TRIPOLI: Libya’s rival factions should stick to a UN peace process and prepare for elections in spring 2018, French Foreign Minister Jean-Yves Le Drian said on Thursday, trying to give stalled UN talks a new push.

The North African country has two rival governments, one in the east and a UN-backed administration in the capital Tripoli in the west, in a conflict stemming from the overthrow of Muammar Qaddafi in 2011.

France was a leading player in the NATO intervention against Qaddafi, sending warplanes to bomb his forces.

The UN launched a new round of talks in September in Tunis between the rival factions to prepare for presidential and parliamentary elections in 2018, but they broke off after one month.

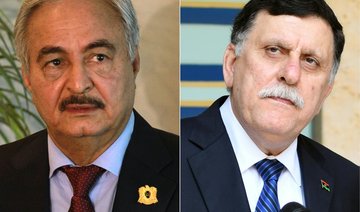

“I noted the desire from the Prime Minister (Fayez Al-Seraj) to stick to the calendar. We have a total convergence of views to implement this agenda,” Le Drian said after meeting the Tripoli-based prime minister in the Libyan capital.

Drian will later fly to the eastern city of Benghazi to meet the powerful eastern military commander Khalifa Haftar, who on Sunday called the UN-backed government and peace process obsolete.

The UN talks had stumbled over the question of what role Haftar should play. He indicated on Sunday he wants to run as presidential candidate.

Haftar remains popular among Libyans in the east who are weary of the chaos, but faces opposition in western Libya.

The eastern-based House of Representatives on Tuesday widened divisions between east and west by approving a new central bank governor. The bank’s Tripoli headquarters and UN rejected the move.

Le Drian said a political deal would help solve crisis of thousands of illegal migrants stuck in detention centers in Libya where human rights groups said they often face abuse. Libyan officials deny this but say they are overwhelmed with a flood of migrants.

Libya is to main departure point for illegal migrants heading for Europe by boat.

France urges Libya to act on UN peace plan

France urges Libya to act on UN peace plan

Britain needs ‘AI stress tests’ for financial services, lawmakers say

- Lawmakers urge AI-specific stress tests for financial firms

LONDON: Britain’s financial watchdogs are not doing enough to stop artificial intelligence from harming consumers or destabilising markets, a cross-party group of lawmakers said on Tuesday, urging regulators to move away from what it called a “wait and see” approach.

In a report on AI in financial services, the Treasury Committee said the Financial Conduct Authority and the Bank of England should start running AI-specific stress tests to help firms prepare for market shocks triggered by automated systems.

The committee also called on the FCA to publish detailed guidance by the end of 2026 on how consumer protection rules apply to AI, and on the extent to which senior managers should be expected to understand the systems they oversee.

“Based on the evidence I’ve seen, I do not feel confident that our financial system is prepared if there was a major AI-related incident and that is worrying,” committee chair Meg Hillier said in a statement.

TECHNOLOGY CARRIES ‘SIGNIFICANT RISKS’

A race among banks to adopt agentic AI, which unlike generative AI can make decisions and take autonomous action, runs new risks for retail customers, the FCA told Reuters late last year.

About three-quarters of UK financial firms now use AI. Companies are deploying the technology across core functions, from processing insurance claims to performing credit assessments.

While the report acknowledged the benefits of AI, it warned the technology also carried “significant risks” including opaque credit decisions, the potential exclusion of vulnerable consumers through algorithmic tailoring, fraud, and the spread of unregulated financial advice through AI chatbots.

Experts contributing to the report also highlighted threats to financial stability, pointing to the reliance on a small group of US tech giants for AI and cloud services. Some also noted that AI-driven trading systems may amplify herding behavior in markets, risking a financial crisis in a worst-case scenario.

An FCA spokesperson said the regulator welcomed the focus on AI and would review the report. The regulator has previously indicated it does not favor AI-specific rules due to the pace of technological change.

The BoE did not respond to a request for comment.

Hillier told Reuters that increasingly sophisticated forms of generative AI were influencing financial decisions. “If something has gone wrong in the system, that could have a very big impact on the consumer,” she said.

Separately, Britain’s finance ministry appointed Starling Bank CIO Harriet Rees and Lloyds Banking Group ‘s Rohit Dhawan as “AI Champions” to help steer AI adoption in financial services.