged was a former Goldman Sachs banker, Tim Leissner, who pleaded guilty to money laundering conspiracy and to conspiring to violate foreign bribery laws. Another former bank official, Ng Chong Hwa, 51, also known as Roger Ng, was arrested earlier Thursday in Malaysia and accused of circumventing internal accounting controls, prosecutors said.

Leissner’s attorney did not return messages seeking comment. It was not clear if Ng had a lawyer.

A spokesman for Goldman Sachs, which the indictment says raised about $6.5 billion through bond offerings for the fund, said the firm “continues to cooperate with all authorities investigating this matter.”

Police in Malaysia said in July that Low had fled Macau to an unknown destination. Before facing criminal charges, Low became well known in the New York City and Los Angeles club scenes. In 2012, he threw a lavish 31st birthday bash attended by Leonardo DiCaprio, Kim Kardashian and other celebrities that The Wall Street Journal called the “wildest party (Las) Vegas ever saw.”

Low, who remains at large, issued a statement through a spokesman maintaining his innocence.

“Mr. Low simply asks that the public keep an open mind regarding this case until all of the evidence comes to light, which he believes will vindicate him,” the statement said.

Leissner acknowledged paying millions of dollars in bribes and kickbacks to government officials in Malaysia and Abu Dhabi, according to court records. He was ordered to forfeit $43.7 million as part of his guilty plea.

The set of charges represent the first criminal prosecutions in the US arising from the epic corruption scandal at the state investment fund known as 1MDB. The Justice Department in 2016 moved to recover more than $1 billion that it said had been stolen, filing a civil complaint that sought the forfeiture of property, including a Manhattan penthouse, a Beverly Hills mansion, a luxury jet and paintings by Vincent Van Gogh and Claude Monet.

In a speech last year in Washington, US Attorney General Jeff Sessions denounced the scandal as “kleptocracy at its worst.” The pilfered funds were used on a “lavish spending spree,” the attorney general said, including a $265 million yacht and a $100 million investment in the music label EMI.

“In total, 1MDB officials allegedly laundered more than $4.5 billion in funds through a complex web of opaque transactions and fraudulent shell companies with bank accounts in countries ranging from Switzerland and Singapore to Luxembourg and the United States,” Sessions said.

The fund, 1Malaysia Development Berhad, was set up in 2009 by then-Prime Minister Najib Razak to promote economic development. It relied primarily on debt to fund investment and economic development projects and was overseen by senior Malaysian government officials, according to court records.

Najib chaired its advisory board and as finance minister held veto power over its activities. Low, a friend of Najib’s stepson Riza Aziz, had no official role at 1MDB but had considerable influence over its dealings and was in frequent contact with Najib, US authorities have said.

“As noted in the indictment today, Mr. Low held no formal position at 1MDB, nor was he ever employed by Goldman Sachs, or the Governments of Malaysia or Abu Dhabi,” Low’s spokesman said.

The scandal has already had major political ramifications in Malaysia, where Najib in 2015 sacked his attorney general and a deputy prime minister for demanding answers about 1MDB. A parliamentary inquiry found many irregularities but had no mandate to prosecute.

Former leader Mahathir Mohamad, outraged over the scandal, came out of retirement and the opposition united behind him in the national elections, leading to Najib’s ouster in May.

Najib and his former treasury chief were charged last week with criminal breach of trust involving 6.64 billion ringgits ($1.6 billion), charges that came on top of 32 earlier counts of corruption, breach of trust and money laundering that Najib faces in connection with the 1MDB scandal.

Najib and Mohamad Irwan Serigar Abdullah, the former treasury secretary-general, pleaded not guilty to misappropriating government funds between December 2016 and December 2017. Police have also seized hundreds of luxury handbags, jewelry and cash — worth more than $266 million — during raids on apartments linked to Najib’s family.

An attorney for Najib, Shafee Abdullah, dismissed the latest charges as “foolish.”

US charges Malaysian financier in multibillion-dollar 1MDB corruption scandal

US charges Malaysian financier in multibillion-dollar 1MDB corruption scandal

- A three-count indictment charges against Low Taek Jho, also known as Jho Low, was announced

- The set of charges represent the first criminal prosecutions in the US arising from the epic corruption scandal at IMDB

Arab food and beverage sector draws $22bn in foreign investment over 2 decades: Dhaman

JEDDAH: Foreign investors committed about $22 billion to the Arab region’s food and beverage sector over the past two decades, backing 516 projects that generated roughly 93,000 jobs, according to a new sectoral report.

In its third food and beverage industry study for 2025, the Arab Investment and Export Credit Guarantee Corp., known as Dhaman, said the bulk of investment flowed to a handful of markets. Egypt, Saudi Arabia, the UAE, Morocco and Qatar attracted 421 projects — about 82 percent of the total — with capital expenditure exceeding $17 billion, or nearly four-fifths of overall investment.

Projects in those five countries accounted for around 71,000 jobs, representing 76 percent of total employment created by foreign direct investment in the sector over the 2003–2024 period, the report said, according to figures carried by the Kuwait News Agency.

“The US has been the region's top food and beverage investor over the past 22 years with 74 projects or 14 projects of the total, and Capex of approximately $4 billion or 18 percent of the total, creating more than 14,000 jobs,” KUNA reported.

Investment was also concentrated among a small group of multinational players. The sector’s top 10 foreign investors accounted for roughly 15 percent of projects, 32 percent of capital expenditure and 29 percent of newly created jobs.

Swiss food group Nestlé led in project count with 14 initiatives, while Ukrainian agribusiness firm NIBULON topped capital spending and job creation, investing $2 billion and generating around 6,000 jobs.

At the inter-Arab investment level, the report noted that 12 Arab countries invested in 108 projects, accounting for about 21 percent of total FDI projects in the sector over the past 22 years. These initiatives, carried out by 65 companies, involved $6.5 billion in capital expenditure, representing 30 percent of total FDI, and generated nearly 28,000 jobs.

The UAE led inter-Arab investments, accounting for 45 percent of total projects and 58 percent of total capital expenditure, the report added, according to KUNA.

The report also noted that the UAE, Saudi Arabia, Egypt, and Qatar topped the Arab ranking as the most attractive countries for investment in the sector in 2024, followed by Oman, Bahrain, Algeria, Morocco, and Kuwait.

Looking ahead, Dhaman expects consumer demand to continue rising. Food and non-alcoholic beverage sales across 16 Arab countries are projected to increase 8.6 percent to more than $430 billion by the end of 2025, equivalent to 4.2 percent of global sales, before exceeding $560 billion by 2029.

Sales are expected to remain highly concentrated geographically, with Egypt, Saudi Arabia, Algeria, the UAE and Iraq accounting for about 77 percent of the regional total. By product category, meat and poultry are forecast to lead with sales of about $106 billion, followed by cereals, pasta and baked goods at roughly $63 billion.

Average annual per capita spending on food and non-alcoholic beverages in the region is projected to rise 7.2 percent to more than $1,845 by the end of 2025, approaching the global average, and to reach about $2,255 by 2029. Household spending on these products is expected to represent 25.8 percent of total expenditure in 13 Arab countries, above the global average of 24.2 percent.

Arab external trade in food and beverages grew more than 15 percent in 2024 to $195 billion, with exports rising 18 percent to $56 billion and imports increasing 14 percent to $139 billion. Brazil was the largest foreign supplier to the region, exporting $16.5 billion worth of products, while Saudi Arabia ranked as the top Arab exporter at $6.6 billion.