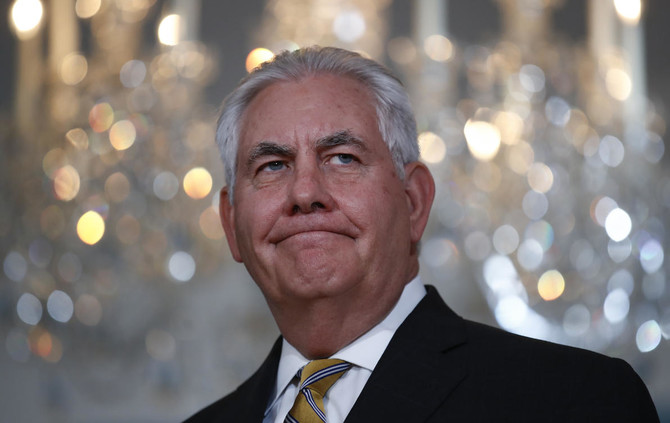

CAIRO: US Secretary of State Rex Tillerson has arrived in Egypt at the start of a regional tour that coincides with heightened regional tension and unease over the Trump administration’s Mideast policies.

His arrival Sunday came one day after Israel carried out a wave of airstrikes in Syria after intercepting an Iranian drone that had infiltrated its airspace and an Israeli F-16 was downed upon its return from Syria. It was the most serious Israeli engagement in Syria since the war there began in 2011.

In Egypt, as well as in Kuwait, Lebanon and Jordan — the tour’s other Arab stops — Tillerson will almost certainly hear misgivings about President Donald Trump’s recent decision to recognize Jerusalem as Israel’s capital.

He visits NATO ally Turkey on the tour’s final stop.

US Secretary of State in Egypt at start of Mideast tour

US Secretary of State in Egypt at start of Mideast tour

Veon Group invests $20 million in Pakistan’s Mobilink Bank to accelerate digital Islamic banking

- The investment builds on $15 million capital deployed by Veon in January 2025

- The capital will be used to scale the bank’s micro, small and medium enterprises

KARACHI: Global digital operator Veon Group has announced an investment of $20 million in Pakistan’s Mobilink Bank to support its growth and digital Islamic banking expansion in Pakistan, it said on Friday.

Mobilink Bank is a part of Veon Group, a global digital operator that provides services to over 150 million connectivity customers and over 140 million monthly active digital users. The Nasdaq-listed company operates across five countries that are home to more than 6 percent of the world’s population.

The investment builds on $15 million capital deployed by Veon in January 2025 and underscores its confidence in Mobilink Bank’s growth momentum and its integrated digital financial ecosystem with JazzCash, amid the rapid expansion of Pakistan’s digital banking and microfinance sector, according to Veon Group.

The capital will be used to scale Mobilink Bank’s micro, small and medium enterprises (MSME) financing portfolio, advance its Islamic banking offerings, and strengthen its evolution into a technology-driven, digitally native bank, with a continued focus on expanding regulated financial access for underserved communities.

“This investment will accelerate the expansion of our shariah-compliant Islamic banking offerings, helping small businesses formalize cash flows, access regulated credit, and build long-term financial resilience,” said Haaris Mahmood Chaudhary, president and chief executive officer of Mobilink Bank.

“As a future-ready digital bank, our focus remains on delivering practical, technology-enabled financial solutions that empower entrepreneurs — particularly women and underserved communities — across Pakistan.”

Mobilink Bank’s expanding deposit base and MSME-oriented lending portfolio are enabling small businesses to transition from informal cash usage to regulated banking, while targeted women-centric financial products and green financing initiatives support inclusive growth and resilience in the face of Pakistan’s climate and economic challenges, according to a statement issued by Veon Group.

Mobilink Bank, together with JazzCash, which serves over 57 million customers and is supported by a nationwide network of more than one million merchants and agents, anchors one of Pakistan’s largest digital financial ecosystems. During the year, JazzCash processed gross transaction value exceeding Rs15 trillion ($53 billion), underscoring the scale, resilience, and impact of fintech in advancing financial inclusion, social mobility, and responsible digital innovation across Pakistan.

The investment reflects Veon Group’s broader digital strategy of strengthening high-impact financial ecosystems through technology-led solutions and disciplined capital deployment, positioning Mobilink Bank as a key contributor to Pakistan’s evolving financial sector, according to the global digital operator.

“This continued stream of investment from VEON underscores our long-term commitment to Pakistan and confidence in the structural shift underway in the country’s digital financial services ecosystem,” Veon Group Executive Committee Member and Chairman Mobilink Bank, Aamir Ibrahim, was quoted as saying.

“It strengthens Mobilink Bank and JazzCash’s ability to execute on our strategic priorities, invest in resilient technology infrastructure, and contribute to the development of inclusive and sustainable digital banking.”