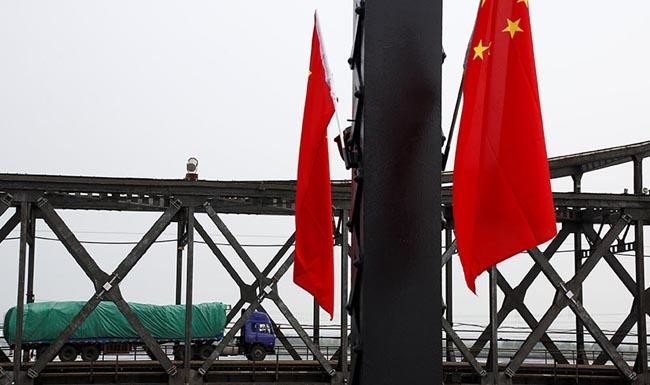

BEIJING: China’s January trade with North Korea fell to the lowest level since at least June 2014, the latest sign that China has kept up pressure on its isolated neighbor in line with United Nations trade sanctions.

China remains North Korea’s largest trading partner and sole major ally, though overall trade has fallen in recent months as the sanctions take effect.

Trade between China and North Korea totaled $215.97 million in January, down 52 percent from the year-earlier period and 31 percent month-on-month, final trade numbers from the General Administration of Customs showed on Friday.

The US has led an international campaign to tighten sanctions on North Korea to force it to give up development of nuclear weapons and missiles capable of hitting the US.

China has backed successive rounds of sanctions but has been wary of U.S. efforts to toughen these further and has been accused by US officials of not fully implementing existing UN steps.

The Trump administration plans to announce on Friday what is being billed as the largest package of sanctions yet against North Korea to increase pressure on Pyongyang for its nuclear and ballistic missile tests, a senior administration official said.

China’s exports to North Korea totaled $168.88 million in January compared with $257.73 million in December, while imports from North Korea were $47.09 million versus $54.68 million in December.

Data set to be released by China on Saturday will provide more detail on imports and exports of specific products to and from North Korea, shedding more light on which shipments were affected.

Beijing imported no iron ore, coal or lead from North Korea, and exported no oil products except for a tiny amount of jet fuel, in December, the third full month of the latest United Nations trade sanctions.

China January trade with North Korea falls to lowest since at least June 2014

China January trade with North Korea falls to lowest since at least June 2014

PIF’s Humain invests $3bn in Elon Musk’s xAI prior to SpaceX acquisition

JEDDAH: Humain, an artificial intelligence company owned by Saudi Arabia’s Public Investment Fund, invested $3 billion in Elon Musk’s xAI shortly before the startup was acquired by SpaceX.

As part of xAI’s Series E round, Humain acquired a significant minority stake in the company, which was subsequently converted into shares of SpaceX, according to a press release.

The transaction reflects PIF’s broader push to position Saudi Arabia as a central hub in the global AI ecosystem, as part of its Vision 2030 diversification strategy.

Through Humain, the fund is seeking to combine capital deployment with infrastructure buildout, partnerships with leading technology firms, and domestic capacity development to reduce reliance on oil revenues and expand into advanced industries.

The $3 billion commitment offers potential for long-term capital gains while reinforcing the company’s role as a strategic, scaled investor in transformative technologies.

CEO Tareq Amin said: “This investment reflects Humain’s conviction in transformational AI and our ability to deploy meaningful capital behind exceptional opportunities where long-term vision, technical excellence, and execution converge, xAI’s trajectory, further strengthened by its acquisition by SpaceX, one of the largest technology mergers on record, represents the kind of high-impact platform we seek to support with significant capital.”

The deal builds on a large-scale collaboration announced in November at the US-Saudi Investment Forum, where Humain and xAI committed to developing over 500 megawatts of next-generation AI data center and computing infrastructure, alongside deploying xAI’s “Grok” models in the Kingdom.

In a post on his X handle, Amin said: “I’m proud to share that Humain has invested $3 billion into xAI’s Series E round, just prior to its historic acquisition by SpaceX. Through this transaction, Humain became a significant minority shareholder in xAI.”

He added: “The investment builds on our previously announced 500MW AI infrastructure partnership with xAI in Saudi Arabia, reinforcing Humain’s role as both a strategic development partner and a scaled global investor in frontier AI.”

He noted that xAI’s trajectory, further strengthened by SpaceX’s acquisition, exemplifies the high-impact platforms Humain aims to support through strategic investments.

Earlier in February, SpaceX completed the acquisition of xAI, reflecting Elon Musk’s strategy to integrate AI with space exploration.

The combined entity, valued at $1.25 trillion, aims to build a vertically integrated innovation ecosystem spanning AI, space launch technology, and satellite internet, as well as direct-to-device communications and real-time information platforms, according to Bloomberg.

Humain, founded in August, consolidates Saudi Arabia’s AI initiatives under a single entity. From the outset, its vision has extended beyond domestic markets, participating across the global AI value chain from infrastructure to applications.

The company represents a strategic initiative by PIF to diversify the Kingdom’s economy and reduce oil dependence by investing in knowledge-based and advanced technologies.