ISLAMABAD: President Mamnoon Hussain has said there is no more significant day in Pakistan's history than March 23 — the day its founders stood up against foreign subjugation to create a democratic state.

In a speech at the Pakistan resolution day parade in Islamabad, Hussain said the entire nation pays tribute to all leaders that made sacrifices towards the creation of Pakistan.

He thanked the UAE, Turkey and Jordan for their armed forces participation in the parade and welcomed Sri Lankan President Maithripala Sirisena, to the ceremony.

President Hussain underscored the great sacrifices of Pakistan armed forces and the nation, pointing to the success of military and civil-military anti-terror operations. He also announced the setting up of an award to honour law enforcement officers and armed forces.

However, in a warning to India, he said that while Pakistan was striving for regional peace but its western neighbor should not interpret this as weakness. The decades-old Kashmir dispute can only be resolved peacefully, he added, reminding India that the Kashmir struggle cannot be silenced.

Pakistan will continue to play a supportive role in assisting Afghanistan to secure peace and a stable government, he added.

Prime Minister Shahid Khaqan Abbasi celebrated the 78th Pakistan Day with a video message calling for peace.

“Pakistan is a great nation,” he said. “Our endeavor for peace and prosperity is unwavering. I am hopeful we will make this country a cradle of peace and progression.

“This nation’s success and advancement is our responsibility, which is [Sir Mohammed] Iqbal’s dream and the founding fathers’ precious gift. Pakistan is a symbol of peace.”

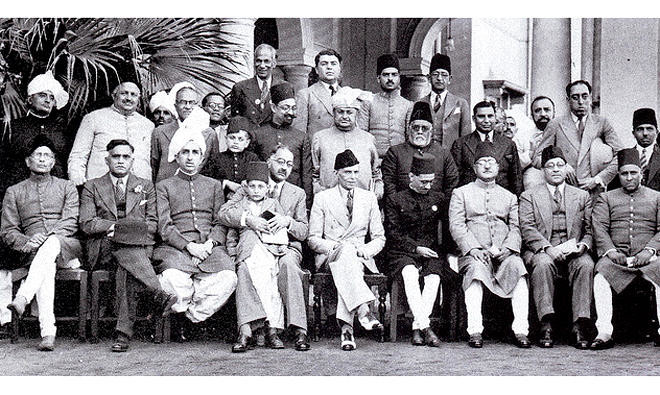

Each year on March 23, Pakistan marks the 1940 Lahore Resolution. On that day the Muslim League, led by Quaid-e-Azam Mohammed Ali Jinnah, approved the historic resolution, which later became known as the Pakistan Resolution. This paved the way for a Muslim-majority nation state seven years later, when Pakistan was created in the partitioning of former British India.

The resolution dismissed the concept of a united India. It urged the creation of an autonomous Muslim state consisting of the provinces of Punjab, NWFP (Khyber-Pakhtunkhwa Khwa), Sindh and Baluchistan in the west, and Bengal and Assam in the east.

Pakistan Day also commemorates the adoption of the country’s first constitution, as Pakistan moved toward becoming the world’s first Islamic republic on the same date in 1956. The constitution was eventually ratified on Aug. 14, 1973.

A public holiday, the occasion is marked by a military parade in Islamabad attended by the prime minister, president, cabinet ministers, representatives from the armed services and other dignitaries.

Syed Mohammed Zafar, a leading human-rights activist and veteran politician, said: “Pakistan Day has special significance as from this day, Pakistan said goodbye to Dominion status and became a sovereign republic.”

“Most nations do bring out military might in the form of a parade and display their hardware to assure people that their territorial sovereignty is in good hands”, said Zafar.

Pakistan abandoned the military parade after 2008, fearing it would be targeted by terrorists. But after the massacre of more than 150 schoolchildren in Peshawar, the event was reinstated in 2015 by the military to show determination to defeat the terrorists.

Celebrating the day a Muslim nation state was born

Celebrating the day a Muslim nation state was born

Islamabad dismisses claims about paying up to 8 percent interest on foreign loans as ‘misleading’

- Pakistan has long relied on external loans to help bridge persistent gaps in public finances and foreign exchange reserves

- Pakistan’s total external debt, liabilities stand at $138 billion at an overall average cost of around 4 percent, ministry says

KARACHI: Pakistan’s finance ministry on Sunday dismissed as “misleading” claims that the country is paying up to 8 percent interest on external loans, saying the overall average cost of external public debt is approximately 4 percent.

Pakistan has long relied on external loans to help bridge persistent gaps in public finances and foreign exchange reserves, driven largely by a narrow tax base, chronic trade deficits, rising debt-servicing costs and repeated balance-of-payments pressures.

Over the decades, successive governments have turned to multilateral and bilateral lenders, including the International Monetary Fund, the World Bank and the Asian Development Bank, to support budgetary needs and shore up foreign exchange reserves.

The finance ministry on Sunday issued a clarification in response to a “recent press commentary” regarding the country’s external debt position and associated interest payments, and said the figures required contextual explanation to ensure accurate understanding of Pakistan’s external debt profile.

“Pakistan’s total external debt and liabilities currently stand at $138 billion. This figure, however, encompasses a broad range of obligations, including public and publicly guaranteed debt, debt of Public Sector Enterprises (both guaranteed and non-guaranteed), bank borrowings, private-sector external debt, and intercompany liabilities to direct investors. It is therefore important to distinguish this aggregate figure from External Public (Government) Debt, which amounts to approximately $92 billion,” it said.

“Of the total External Public Debt, nearly 75 percent comprises concessional and long-term financing obtained from multilateral institutions (excluding the IMF) and bilateral development partners. Only about 7 percent of this debt consists of commercial loans, while another 7 percent relates to long-term Eurobonds. In light of this composition, the claim that Pakistan is paying interest on external loans ‘up to 8 percent’ is misleading.

The overall average cost of External Public Debt is approximately 4 percent, reflecting the predominantly concessional nature of the borrowing portfolio.”

With respect to interest payments, public external debt interest outflows increased from $1.99 billion in Fiscal Year (FY) 2022 to $3.59 billion in FY2025, representing an increase of 80.4 percent, not 84 percent as reported. In absolute terms, interest payments rose by $1.60 billion over this period, not $1.67 billion, it said.

According to the State Bank of Pakistan’s records, Pakistan’s total debt servicing payments to specific creditors during the period under reference were as follows: the IMF received $1.50 billion, of which $580 million constituted interest; Naya Pakistan Certificates payments totaled $1.56 billion, including $94 million in interest; the Asian Development Bank received $1.54 billion, including $615 million in interest; the World Bank received $1.25 billion, including $419 million in interest; and external commercial loans amounted to nearly $3 billion, of which $327 million represented interest payments.

“While interest payments have increased in absolute terms, this rise cannot be attributed solely to an expansion in the debt stock,” the ministry said. “Although the overall debt stock has increased slightly since FY2022, the additional inflows have primarily originated from concessional multilateral sources and the IMF’s Extended Fund Facility (EFF) under the ongoing IMF-supported program.”

Pakistan secured a $7 billion IMF bailout in Sept. 2024 as part of Prime Minister Shehbaz Sharif’s efforts to stabilize the South Asian economy that narrowly averted a default in 2023. The government has since been making efforts to boost trade and bring in foreign investment to consolidate recovery.

“It is also important to note that the increase in interest payments reflects prevailing global interest rate dynamics. In response to the inflation surge of 2021–22, the US Federal Reserve raised the federal funds rate from 0.75-1.00 percent in May 2022 to 5.25–5.50 percent by July 2023. Although rates have since moderated to around 3.75 percent, they remain significantly higher than 2022 levels,” the finance ministry said.

“The government remains committed to prudent debt management, transparency, and the continued strengthening of Pakistan’s macroeconomic stability,” it added.