JALALABAD, Afghanistan: A suicide bomb blast in Afghanistan’s eastern city of Jalalabad killed 33 people and injured more than 100 on Saturday outside a bank where government workers collect salaries, the city’s police chief said.

Police were investigating whether there was a second explosion after people rushed to the scene to help, the police chief, Fazel Ahmad Sherzad, told a news conference.

“It was a suicide attack,” Sherzad said, adding police had yet to determine if the attacker had worn the explosives or had placed them in a car. “It is early to say what kind of suicide bomber.”

Taleban insurgents denied responsibility. The militants, who were ousted from power by a US-led invasion in 2001, rarely claim attacks that kill large groups of civilians, saying their activities are restricted to foreign or Afghan military and government targets.

“It was an evil act. We strongly condemn it,” the Islamist militants’ spokesman, Zabihullah Mujahid, told Reuters.

Police said another blast that shook Jalalabad was a controlled detonation after experts discovered a further bomb close to the scene of the first explosion.

Local media reported a former spokesman for the Pakistani Taleban claimed responsibility for bombings in the eastern city on behalf of the Islamic State in both Pakistan and Afghanistan.

The spokesman could not be reached and his connection to the group could not be verified by Reuters.

Elsewhere in the east, the Taleban announced the execution of three men accused of murdering a couple during a robbery, saying they had been tried by an Islamic court.

The killing was carried out in front of a crowd by Taleban fighters who fired at the men with AK-47s, according to a Reuters witness. Footage seen by Reuters show the men were made to sit on the ground with their eyes blindfolded and their hands tied at the time of their execution.

“(They) killed a female doctor and her husband ... inside their house and then they took all their assets, jewelry and cash,” the Taleban said in a statement.

The executioners, one stood behind each man, also had their faces covered, and were dressed in white salwar kameez and turbans. After the initial shots were fired, one continued to shoot at the bodies while the crowd of villagers cheered.

This is the first year Afghan forces are facing the Taleban with very limited international support on the ground, although help with intelligence and special operations will continue through 2016.

On Saturday, parliament approved the nomination of 16 ministers, leaving only the position of defense minister vacant because the president and his coalition have been unable to agree on a candidate.

The vacancy has frustrated military officials who say the army has been left rudderless in the face of escalating violence by the Taleban.

NATO, which at its peak had 130,000 soldiers in Afghanistan, has only a small contingent of around 12,000 troops left and most are involved in training.

Afghanistan suicide blast kills 33, targets government workers

Afghanistan suicide blast kills 33, targets government workers

World food prices up in April for second month: UN agency

PARIS: The UN food agency’s world price index rose for a second consecutive month in April as higher meat prices and small increases in vegetable oils and cereals outweighed declines in sugar and dairy products.

The Food and Agriculture Organization’s price index, which tracks the most globally traded food commodities, averaged 119.1 points in April, up from a revised 118.8 points for March, the agency said on Friday.

The FAO’s April reading was nonetheless 7.4 percent below the level a year earlier.

The indicator hit a three-year low in February as food prices continued to move back from a record peak in March 2022 at the start of Russia’s invasion of Ukraine.

In April, meat showed the strongest gain in prices, rising 1.6 percent from the prior month.

The FAO’s cereal index inched up to end a three-month decline, supported by stronger export prices for maize. Vegetable oil prices also ticked higher, extending previous gains to reach a 13-month high due to strength in sunflower and rapeseed oil.

The sugar index dropped sharply, shedding 4.4 percent from March to stand 14.7 percent below its year-earlier level amid improving global supply prospects.

Dairy prices edged down, ending a run of six consecutive monthly gains.

In separate cereal supply and demand data, the FAO nudged up its estimate of world cereal production in 2023/24 to 2.846 billion metric tonnes from 2.841 billion projected last month, up 1.2 percent from the previous year, notably due to updated figures for Myanmar and Pakistan.

For upcoming crops, the agency lowered its forecast for 2024 global wheat output to 791 million tonnes from 796 million last month, reflecting a larger drop in wheat planting in the EU than previously expected.

The revised 2024 wheat output outlook was nonetheless about 0.5 percent above the previous year’s level.

Israel confirms death of hostage held in Gaza

- Or was killed and his body held in Gaza since October 7

- His wife was killed in the initial attack while two of their three children were abducted

Jerusalem: An Israeli man held hostage in Gaza since the October 7 Hamas attack has been confirmed dead, the government and the kibbutz where he had lived said early Friday.

Dror Or, 49, is the latest hostage to have been confirmed dead by Israel after begin captured during the Hamas attack that triggered war with Israel.

Or was killed and his body held in Gaza since October 7, the Beeri kibbutz said. It was one of the communities hardest hit in the Hamas attack on southern Israel from the Gaza Strip.

His wife Yonat was killed in the initial attack while two of their three children, Noam and Alma, aged 17 and 13, were abducted and then freed in November as part of a ceasefire and hostages-for-prisoners swap deal between Israel and Hamas.

Israel estimates that 129 captives seized by militants during their attack remain in Gaza. The military says 35 of them are dead including Or.

“We are heartbroken to share that Dror Or, who was kidnapped by Hamas on October 7, had been confirmed as murdered and his body is being held in Gaza,” the Israeli government said on X.

The two children and their brother Yahli are now orphans, it added.

Campaign group the Hostages and Missing Families Forum said it will provide assistance to Or’s family.

The forum and Israeli government did not say how they learned of Or’s death.

“Only by securing the release of all hostages, the living for rehabilitation, the deceased for burial can our people’s revival and future be ensured,” the forum said in a statement.

“Israeli government must exhaust every effort to bring Dror and... the other murdered hostages back for honorable burials in Israel.”

Or’s death was announced as mediators Qatar, the United States and Egypt await Hamas’s response to a new Israeli proposal for a ceasefire and hostage release.

In late November during a week-long truce, 105 hostages were released including 80 Israelis and people from other countries in exchange for the release of 240 Palestinians held by Israel.

The war started with Hamas’s October 7 attack on Israel that resulted in the deaths of 1,170 people, mostly civilians, according to an AFP tally of Israeli official figures.

Israel’s retaliatory offensive against Hamas has killed at least 34,596 people in Gaza, mostly women and children, according to the Hamas-run territory’s health ministry.

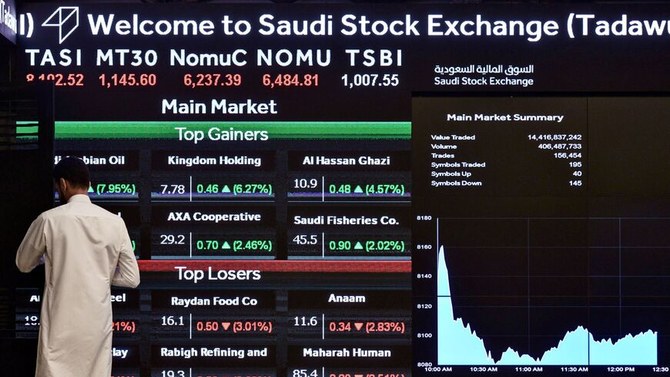

Material sector dominates TASI trading in first quarter of 2024

RIYADH: The materials sector led trading on Saudi Arabia’s Tadawul All Share Index, accounting for approximately SR87 billion ($23.2 billion) or 15.11 percent of the market, according to TASI’s 2024 first-quarter report.

SABIC, the largest component of this sector, boasted a market capitalization of SR234.9 billion, with trading value reaching nearly SR7 billion.

The banking sector trailed with transactions valued at SR71.22 billion, comprising 12.37 percent of the market. Al-Rajhi Bank took the lead in market capitalization within the sector and secured the second spot in trade value totaling SR23.62 billion.

In a February report by Bloomberg, Al-Rajhi Bank, seen as an indicator of Saudi Arabia’s growth strategies, exceeded the performance of JPMorgan Chase & Co., exhibiting nearly a 270 percent surge in shares since the initiation of Vision 2030. It has outpaced both local and global competitors, including state-supported banks, emerging as the largest bank in the Middle East and Africa, boasting a market cap of around $95 billion.

According to Morgan Stanley analysts led by Nida Iqbal, as reported by Bloomberg, “We see it as a long-term winner in the Saudi bank sector… While Al-Rajhi is best placed for a rate-cutting cycle, we believe current valuation levels reflect this.”

Gulf central banks, including Saudi Arabia’s, frequently align their policies with those of the Federal Reserve to maintain their currency pegs to the dollar. According to Bloomberg Intelligence senior analyst Edmond Christou, a reduction in Fed rates could potentially bolster Al-Rajhi Bank’s profitability and expansion, as it will encourage gathering cheap deposits while enabling it to issue debt at more attractive levels.

In this period, the energy sector secured the third position in terms of value traded, reaching SR55.4 billion. Saudi Aramco topped the list with a market capitalization of SR7.47 trillion and registered the highest value among companies traded on the index, totaling SR28.82 billion.

In March of this year, Aramco announced a net income of $121.3 billion for its full-year 2023 financial results, marking the second-highest in its history. Aramco credited these results to its operational flexibility, reliability, and cost-effective production base, underscoring its dedication to delivering value to shareholders.

Tadawul’s quarterly report also indicated that the transportation sector recorded the fourth-highest value traded at SR39.25 billion, equivalent to 6.82 percent of the market. Among the top performers in this sector was cargo firm SAL Saudi Logistics Services, ranking third in value traded on the TASI during this period, following Aramco and Al-Rajhi Bank, with a total value of SR22.74 billion.

SAL debuted on the main market of the Saudi Exchange in November last year. With aspirations to manage 4.5 million tonnes of air cargo by 2030, Saudi Arabia is empowering its logistics sector from a supportive role to a pivotal driver of economic growth.

SAL, in which the Saudi government holds a 49 percent stake through the Saudi Arabian Airlines Corp., experienced a 30 percent surge in its share price during its initial public offering, raising $678 million and becoming Saudi Arabia’s second-largest IPO of the year.

In a January report by Forbes, SAL’s CEO and Managing Director Faisal Al-Beddah emphasized the company’s potential to shape the future of logistics in Saudi Arabia and beyond. He stated: “Logistics is the backbone of any economy. Now we are ready. We have the rotation, we have the infrastructure, we have the regulations, and most importantly, we have the mindset and the technology for Saudi Arabia to be the leading connecting logistics hub in the region.”

The top gainer during this period in terms of price appreciation was MBC Group, with a quarter-to-date percentage change of 127.6 percent, according to Tadawul.

Saudi Arabia’s MBC Group, a media conglomerate, debuted as the first new listing on TASI in 2024. Its trading began on Jan. 8. The company raised SR831 million through its initial public offering.

Saudi Steel Pipes Co. in the materials sector was the second highest gainer, with price appreciating by 88.15 percent.

Etihad Atheeb Telecommunication Co. had a QTD price percentage change of 81.91 percent making it the third-highest gainer on the exchange during this period.

TASI concluded the first quarter of 2024 with a 3.6 percent increase, climbing by 435 points to reach 12,402 points.

Saudi startups raised $3.3bn in last 10 years, says report

- MAGNiTT report shows fintech emerged as the most funded sector in Kingdom

RIYADH: Startups in Saudi Arabia saw massive growth during the last decade raking in $3.3 billion in venture capital funding, according to a report issued by MAGNiTT.

The data platform, in its “10 Years Saudi Arabia Founders Report” sponsored by Saudi Venture Capital Co., provides an in-depth analysis of the backgrounds, experiences, and expertise of founders.

“MAGNiTT initially published a report on founders in the MENA VC ecosystem in 2018, focusing on uncovering the DNA of successful entrepreneurs in the region. Today, in partnership with the Saudi Venture Capital Co., we present a comprehensive report on the founders of the top 200 funded startups in the Kingdom over the last ten years,” said Philip Bahoshy, CEO and founder of the platform.

“By shedding light on founders’ experiences in the Saudi ecosystem, we aim to dispel myths around founders, empower aspiring entrepreneurs looking to establish their ventures in the Kingdom, guide government decision-makers in shaping policies conducive to innovation, and provide invaluable intelligence to investors seeking opportunities in the region,” he added.

SVC CEO Nabeel Koshak emphasized the remarkable growth and dynamism in the Saudi startup landscape.

FASTFACTS

Forty-four percent of these startups were launched by teams with two founding members, who together secured 53 percent of the total funds.

Startups founded by a single individual accounted for 30 percent of the funded startups but only captured 15 percent of the funding in the last decade.

Thirty-six percent of the 400 founders analyzed had at least 10 years of work experience before launching their respective startups.

Fifty-nine percent of founders had technical education backgrounds, highlighting science, technology, engineering, and mathematics.

Thirty-nine percent of founders held degrees in business, contrasting with the global average of 19 percent, according to an Endeavor Insight study.

“The Kingdom’s strategic initiatives, driven by the Saudi Vision 2030, have laid a solid foundation for innovation, entrepreneurship, and investment. As a result, we have seen a surge in startup activity, with a growing number of ambitious founders seizing opportunities and driving innovation across various sectors,” he said.

“The goal of the report is to provide policymakers, government officials, and investors with insights and data to inform strategic decisions and policies to further nurture the startup ecosystem for the next 10 years,” Koshak added.

A decade of funding

Compiling data from the 200 Saudi-based startups, which collectively raised a total of $3.3 billion from 2014 to 2023, the report highlighted that 44 percent of these startups were launched by teams with two founding members, who together secured 53 percent of the total funds.

He further stated that with the significant support for innovation, the Kingdom is set to witness the emergence of more unicorns.

In contrast, startups founded by a single individual accounted for 30 percent of the funded startups but only captured 15 percent of the funding in the last decade.

Notably, 36 percent of the 400 founders analyzed had at least 10 years of work experience before launching their respective startups.

The report also indicated a trend toward entrepreneurship among less experienced founders, with 66 percent being first-time startup founders and only 30 percent with previous regional startup experience.

It revealed a significant gender disparity in the VC landscape within Saudi Arabia, with male founders comprising 94 percent of the total 400 individuals, while female founders accounted for only 6 percent.

This gender gap is considerably wider than the global norms, where, according to research by Startup Genome conducted between 2016 and 2022, the average proportion of female founders in an ecosystem was 15 percent.

Additionally, only 7 percent of solo founders were female, and there were no recorded startups with two or more female founders only.

However, as the number of founders per startup increased, so did gender diversity, albeit slightly. In startups with three founders, 18 percent were of mixed gender, while in startups with four or more founders, the figure was 12 percent.

Furthermore, 91 percent of male-only founded startups claimed 98 percent of total funding. Conversely, 3 percent of female-only founded startups accounted for 0.4 percent of the total funding.

Founders' education

The report further delved into the education qualification of founders revealing that 55 percent in the Kingdom had attained at least a bachelor’s degree.

In terms of technical development, 59 percent of founders had technical education backgrounds, highlighting science, technology, engineering, and mathematics.

Thirty-nine percent of founders held degrees in business, contrasting with the global average of 19 percent, according to an Endeavor Insight study.

Over half of the 400 founders obtained their degrees internationally, while 22 percent held both international and local degrees.

King Saud University, King Fahd University of Petroleum and Minerals, and King AbdulAziz University were among the most common institutions for startup founders.

Seven of the top 10 universities of Saudi founders that raised funding were public institutions.

The top international schools of Saudi founders had Stanford and Harvard among the top choices, mirroring global trends.

Professional experience

Despite fintech being the most funded sector, only 7 percent of founders had experience in finance, and 18 percent in banking, which is lower compared to the 48 percent with backgrounds in information technology.

Additionally, even fewer founders, only 12 percent, had experience in e-commerce, despite this industry accounting for the highest share of deals, 20 percent, closed by the top 200 Saudi startups.

The report also revealed that 36 percent of the founders in Saudi Arabia are skilled professionals with over 10 years of experience before starting their businesses.

Notably, Saudi Aramco was the most common previous employer among the funded founders, with 7 percent having worked there before launching their startups.

Furthermore, McKinsey and Microsoft were among the top 10 companies where the 400 founders covered in this report had previously been employed.

The majority of these founders held significant leadership roles, with 31 percent having served as a founder, co-founder, or board member. Only 4 percent originated from entry-level positions.

The report also pointed out: “While Saudi Arabia has witnessed several serial entrepreneurs, 66 percent of founders in the last decade were first-time founders,” indicating a vibrant and growing entrepreneurial ecosystem.

Mounir Lazzez to launch new MMA promotional company with big fight night in Dubai

- 971 Fighting Championship hosts its inaugural event at The Agenda on Saturday, May 4

- Mouhamed Fakhreddine faces Gianni Melillo in main event on 14-bout card

DUBAI: Mounir Lazzez, having recently made the move into mixed martial arts promotion, is confident of surpassing his achievements as a fighter when he launches his new venture, 971 Fighting Championship, in Dubai on Saturday.

Spearheaded by Tunisian Lazzez, the first fighter born and raised in an Arab country to be signed to the UFC, 971 Fighting Championship is an innovative MMA entertainment brand that has been created with view to changing the face of the combat sports industry in the region.

Saturday’s high-profile launch event, at The Agenda in Dubai Media City, features 14 professional bouts, with Lebanon’s Mohammed Fakhreddine, the first Arab double champion, and Italy’s Gianni Melillo going head-to-head in the main event.

The two co-main events, meanwhile, are equally intriguing, with Ireland’s John Mitchell facing Egypt’s Adham Mohammed, while Eslam Abdul Baset, another Egyptian, takes on the UK’s Dan Vinni.

With further shows confirmed for August, October and December, Lazzez believes the arrival of 971 Fighting Championship signals an exciting new chapter for MMA.

“This is a big moment in relation to the long-term future of the sport, with 971 Fighting Championship providing a platform for fighters at various stages of their careers to showcase their talents,” he said.

“As a company, 971 Fighting Championship is fully committed to hosting entertaining events where elite athletes push their bodies to the limit and fans … go away knowing they have witnessed something special.

“Saturday’s launch event features some fantastic fighters, and The Agenda is a perfect location to launch such an amazing concept. We’re really looking forward to what promises to be a truly special occasion.”

After taking up MMA classes at the age of 15 in Tunisia, Lazzez’s career began to take off after a move to Dubai, where he represented several promotions, including the likes of Brave Combat Federation, and UAE Warriors, before signing to UFC in 2020.

Lazzez enjoyed a stunning debut, picking up the Fight of the Night award after a unanimous decision win over Abdul Razak Alhassan, before going on to face the likes of Warlley Alves, Ange Loosa and Gabriel Bonfim.

Now Lazzez is focused on ensuring 971 Fighting Championship is in a position to compete with some of its more established competitors in the long term.

“Becoming a professional MMA fighter was always my ambition and to have achieved a personal goal is a source of great pride, but that particular chapter is now closed,” he said.

“The 971 Fighting Championship has big aspirations, and everybody involved in the project is fiercely passionate about making the brand a major success.”

Lazzez now has an opportunity to make his mark on the sport in a different way, and he is well aware 971 Fighting Championship’s first event is a huge opportunity to put the brand on the map.

“While we have been working extensively behind the scenes for many months, Saturday’s event marks the beginning of our journey,” he says.

“Having been involved in the industry for many years, I’m well placed to assess what works well and, perhaps more importantly, what doesn’t.

“We believe our brand will become a huge success, but that will only be achieved with hard work and dedication.

“For a launch event, Saturday’s show is huge, with 14 bouts and a card made up of fighters from all around the world, which is what 971 Fighting Championship is all about. We can’t wait to get started.”