Bayut.com, a leading property portal in the UAE, has confirmed that the UAE estate market has witnessed a balancing act in the first half of 2017 — although both sale and rental prices in Dubai and Abu Dhabi having experienced a small dip, the market still represents a rich ground for investors looking for strong returns.

Haider Ali Khan, CEO of Bayut.com, said: “We at Bayut have always been data focused and our aim is to be at the forefront of assessing the market trends based on the properties being listed by the real estate brokerage community.”

He added: “Over the past years, the market has gradually matured, and as this progression has taken place, investors need more credible information regarding the housing market, and we are working diligently in doing our part by presenting the information.”

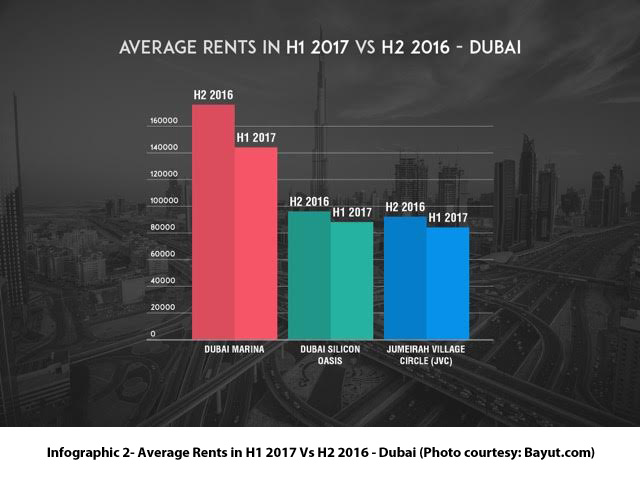

The report revealed that the most popular communities in Dubai for rent in H1 2017 were Dubai Marina, Dubai Silicon Oasis, and Jumeirah Village Circle.

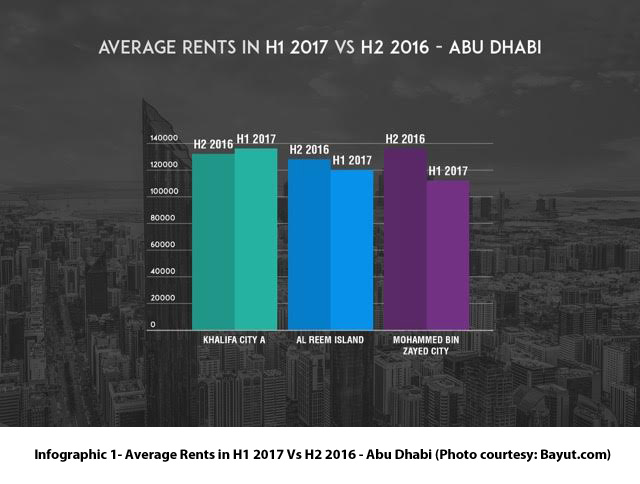

In Abu Dhabi, the most sought-after areas for rent were Al-Reem Island, Khalifa City, and Mohamed Bin Zayed City.

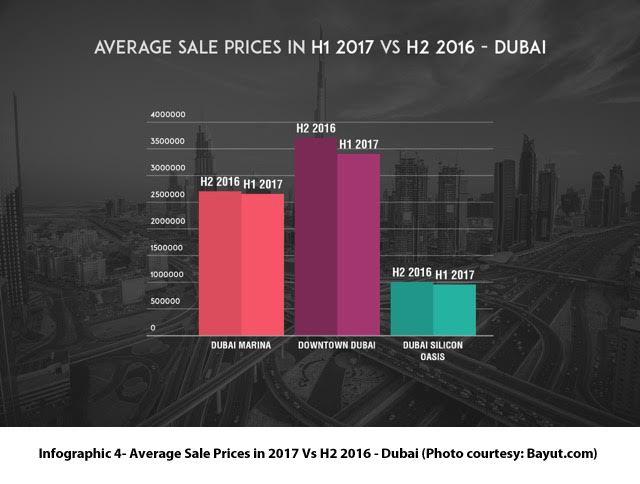

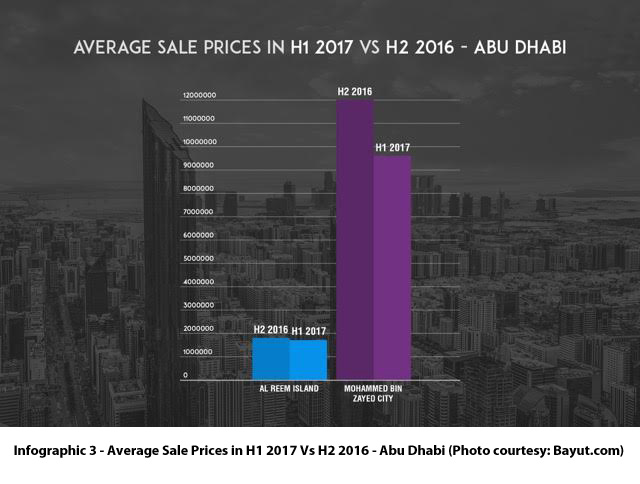

The most searched areas in both emirates, for buying property in H1 2017 were the traditionally in-demand areas, such as Dubai Marina, Downtown Dubai, and Al-Reem Island, but also smaller family-friendly suburban areas like Arabian Ranches and Jumeirah Village Circle.

Bayut.com’s H1 report focuses on the performance of Dubai and Abu Dhabi in both sales and rent categories.

Compared to H2 2016, average rents have dropped by 10.4 percent in Dubai, and average property sale prices have declined by seven percent. The decrease from both sides of the real estate market indicates that the average return on investment (ROI) has remained stable (4.7 percent) while the market itself has become increasingly accessible for buyers.

The market report for Abu Dhabi H1 2017 has experienced a similar trend to that of Dubai as both rent and property price averages have experienced a decline.

The data Bayut.com has gathered is in line with the overall market predictions and trends that anticipated a price fall in Abu Dhabi in 2017.