TOKYO: Toyota Motor and Panasonic said on Wednesday they are considering jointly developing batteries for electric vehicles (EVs), a partnership that could help Panasonic extend its market lead in automotive lithium-ion batteries.

The announcement builds on an existing agreement under which Panasonic manufactures batteries for Toyota’s gasoline-electric and plug-in hybrid vehicles.

Toyota said last year it was planning to add fully electric vehicles to its product line-up in a shift away from its previous green-car strategy of focusing on plug-in hybrid and fuel-cell vehicles. It has said it plans to start marketing pure EVs in the early 2020s.

Panasonic is the main EV battery supplier for luxury US car maker Tesla. The electronics firm commands 29 percent of the market for batteries used in plug-in hybrids and EVs, showed Nomura Research data for the first half of 2017.

Nearest rival LG Chem holds 13 percent of the market, followed by China’s BYD on 10 percent and Contemporary Amperex Technology (CATL) at 9 percent.

“Working with automakers from the initial stages could allow battery makers to win orders that unlock economies of scale further down the road,” Credit Suisse analyst Mika Nishimura said in a research note to clients ahead of the Toyota-Panasonic announcement. “Partnerships could also allow battery makers to share R&D and capex costs with automakers to some extent.”

Panasonic sees batteries as central to its plan to nearly double automotive business revenue to ¥2.5 trillion ($826.14 billion) by the year through March 2022. To that end, it has been expanding battery production capacity globally.

It started mass production of battery cells at Tesla’s “Gigafactory” in the US state of Nevada earlier this year and plans to follow suit at a new plant in Dalian, China. It is also adding new production lines in Japan.

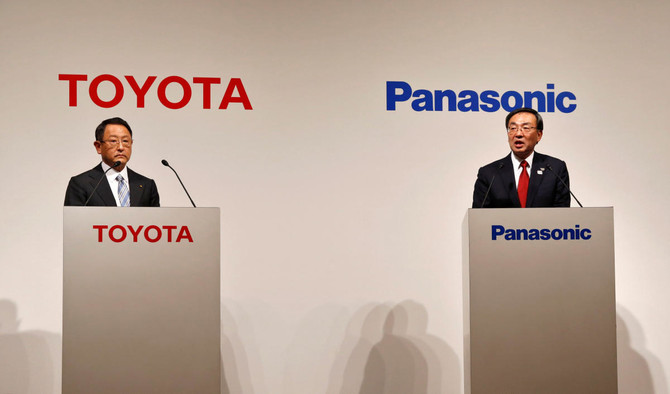

Toyota, Panasonic consider joint development of EV batteries

Toyota, Panasonic consider joint development of EV batteries

Saudi business optimism holds firm above 60 on non-oil strength

RIYADH: Saudi Arabia’s Business Confidence Index held at 61.6 points in January, reflecting sustained optimism across the Kingdom’s non-oil sectors, official data showed.

The index slipped 0.6 percent from 62 points in December, the General Authority for Statistics said, but remained well above the neutral 50 threshold, indicating continued expansion in business sentiment.

The sustained momentum in the BCI underscores the progress made under Saudi Arabia’s Vision 2030 agenda, which seeks to diversify the economy by reducing reliance on crude revenues.

“The index continues to reflect prevailing optimism in the business sector, supported by establishments’ confidence in the stability of economic activity and the continued growth across various sectors,” said GASTAT.

According to the report, the BCI for the industrial sector recorded 61.7 points in January, maintaining an optimistic level despite a slight decline of 0.8 percent compared to the previous month.

The slight decline in the industrial sector was driven by weaker confidence around current input costs and expectations for the coming month.

In January, the BCI for the services sector recorded 61.3 points, marginally down 1.2 percent from December, due to a limited decline in confidence related to input costs for the current month and expected inputs for the coming month.

The construction sector’s BCI stood at 61.6 points in January, marking a slight fall of 0.3 percent compared to the previous month.

“The marginal decrease (in the construction sector) is attributed to a limited decline in confidence among construction sector establishments, particularly with regard to input costs for the current month and expected inputs for the coming month,” added GASTAT.

Earlier this month, the Riyad Bank Purchasing Managers’ Index compiled by S&P Global showed Saudi Arabia’s PMI at 56.3 in January, driven by output growth, improving market conditions and stronger demand among non-oil businesses.

A separate January report by Standard Chartered forecasts Saudi Arabia’s economy will expand 4.5 percent in 2026, supported by sustained momentum in both hydrocarbon and non-oil sectors. The bank expects non-oil growth at a similar pace, driven by investment and consumption.