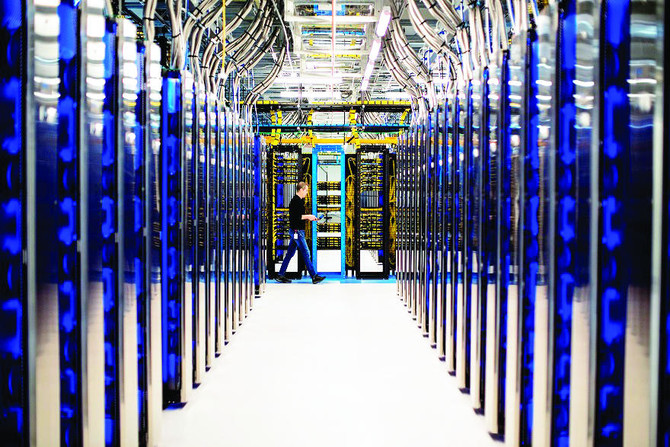

Microsoft has revealed plans to deliver the intelligent, trusted Microsoft Cloud from its first data centers located in the Middle East. The move aims to empower organizations, governments, and businesses to achieve more and recognize the unprecedented opportunity for digital transformation in the region.

The Microsoft Cloud, comprising Azure, Office 365 and Dynamics 365, will offer enterprise-grade reliability and performance, combined with data residency, from data centers located in Abu Dhabi and Dubai with initial availability expected in 2019. Microsoft’s deep expertise in data protection, security and privacy, including the broadest set of compliance certifications in the industry, means customers in the region can accelerate their digital transformation knowing they have a trusted partner. Each new data center will adhere to Microsoft’s trusted cloud principles and becomes part of one of the largest cloud infrastructures in the world, already serving more than a billion customers and 20 million businesses.

“Today’s announcement marks the second data center expansion for Microsoft in the Middle East and Africa in less than a year,” said Samer Abu-Ltaif, president of Microsoft Middle East Africa. “The Microsoft data centers in South Africa, together with this expansion in the UAE, highlight our ongoing commitment to the region, where we have invested for more than 20 years. We see enormous opportunity in MEA for cloud technology to be the key driver of economic development, as well as provide sustainable solutions to many pressing issues such as youth employability, education and health care. We will continue to work with governments and organizations across the region to accelerate their digital transformation, and I am excited about the role that our new data centers will play in this transformation.”

Microsoft works closely with technology partners throughout the Middle East and Africa, facilitating training and increasing employability across many sectors. Approximately 4,000 start-ups have been supported through programs like the Microsoft Virtual Academy, and Microsoft’s Cloud Society initiative is helping people in the region build marketable skills, readying them for the digital jobs of the future. The integration of the Abu Dhabi and Dubai data centers with Microsoft’s global cloud infrastructure is expected to connect regional businesses with global opportunities, help accelerate new investments and job opportunities and improve access to cloud services for people and organizations across the Middle East.

Microsoft’s network of 17,800 partners across the region, has recently been bolstered by the new Cloud Solutions Provider program, creating a platform for partners to deliver Microsoft’s cloud solutions locally.

Microsoft to open first Middle East cloud data centers in UAE

Microsoft to open first Middle East cloud data centers in UAE

Sulaiman Al-Rajhi Endowment projects worth SR8bn launched in Makkah

Sulaiman Al-Rajhi Real Estate Company has announced the launch of several real estate projects belonging to the Sulaiman Al-Rajhi Endowment system in Makkah, with a total investment exceeding SR8 billion ($2.1 billion). These projects include commercial, residential, and hospitality developments, as well as strategic land plots, as part of the company’s commitment to supporting the Kingdom’s real estate sector and enhancing the quality of life in the holy city.

The announcement was made during a field tour by a delegation of high-level officials including Saleh Al-Rasheed, CEO of the Royal Commission for Makkah City and Holy Sites; Ihsan Bafakih, chairman of the board of directors of Sulaiman bin Abdulaziz Al-Rajhi Holding Company; Haitham Al-Fayez, chairman of Sulaiman Al-Rajhi Real Estate Company and CEO of Sulaiman Al-Rajhi Holding Company; Moath Al-Mukhudub, managing director and CEO of Sulaiman Al-Rajhi Real Estate Company; and Anas Mansour Abadi, CEO of real estate at Sulaiman Al-Rajhi Holding Company and representative of the Sulaiman Al-Rajhi Endowment, alongside members of the board of directors of both the holding and real estate companies and the executive team.

The tour included the launch of the Tilal Towers project, with an investment value of SR2 billion, featuring more than 2,500 hotel rooms, strengthening the hospitality sector in Makkah.

The delegation also visited the Tilal Village project, valued at SR2.8 billion. It is one of the prominent qualitative projects within the hospitality ecosystem in Makkah.

Furthermore, the visit covered the residential buildings within Tilal Village, comprising 828 units, with an investment of SR800 million. The delegation inspected the specialized hospital, medical complex housing, and the office and commercial plazas.

During the tour, a contract was signed for the Al-Rajhi Center project, valued at SR250 million, as part of a comprehensive rehabilitation plan.

The inspection also included the Al-Ukayshiyyah land, spanning 4 million square meters, and the Al-Ghazzawi project land, valued at SR250 million.

The tour concluded with prayers at the Aisha Al-Rajhi Mosque, the second-largest mosque in Makkah after the Grand Mosque, with a capacity for 50,000 worshippers.

This visit underscores the importance of these investments, which represent a clear direction toward enhancing the management of the endowment’s assets through diversification, redevelopment, and strategic expansion, in line with the development goals of the Makkah city and Saudi Vision 2030.

Sulaiman Al-Rajhi Real Estate, a subsidiary of Sulaiman bin Abdulaziz Al-Rajhi Holding Company, continues to provide innovative solutions to elevate the real estate sector to international standards.