LONDON: British Muslim women have been celebrated for their outstanding achievements in the rapidly expanding community of Muslim female entrepreneurs in the UK.

The inaugural Saverah Women in Business Awards ceremony, at the London Marriott Hotel Regent’s Park, featured 17 categories, including businesswoman of the year, food and beverage, start-up, beauty, health and wellness, fashion, digital, SME, family, and young businesswoman of the year.

More than 200 unique and thriving businesses entered their nominations, and 90 companies were shortlisted as finalists.

“It was a wonderful opportunity to celebrate the amazing talented British Muslim women that we have, and I think it’s really good to have all of these positive role models and we’ve got so many young girls out there who are aspiring to do the best that they can do,” Ridwana Wallace-Laher, one of the judges, told Arab News.

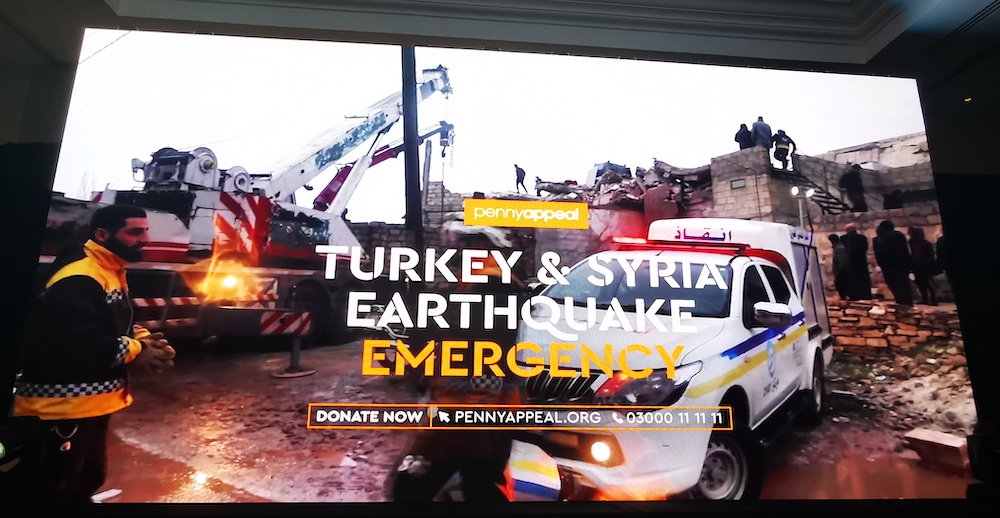

Penny Appeal raised at least £50,000 ($60,000) for victims of the earthquakes in Turkiye during the ceremony. (AN Photo/Sarah Glubb)

“There’s so many talented women out there,” she added. “It’s wonderful to see that all the women in the room are there as future leaders and future role models.”

Wallace-Laher’s charity Penny Appeal was one of several organizations to sponsor the ceremony, which raised at least £50,000 ($60,000) for victims of the earthquakes in Turkiye.

Sarah Kaisar, founder and director of Sarah Artistry Academy — a beauty and aesthetic global qualifications provider, won the Businesswoman of the Year award for her positive impact in the industry.

The London-based company, which also provides aesthetic treatments and skin and cosmetic products, provides accessible and feasible opportunities for thousands of women around the world that want to potentially pursue a career in the beauty or aesthetics sector, she said.

“My main aim has always been to break the stigma against the sector,” Kaisar, 30, said. “I reach out to communities that may not have the means to follow their career paths, and I would ideally reach women to give them an opportunity to make something of themselves.”

Sarah Kaisar, founder and director of Sarah Artistry Academy, won the Businesswoman of the Year award for her positive impact in the industry. (Supplied)

The British-Pakistani, who has a legal background, said her company is currently also based in Dubai, Madrid and Los Angeles but would like to expand to more countries around the world and offer even higher qualifications.

Sweet Lounge, which was set up in 2014 and specializes in vegan and halal confectionery, received the Food and Beverage Business of the Year award.

The Midlands-based company stocks in a number of UK chains, but has also started exporting to the Middle East, including Saudi Arabia and Kuwait.

“As a Muslim businesswoman, the way that people may look at me, it might be slightly different from others, as you can understand business is a very male dominated industry already,” said Greta McDonald, CEO and founder of Sweet Lounge Group.

Greta McDonald, CEO and founder of Sweet Lounge Group, received the Food and Beverage Business of the Year award. (AN Photo/Sarah Glubb)

“To be a female, and to try and achieve big things in the industry that I’m in, people might think I’m not able to achieve those things,” said the 28-year-old British-Lithuanian. “So, I feel like I have to set an example that there’s no limit for Muslim women to achieve anything in business.”

McDonald, who converted to Islam eight years ago, said the UK was a very multicultural country, with “no limits” and plenty of opportunities for women entrepreneurs.

The Digital Business of the Year award was given to rotibox, a modern solution for making traditional homemade rotis with no mess, which was created by entrepreneur and mom Sophia Choudry three years ago.

“To win this award is amazing, especially to be the winner of digital business, because three years ago, I didn’t even have an Instagram account, so it means a lot that I’ve been recognized for all the efforts that I’ve made across all the social media platforms,” she said.

The Digital Business of the Year award was given to rotibox, which was created by entrepreneur and mom Sophia Choudry. (AN Photo/Sarah Glubb)

“It’s fantastic that my product is being recognized and I’m making a difference in people’s lives, but I also feel very privileged to be representing South Asian culture,” and keeping it “alive through food,” the 44-year-old British-Pakistani added.

LCFitness, a ladies only fitness business specialized in high strength workouts, won the Health and Wellness Business of the Year award, honoring seven years of hard work.

Personal trainer and strength and conditioning coach, Lianne Crisp, 39, set up her business to teach kettlebell workouts.

“I’m a Muslim woman, a hijabi woman, and at the time, ladies only fitness, there was only something like Zumba or dance, and that was something that I wasn’t interested in,” she said.

Personal trainer and strength and conditioning coach, Lianne Crisp, won the Health and Wellness Business of the Year award for her ladies only fitness business, LCFitness. (AN Photo/Sarah Glubb)

“I thought, if I want to train strength, and if I want to use kettlebells, surely there’s going to be other women like me that don’t just want to do some kind of dance-based fitness, and then, lo and behold, I have over 200 females on my books and I’m the only trainer,” she added.

Crisp, who converted to Islam at the age of 17, said it was important for women in the fitness industry to work together and support and champion each other.

“At the end of the day, that’s the only way that we’re going to be able to grow as Muslim females if we push each other up and raise each other up and there’s no competition because we’re all unique. We’re all different and we’re striving,” she added.