CAIRO: The burgeoning expatriate community and digital surge in Saudi Arabia have beckoned UAE-based travel tech startup Tumodo to expand its horizons.

In an interview with Arab News, Vladimir Kokorin, co-founder of the firm, unveiled the company’s ambitious strategy to venture into the Saudi market, buoyed by a successful $35 million raised in its latest funding round.

He said: “2024 will be the year to set up the foundation for accelerated growth in the upcoming years. Our target is to reach $100 million in sales by early 2026. By the end of 2025, we aim to have an annualized turnover of $123 million.”

Kokorin added: “We also plan to have a strong presence in five major cities including Jeddah, Riyadh, Dammam, Makkah, and Medina with about 800 clients nationwide by the end of 2025.”

By the end of April, Tumodo aims to be fully operational in Saudi Arabia, marking a significant milestone in its expansion journey.

Amid its $35 million pre-seed round, Tumodo anticipates becoming profitable in existing markets, launching new markets —including India and Germany, and reaching targeted transaction counts.

“Tumodo aims to achieve profitability in its current markets, such as Saudi Arabia, by efficiently managing its operations and increasing revenue streams. This milestone signifies the company’s ability to sustainably generate positive cash flow and financial stability,” Kokorin stated.

Tumodo is also preparing to navigate Saudi Arabia’s regulatory environment with a proactive compliance approach, ensuring adherence to local regulations through thorough research and engagement with local advisors, Kokorin explained.

He emphasized the importance of expanding into the Kingdom is underscored by Saudi Arabia’s rapid travel market growth, increased tech investment, rising number of registered companies, and expanding expat population.

Tumodo’s expansion aligns with these dynamics, positioning the company to capitalize on the growing demand for innovative travel management solutions in the Kingdom, supporting its vision for long-term growth and success in the region.

A Saudi landing

Kokorin outlined ambitious short-term objectives for the company’s expansion into the Saudi Arabian market, emphasizing a strategic focus on becoming the leading online travel management platform within three years.

Tumodo aims to be synonymous with value and efficiency, aspiring to dominate the market by demonstrating their superior technology and service offerings.

In the long term, the firm plans to revolutionize Saudi Arabia’s travel services sector by modernizing traditional processes and enhancing operational efficiency.

“We recognize the growing trend of multinational corporations establishing global and regional headquarters in Saudi Arabia, which is expected to drive an increase in business travel demand,” Kokorin said.

Tumodo aims to achieve profitability in its current markets, such as Saudi Arabia, by efficiently managing its operations and increasing revenue streams.

Vladimir Kokorin, co-founder of Tumodo

“We plan to develop tailored solutions and services specifically designed to meet the unique needs and preferences of multinational companies operating in Saudi Arabia. By forging strategic partnerships and alliances with multinational corporations, business associations, and industry organizations, Tumodo aims to become their preferred travel management partner,” he added.

“We also plan to expand our network and presence in key business hubs and economic centers where multinational corporations are concentrated, such as Riyadh, Jeddah, and Dammam, to better serve the growing demand for corporate travel services,” he stated.

Discussing broader ambitions, Kokorin reveals Tumodo’s global expansion plans, targeting key markets in Europe, the Americas, India, and the UK in 2024.

This global outreach aligns with Tumodo’s vision to be a frontrunner in the international travel management landscape, catering to diverse markets and leveraging growth opportunities in emerging economies.

Moreover, Tumodo is keen on forging partnerships with Saudi government entities to contribute to the sector’s advancement, particularly focusing on automation, analytics, and green initiatives.

Business fundamentals

Kokorin shed light on the company’s mission to revolutionize Saudi Arabia’s travel tech sector through innovative automation.

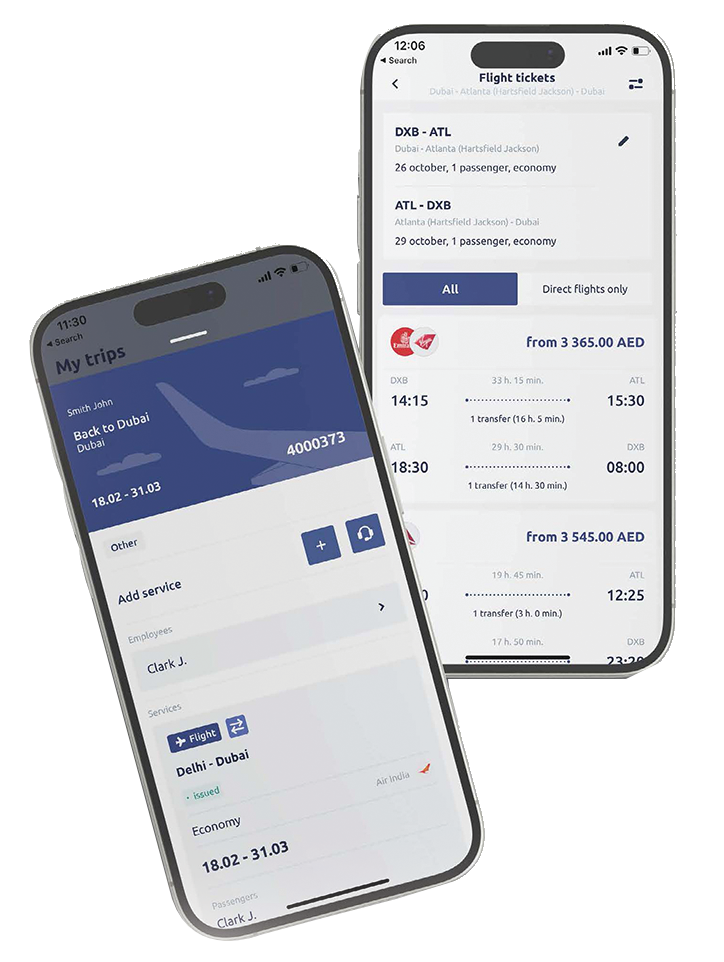

Tumodo is focused on simplifying the complexities of travel administration, which encompasses a wide range of tasks from booking flights and accommodations to managing itineraries and processing reimbursements.

By leveraging technology, Tumodo aims to streamline these processes, significantly reducing manual efforts, time, and the likelihood of errors.

The company’s solutions are designed to provide businesses with enhanced visibility and control over their travel expenses, ensuring transparency and accountability in managing travel-related costs, which, in turn, aids in optimizing travel budgets and improving financial management practices.

Discussing Tumodo’s business model, Kokorin says the company’s revenue streams include booking commissions and a processing fee.

These are earned when customers book various travel services through Tumodo’s platform, while the processing charge covers the transaction’s facilitation costs and system maintenance.

Kokorin emphasizes Tumodo’s commitment to transparency, ensuring there are no hidden fees for users, thus maintaining clear operations.

On the topic of profitability, Kokorin acknowledges Tumodo is currently in the investment stage, focusing on development, marketing, and talent acquisition.

“Our MENA revenue stream is growing consistently and in accordance with our projections, allowing us to cover all our basic costs. The initial funding, however, comes from the investors, and we expect to start returning investments within one to two years,” Kokorin stated.

The inspiration behind Tumodo, as Kokorin reveals, stems from the global trend towards digitization, which now encompasses sectors that were traditionally offline.

“From media to automobiles, people need speed, connectivity and ergonomics. Business travel is no exception. The idea was to make business travel convenient, fast and simple for all people by using computer technology. Why spend hours and days booking and managing travel via phone or in the agent office, if it can all be done from your mobile device with just a few clicks?” he said.

In terms of measuring success, Kokorin says market penetration and customer satisfaction are key indicators for Tumodo.

The company prides itself on retaining customers over time, viewing the growing customer base as a testament to its mission’s fulfilment. Kokorin also highlights the importance of developing local metrics specific to the Saudi market, although these are still under consideration.

Looking forward

Kokorin offers an optimistic view of the travel tech market in Saudi Arabia, highlighting its potential for growth and technological advancement.

With Vision 2030 driving the Kingdom’s development initiatives, there’s an increasing trend toward embracing digital solutions in travel management among Saudi companies.

This evolution is expected to boost demand for platforms like Tumodo, which streamline and automate travel processes.

“In light of these market dynamics, Tumodo aims to position itself as the leading online travel management company in Saudi Arabia. Through its user-friendly interface, robust features, and dedication to customer satisfaction, Tumodo aims to establish itself as the preferred choice for companies in Saudi Arabia,” Kokorin explained.