RIYADH: Saudi Arabia’s ambitious National Transformation Program, which sought to develop the necessary infrastructure for the realization of the Kingdom’s Vision 2030 goals, has soared past its initial targets and created tangible growth for the nation’s citizens, residents and investors.

Launching the economic diversification plan in 2016, Crown Prince Mohammed Bin Salman vowed to improve the Kingdom’s business environment, allowing the economy to flourish and drive employment opportunities for citizens and long-term prosperity for the nation, a task which the NTP undertook.

Within the framework of the Vision, the NTP was tasked with the fulfilment of 34 out of the 96 objectives, thus encompassing more than 35 percent of its goals.

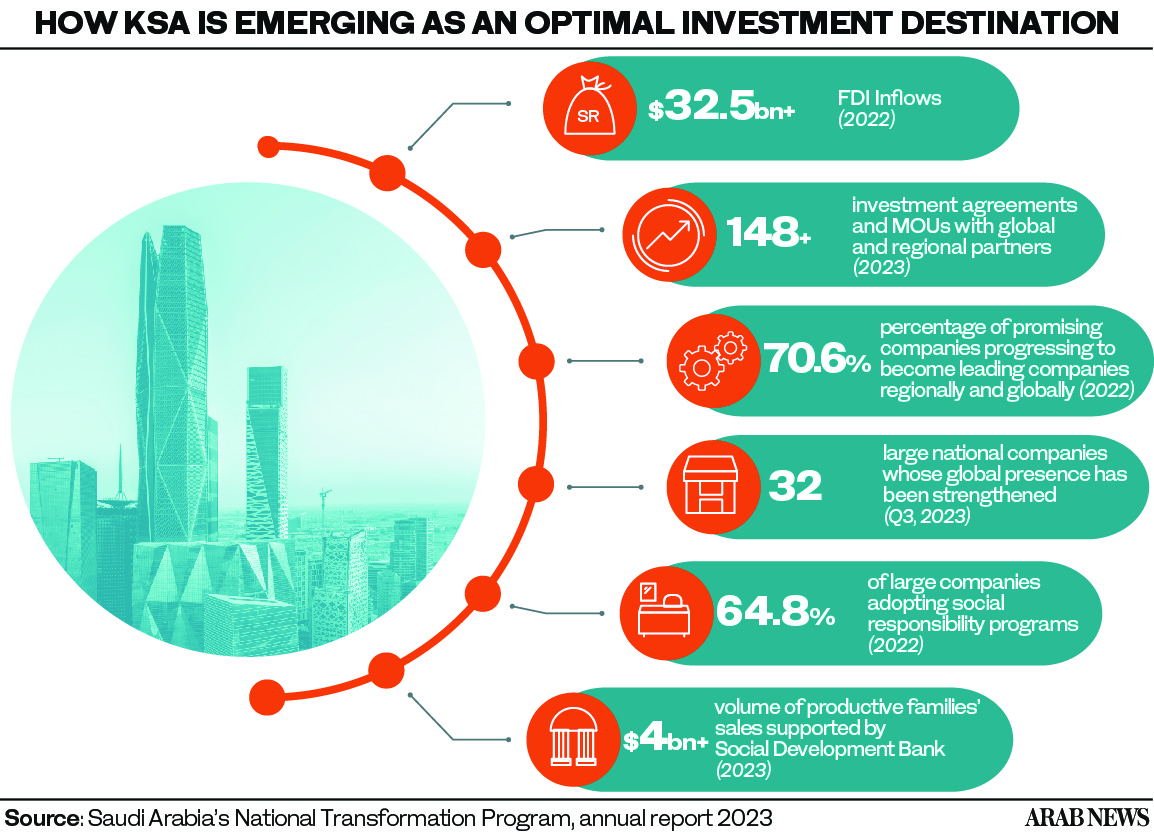

From increasing foreign direct investments, growing the number of small and medium enterprises and improving working conditions for expatriates, the 2023 annual progress report for the program outlines an umbrella of success stories, exceeding beyond their initial key performance indicators.

In a statement, Thamir Al-Sadoun, NTP CEO, said: “We at the National Transformation Program are immensely proud of these inspiring achievements. The Program was launched in 2016 with Saudi Vision 2030, and we have since worked diligently and with greater ambition. We established new initiatives, monitored the impact’s sustainability, and collaborated with all our stakeholders.”

Transforming the business ecosystem

Equipped with a strategic geographic location at the crossroads of three continents, a strong industrial infrastructure and specialized incentives for the private sector, Saudi Arabia currently stands as the second-best economy globally for business, according to the Global Entrepreneurship Monitor Report for 2022.

This is as a testament to the Kingdom’s ongoing economic reforms which seek to empower the private sector and attract local and foreign investments.

In 2023, more than 8,500 foreign investment licenses were issued, an increase of more than 96 percent compared to the previous year, the NTP report outlined.

Riyadh became a valuable investment destination for global investors, whereby more than 180 companies obtained permits in 2023 to open a regional office.

Re-affirming this notion, the country also saw upwards of $32.5 billion in FDI inflows in 2022, the report highlighted.

Similarly, the Kingdom ranked first in the Middle East and North Africa region for Venture Capital Investment in 2023, capturing 52 percent of the total capital deployed in the region with a value of $1.4 billion.

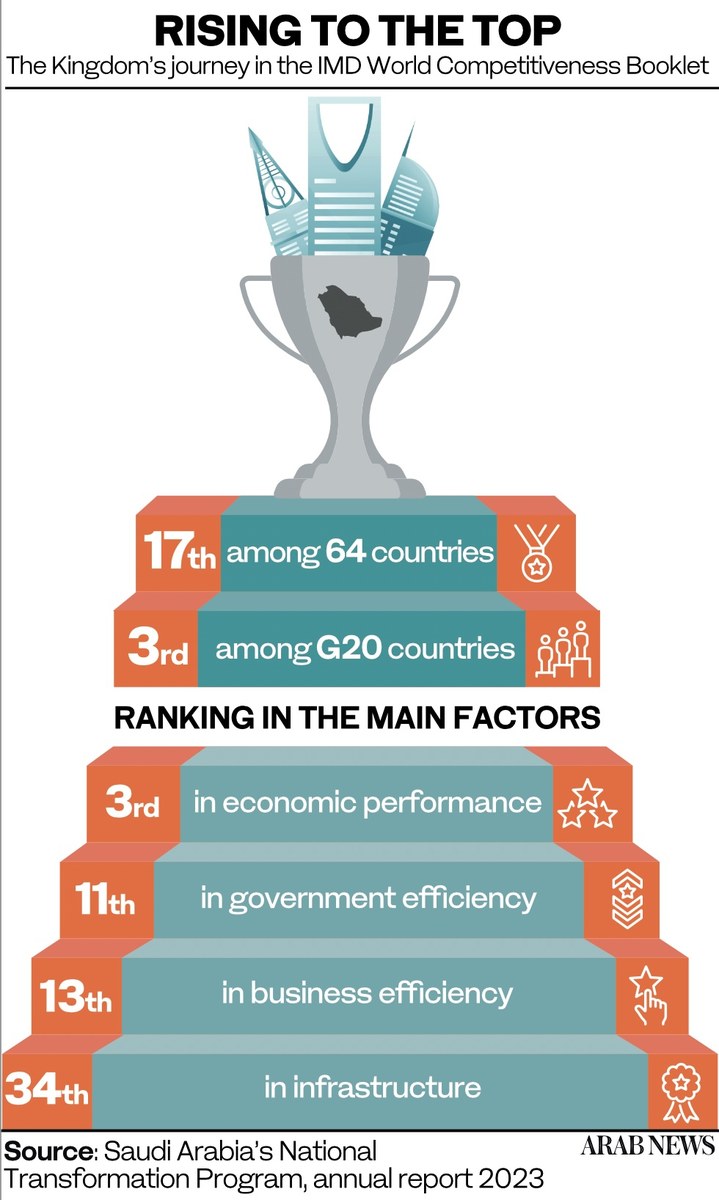

This has led to Saudi Arabia emerging as an “optimal investment destination,” according to the report, with the nation advancing in the International Institute for Management Development’s World Competitiveness Booklet.

The country now ranks third in the G20, and 17th among 64 nations.

This was driven by the fact that in 2022, the Saudi economy recorded the highest growth among G20 countries despite global economic challenges.

The National Transformation Program’s initiatives contributed to this achievement by empowering the private sector and improving the investment environment, hence making the Kingdom an attractive and strong investment destination, the report highlighted.

In the main indices of the ranking, Saudi Arabia has secured third place in economic performance, 11th in government efficiency, and 13th in business efficiency.

Demonstrating this, the report outlines that it merely takes one business day and two documents to obtain an investment license in the Kingdom.

Some of the driving forces behind the rise in rankings also include upwards of 148 agreements and memorandums of understanding signed with global and regional partners, 32 large national companies whose global presence has been strengthened and 70.6 percent of promising companies progressing to become leading companies regionally and globally.

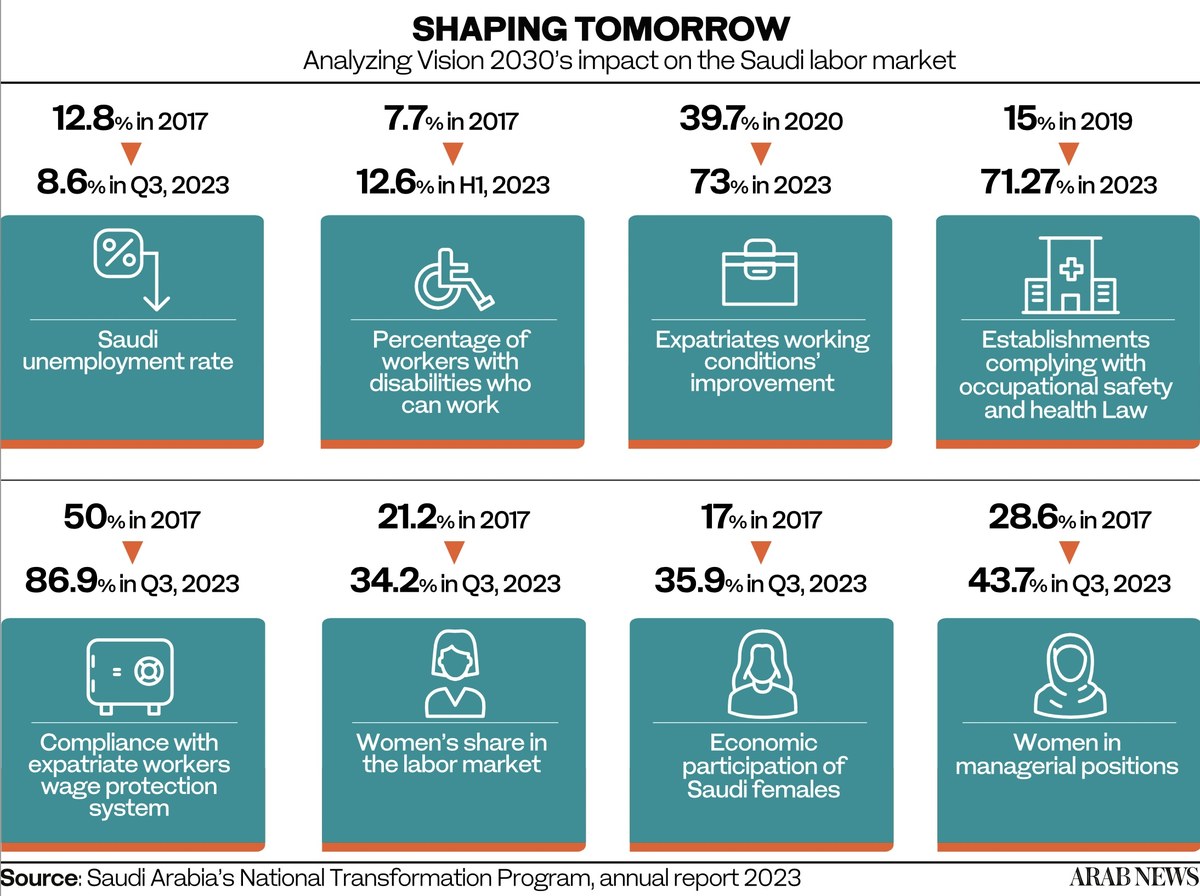

Major benchmarks were similarly surpassed within the Saudi labor market, with the nation’s unemployment rate decreasing to 8.6 percent percent in the third quarter of 2023, compared to 12.8 percent in 2017.

Expatriate working conditions also saw drastic improvement, marking a 33.3 percent growth from 39.7 percent in 2020 to 73 percent in 2023. Similarly, the compliance rate with the expatriate workers wage protection system also saw a major jump from 50 percent in 2017 to 86.9 percent in the third quarter of 2023.

Women’s involvement in the business witnessed similar improvements, with the economic participation rate of Saudi females surging to 35.9 percent in the third quarter of 2023, from 17 percent in 2017.

The ratio of females in managerial positions grew 15.1 percent from 28.6 percent in 2017, to 43.7 percent in the third three-month period of 2023, while women’s share in the labor market stood at 34.2 percent, compared to 21.2 percent in 2017.

The small and medium enterprises boom

The Kingdom has recorded over a 200 percent growth in SMEs since the launch of Vision 2030, boasting 1.3 million of these firms by the end of the third quarter of 2023, the NTP report outlined.

This growth encapsulated SR10 billion ($2.67 billion) in financial aid for SMEs and 6.7 million employees in the sector by the end of September 2023.

In 2022, the Small and Medium Enterprises Bank was established by the Council of Ministers as one of several development funds and financial institutions affiliated with the National Development Fund.

The SME Bank aims to increase financing provided to the sector, and enhance the contribution of institutions in providing innovative funding solutions that help achieve stability for this sector.

SMEs are being positioned to become a vital part of economic development in the Kingdom and an enabler to achieve Saudi Vision 2030.

Therefore, the National Transformation Program’s initiatives supported several programs, centers, and services provided by the Small and Medium Enterprises General Authority, also known as Monsha’at.

Among them is the “Tomoh” program, a community for fast-growing SMEs, aiming to stimulate their growth through services and programs. Tomoh contributed to listing 18 enterprises in the Saudi Stock Exchange parallel market “Nomu.”

Reflecting on the program’s accomplishments, Chairman of the NTP Committee Mohammed Al-Tuwaijri said: “The National Transformation Program’s 2023 achievements report sheds light on its impact after seven years since its launch.

“Through this Program, the Vision continues to develop the infrastructure for the benefit of citizens and residents, investors (looking) to capitalize on the enormous opportunity, and tourists visiting Saudi Arabia.”

He added: “At the National Transformation Program, we are proud to have been part of this promising journey from the start, and we look forward to continuing to build a sustainable infrastructure to attain world-class work and living environments.”