LONDON: The chairman of the London Stock Exchange Group has urged Saudi Arabia to press on with its Vision 2030 reforms, saying the UK was a “natural partner” in the Kingdom’s economic diversification strategy.

Speaking at the opening of the annual BMG Economic Forum, held in conjunction with Arab News, LSE chairman Donald Brydon said London would would provide “a gateway and a bridge” for international capital for such privatizations.

“The Kingdom’s time for privatizations is now, and the UK is the natural partner to ensure the successful delivery of these,” Brydon told attendees of the forum held at the bourse’s London headquarters.

“London is especially well placed to provide the Kingdom a gateway and a bridge to global investors and attracting foreign direct investment to London’s internationally oriented investor base.

“We can draw on our experiences to support the Kingdom as it takes its rightful place as a global investment power hub and to help deepen liquidity in the Saudi capital market.”

The privatization of key state assets is a central part of Saudi Arabia’s Vision 2030 strategy, unveiled in 2016, as part of a strategy to reduce its dependence on oil revenues.

“Privatizing selected government services will improve quality of services and reduce government’s spending while taking into account citizens’ interest,” the Vision 2030 program stated, and “will also help the government to refocus its efforts on its legislative and organizational roles.”

“Moreover, the program will attract foreign direct investments and improve the balance of payments,” it added.

An audience of government officials, regulators, and industry chiefs at the 12th BMG Economic Forum at London Stock Exchange on Wednesday, July 11, 2018. (AN/ Ziyad Alarfaj)

Brydon hailed Saudi Arabia’s “forward-thinking leadership” as he addressed government officials and industry chiefs at the forum in London. He praised Saudi Arabia for investing in human capital and the nurture of small and medium-sized enterprises (SMEs) in the Kingdom.

“The London Stock Exchange is committed to being a strategic partner with the Kingdom to help deliver the Saudi Vision 2030 and beyond,” Brydon said.

Brydon said that Saudi Arabia’s privatization program differed significantly from early attempts by Gulf states in the 1990s to open key areas of the economy to the private sector.

Such moves, he said, ultimately proved unsuccessful, due to limited political buy-in and the failure to provide agreements on terms and conditions for private investors, together with concerns over the loss of control of key industries.

“The good news is that Vision 2030 addresses these concerns and puts in place the framework for successful privatizations,” he said.

Central to the Saudi government’s reform program is the mooted sale of around 5 percent in Saudi Aramco, the world’s largest oil company, which may raise as much as $100 billion.

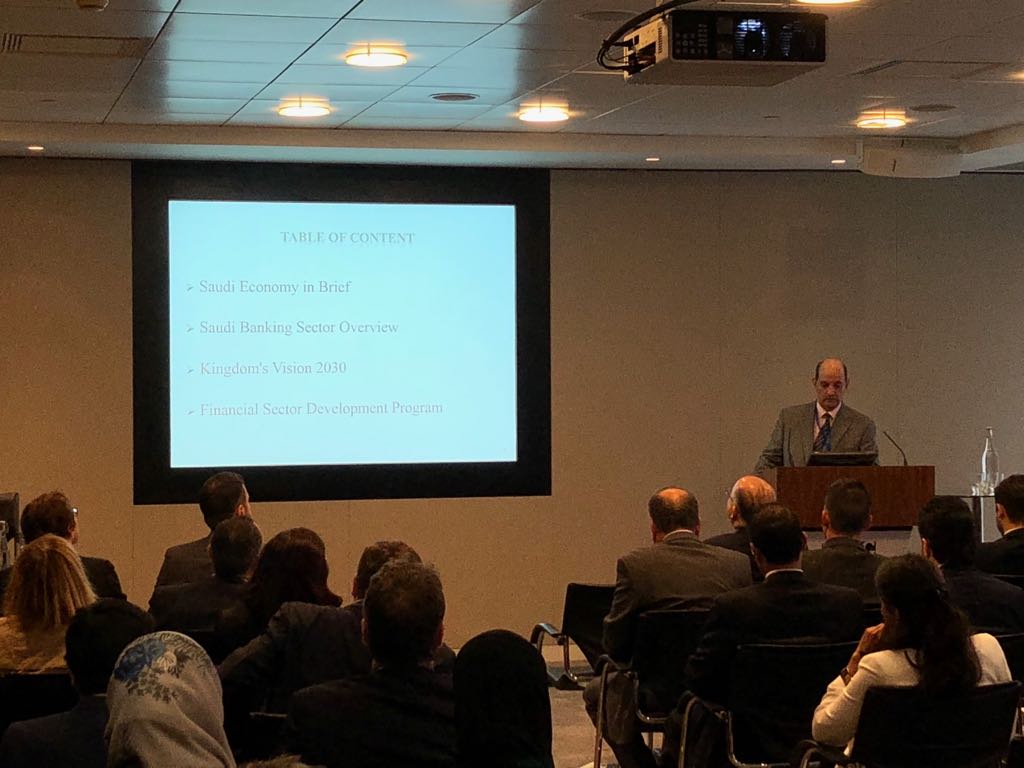

Talat Hafiz, Secretary General of the Media and Banking Awareness Committee - Saudi Banks, led the first panel of the 12th BMG Economic Forum, under the theme 'Business and Financial Environments in Saudi Arabia’ on Wednesday, July 11, 2018. (AN/ Ziyad Alarfaj)

The London Stock Exchange is among the international exchanges vying for part of the listing, alongside bourses in New York and elsewhere.

Originally intended for 2018, the IPO now appears unlikely to happen until 2019 at the earliest. Officials at Aramco and the Saudi stock exchange (Tadawul) have so far declined to say whether the listing will occur on both Tadawul and an international exchange, or whether all shares will be listed domestically.

Brydon noted that the London Stock Exchange had raised nearly $400 billion from international privatizations since 1984, with around $290 billion of that figure raised from non-UK privatizations.

He praised the “far-reaching and world-leading” stock market reforms introduced by Tadawul in the past years, which have prompted index providers MSCI and FTSE Russell to upgrade Saudi stocks to emerging market status this year.

These upgrades, due to be implemented next year, are forecast to attract as much as $50 billion worth of passive and active money into Saudi stocks.

The BMG Economic Forum addressed wider investment opportunities in Saudi Arabia and the Kingdom’s vision for the future.

“This is a new era for Saudi Arabia. An era of great opportunities coupled with great challenges,” said the chairman and CEO of BMG Financial Group, Basil M.K. Al-Ghalayini, as he officially opened the forum.

“Through this forum today, I am sure we can highlight these opportunities and learn how to manage these challenges,” Al-Ghalayini added.

Government officials, regulators, and industry chiefs gathered on the iconic atrium balcony at the London Stock Exchange as the daily 60-second countdown officially marked the start of Wednesday’s trading — and served as a precursor to the forum.

Al-Ghalayini and Dr. Robert Barnes, CEO of Turquoise and global head of primary markets at the London Stock Exchange Group, stepped forward and completed the daily ritual of placing a bespoke engraved glass tablet onto the podium, setting off the 8 a.m. bell.

Talat Hafiz, secretary general of the Media and Banking Awareness Committee at Saudi Banks, led the first panel of the forum, under the theme “Business and Financial Environments in Saudi Arabia.”

“Saudi Arabia is a one-stop shop for investments; we are the heart of the Arab world and an investment powerhouse,” said Hafiz.

Hussain Shobokshi, businessman and consultant and columnist, said: “Our biggest commodity used to be oil. Now, I believe our biggest commodity is youth.”