ISTANBUL: Turkish economic growth slowed to 5.2 percent year-on-year in the second quarter, data showed on Monday, in what officials described as an economic rebalancing before an expected second-half slowdown as Turkey grapples with a currency crisis.

President Tayyip Erdogan has overseen strong growth during his 15 years in power but the economy is now facing challenges after a sharp decline in the lira, triggered partly by concerns about his influence over monetary policy.

In a Reuters poll, the economy had been expected to grow 5.3 percent in the first quarter. The lira firmed to 6.4550 against the dollar after the data from 6.4850 beforehand.

Second quarter gross domestic product (GDP) expanded a seasonally and calendar adjusted 0.9 percent from the previous quarter, data from the Turkish Statistical Institute showed. Last year the economy grew 7.4 percent.

Growth was driven by domestic demand despite a moderate slowdown in consumption and investments in the second quarter but the slowdown will become more visible from the third quarter, said Finance Minister Berat Albayrak.

Rabobank emerging markets forex strategist Piotr Matys said that, given concerns over the economy overheating, the slowdown from 7.3 percent in the first quarter could be seen as encouraging.

“The Turkish economy is widely expected to lose even more momentum in the coming quarters as a result of significant lira depreciation,” he said, adding that attention was focused on the central bank’s rate-setting meeting on Thursday.

Investors expect the central bank to raise interest rates, but the size of the hike will be crucial, Matys added. The bank left rates on hold at its last meeting in July, defying expectations of a hike.

Data last week showed inflation surged to 17.9 percent year-on-year in August, its highest level since late 2003, prompting the central bank to signal it would take action against “significant risks” to price stability.

In the second quarter, the agricultural sector shrank 1.5 percent year-on-year while the industry sector grew 4.3 percent, the construction sector grew 0.8 percent and services expanded 8 percent.

According to a Reuters poll, the economy is expected to grow 3.3 percent in the year as a whole.

The government has been working on stimulus measures to stave off the expected slowdown in the coming quarters. Erdogan, a self-described “enemy of interest rates,” has pushed banks to lend more to boost private spending.

His demands for lower interest rates have fueled concerns that the central bank lacks independence. The lira has tumbled 41 percent against the dollar this year in a slide exacerbated by a bitter diplomatic row with the US.

Officials have said they expect a contraction of the economy in the third quarter and full-year growth of around four percent — below a 5.5 percent government target.

Turkish economic growth dips as lira crisis darkens outlook

Turkish economic growth dips as lira crisis darkens outlook

- Tayyip Erdogan has overseen strong growth during his 15 years in power but the economy is now facing challenges after a sharp decline in the lira

- The government has been working on stimulus measures to stave off the expected slowdown in the coming quarters

Oil Updates – crude set for weekly gain as demand signs, geopolitics seen as positives

SINGAPORE: Oil rose on Friday, set for a weekly gain, as data this week from the US and China, the world’s two largest crude users, pointed to higher demand and continuing uncertainty over the Gaza war supported prices, according to Reuters.

Falling US crude inventories spurred by higher refinery runs coincided with data released on Thursday showing China’s oil imports in April were higher than last year on signs of improving trade activity.

Negotiations to halt the fighting between Israel and Hamas have yielded no results, keeping alive concerns of potential Middle East supply disruptions.

Brent futures rose 58 cents, or 0.6 percent, to $84.41 a barrel 8:14 a.m. Saudi time and are set for a weekly gain of 1.7 percent. US West Texas Intermediate crude climbed 58 cents, or 0.7 percent, to $79.84, set for a weekly increase of 2.2 percent.

China’s exports and imports returned to growth in April after contracting in the previous month, signalling an improvement in demand.

“Ongoing signs of strength in demand in China should see commodity market remain well supported,” ANZ Research said in a note.

Israeli forces bombarded the city of Rafah in the Gaza Strip on Thursday, Palestinian residents said on Thursday, while an Israeli official said indirect negotiations with Hamas had ended. As the conflict continues, it raises the potential for other Middle Eastern countries to become involved, particularly Hamas’ main supporter Iran, a key producer.

“Israel’s groundwork for an intervention in Rafah and growing tensions on its Northern border are a reminder that geopolitical risks could persist through all of Q2 2024, at least,” Citi analysts said in a note.

Still, the bank’s analysts see prices easing through 2024, with Brent averaging $86 a barrel in the second quarter and $74 in the third quarter amid looser supply and demand fundamentals as there are signs that global oil demand growth “appears to be moderating.”

How a Saudi start-up hopes to beat sickle cell disease with an AI-trained gene-editing biorobot

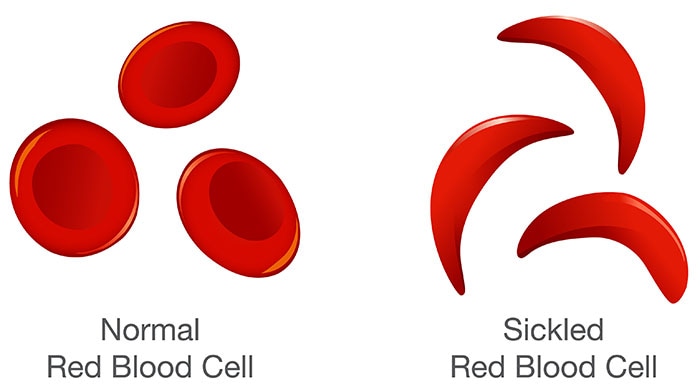

- Sickle cell disease is a genetic blood disorder in which red blood cells are crescent shaped and rigid

- Riyadh-based NanoPalm is combining AI-trained models and nanotechnology to remove faulty genes

RIYADH: Saudi-based biotechnology company NanoPalm is developing a biorobot using a unique blend of artificial intelligence, nanotechnology, and gene therapy to find a solution for patients with sickle cell disease.

Affecting approximately 20 million people worldwide, sickle cell disease is a genetic blood disorder in which red blood cells are crescent shaped and rigid. Patients with sickle cell experience blocked blood vessels, pain, fatigue, and anemia, impacting their well-being.

Founded in 2022, and headquartered in Riyadh, NanoPalm began life at the King Abdulaziz City for Science and Technology (KACST) before it was incubated by the NextEra initiative.

The biotechnology company is run by the Ministry of Communication and Information Technology in partnership with The Garage — once a car park, now a 28,000-square-meter space that can accommodate 300 startups.

Ali Al-Hasan and Samar Al-Sudir, the founders of NanoPalm, have used their expertise to develop a product that goes beyond treating the symptoms of sickle cell. Their aim is to remove the gene from a patient’s body altogether.

With Al-Hasan’s knowledge of nanomedicine and Al-Sudir’s background in chemistry, the pair were able to bring their combined expertise to bear.

The NanoPalm team spent more than a year collecting data to feed into artificial intelligence models, Al-Hasan told Arab News.

“We explored AI and we found it was a long journey where we needed to create our own data and generate the data that will be used to train AI models,” he said.

“It will predict the best gene therapy and predict its safety, its effectiveness, and cut down the duration of the therapy, while making it affordable.

“Discovery is at the heart of any drug development process in any pharma company. Now it has become digitized and AI enabled.”

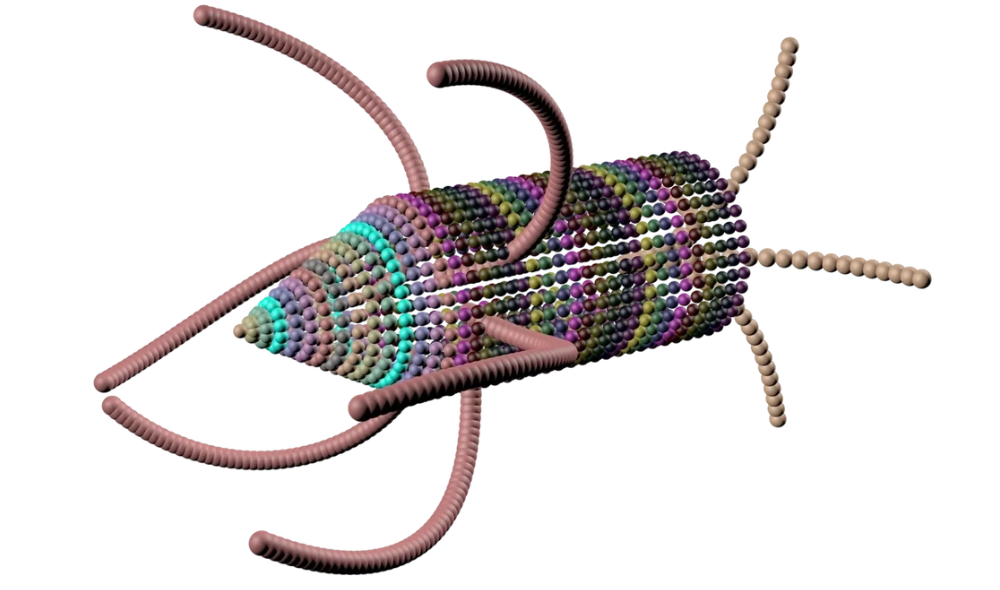

In the development of their product, NanoPalm uses three technologies: AI to model and predict, nanotechnology to create the medicine, and gene therapy to edit genetic material.

“We use the manufacturing recipe from the AI and then go to the lab to build a lipid biorobot,” said Al-Hasan.

Opinion

This section contains relevant reference points, placed in (Opinion field)

“It’s like a vehicle. And those lipid biorobots encapsulate genetic materials such as mRNA and other RNA molecules, which act like scissors to remove the gene that we want to remove.

“When patients come to the clinic, they usually get an IV infusion of biorobots encapsulating genetic materials for four hours and then go home. The biorobots will then navigate their body and find where the disease is. They go after cells responsible for sickle cell.”

NanoPalm has set out to revolutionize the biotech industry. Al-Hasan said the company’s mission is to make treatment more cost-effective.

“As we dove into this problem, we found two important facts,” he said. “Sickle cell disease is not the only genetic disease. There are 6,000 other genetic diseases that have no known cures.

“The second problem is that the current gene therapies are ineffective. They are super expensive. The patients would have to be rich to afford gene therapies, for example, because sickle cell patients would have to pay $2.2 million to get one injection.”

NanoPalm is collaborating with KACST, King Saud University, and the National Guard Hospital to treat 15 sickle cell patients from Saudi Arabia.

Al-Hasan says some 42,000 Saudis stand to benefit from NanoPalm’s product when it is launched in 2030.

China’s exports and imports return to growth

- Shipments from the country grew 1.5 percent last month by value: data

RIYADH: China’s exports and imports returned to growth in April after contracting in the previous month, signaling an encouraging improvement in demand at home and overseas.

The data suggests a flurry of policy support measures over the past several months may be helping to stabilize fragile investor and consumer confidence.

Shipments from China grew 1.5 percent year on year last month by value, customs data showed on Thursday, in line with the increase forecast in a Reuters poll of economists. They fell 7.5 percent in March, which marked the first contraction since November.

Imports for April increased 8.4 percent, beating an expected 4.8 percent rise and reversing a 1.9 percent fall in March.

“Export values returned to growth from contraction last month, but this was mainly due to a lower base for comparison,” said Huang Zichun, China economist at Capital Economics.

“After accounting for changes in export prices and for seasonality, we estimate that export volumes remained broadly unchanged from March,” she added.

In Q1, both imports and exports rose 1.5 percent year on year, buoyed by better-than-expected trade data over the January-February period. But the weak March figures prompted concerns that momentum could be faltering again.

Crude oil imports

China’s crude oil imports rose on the previous year in April, as refiners prepared for a fully recovered Labor Day holiday travel season, official data showed on Thursday.

Crude imports in April totaled 44.72 million tonnes, or about 10.88 million barrels per day, according to data from the General Administration of Customs.

That represented a 5.45 percent increase from the relatively low 10.4 million bpd imported in April 2023.

China saw more than 1.3 billion passenger trips over the five day Labor Day holiday that began on May 1, up 2.1 percent from a year earlier, state media outlet Xinhua reported.

Highway traffic was up 2.1 percent while air trips surged 8.1 percent, Xinhua said.

Domestic airline seat capacity in April was up 1.3 percent on last year, data from consultancy OAG showed.

China’s manufacturing sector continued to see muted recovery in April.

Natural gas imports for April rose 14.7 percent from a year earlier to 10.30 million tonnes, data showed.

Prices of liquefied natural gas for Asia at the end of April were down 11.3 percent on the same period last year, and down 43 percent from last year’s peak in October.

Customs data also showed exports of refined oil products, which include diesel, gasoline, aviation fuel and marine fuel, were up 21.46 percent from a year earlier at 4.55 million tonnes.

Coal imports

China’s coal imports rose in April fueled by lower domestic production and greater buying by power generators to swell stockpiles ahead of the peak summer demand season.

Shipments of coal into the world’s largest consumer of the fuel were 45.25 million tonnes last month, up 11 percent from 40.68 million a year earlier.

That was up by 9.4 percent from March and 2 million tonnes less than December’s record of 47.3 million tonnes.

The boost in imports is partly because domestic coal production has not increased to meet demand, said Feng Dongbin, an analyst with consulting firm Fenwei.

China’s coal output fell 4 percent on the year during the first quarter, the most recent data shows, in part because of a string of deadly accidents that forced mines in the top coal-producing province of Shanxi to halt operations for safety inspections.

Saudi bourse among top 10 in the world in terms of market cap, says official

RIYADH: Saudi Tadawul Group finds itself in a “fortunate” position amid the Kingdom’s rapidly growing industries, said a senior executive.

On the sidelines of the Capital Market Forum 2024 held in Hong Kong, Nayef Al-Athel, group chief of sales and marketing officer at Tadawul Group, highlighted the company’s aim to attract global investors by sharing compelling success stories at international forums.

Speaking to Arab News, Al-Athel explained the dual nature of the group’s goals, emphasizing commercial targets focused on maximizing revenues as a listed company.

He said: “I think we are very fortunate as a capital markets group, fortunate in the sense that a lot is going on in the Kingdom. There’s unbelievable momentum in various facets of this country, and we are fortunate to be at the juncture of spillover from all these industries and all these new sectors being unraveled and unveiled in Saudi Arabia.”

Al-Athel added: “The story of the Kingdom of Saudi Arabia is very attractive, and that attraction then translates to us being very attractive as a capital market.”

Additionally, he emphasized Saudi Arabia’s geographic and time zone position, acting as a bridge between the East and West.

“If you take that from a geographical standpoint, time zone perspective, that can be straightforwardly translated into capital markets narratives of connecting East to West,” Al-Athel said.

He added: “If you look at the conference that we’re in here at CMF Hong Kong, it’s literally an attempt, which we think is very successful of us, connecting East to West.”

Commenting on his statement from the previous CMF in February held in Riyadh, Al-Athel explained how Tadawul Group is at the forefront of global capital market leaders.

“We are a top 10 stock exchange when it comes to market cap, to continue to propel ourselves high incomes to market cap rankings. That, of course, means more IPOs and more capital market transactions, more interest from investors all over the world,” he said.

Al-Athel further explained that the group’s success is building itself as an equity capital market powerhouse in Saudi Arabia, particularly through a significant number of IPOs in recent years. There’s a focus on expanding into debt capital markets and derivatives to diversify their offerings.

“We’ve worked hard on building ourselves as an equity capital market powerhouse. The number of IPOs has been staggering over the last three to four years in the Kingdom,” Al-Athel stated.

However, he mentioned that there are currently no specific announcements to make.

“We’re living in a very exciting situation as we speak, hosting 300 investors from 44 companies at the Capital Market Forum in Hong Kong,” said Al-Athel, adding that it’s the first cross-border capital market event, with participation from entities in Saudi such as the CMA and the Ministry of Investment.

He continued: “This is the flavor of where we are at the moment. This is where we are focused. Again, for sure there will be activity in the foreseeable future.”

Furthermore, Al-Athel mentioned that the group has celebrated 400 securities listed on Tadawul.

“Among those 400 listed securities, we find many success stories, and those success stories do sell themselves internationally. We have more than 22 companies traveling with us to Hong Kong, and the sole purpose of those companies, the Saudi corporates, is to tell their success stories to investors from Asia.

Al-Athel concluded his statement by highlighting the significant transformation undergone by the capital market, particularly with the achievement of 400 listed securities and a diverse investor base spanning Saudi Arabia, the region, and globally.

He noted that the rise in institutional investment and increasing numbers of IPOs signal a healthy market environment.

Al Rajhi Bank launches $1bn in perpetual bonds, says document

RIYADH: Al Rajhi Bank, the world’s largest Islamic bank by assets and market capitalization, has launched $1 billion in Additional Tier 1 sustainable sukuk, or Islamic bonds, a document from one of the banks arranging the deal revealed on Thursday.

The final yield for the debt transaction was set at 6.375 percent, tighter than the initial guidance of around 6.875 percent released in a document earlier in the day. The notes are perpetual in nature and can first be redeemed in May 2029.

The deal received more than $3.5 billion in orders and allocation is expected to happen later in the day, the document showed.

AT1 bonds, the riskiest debt instruments banks can issue, are designed to be perpetual in nature, but lenders can call them after a specified period.