LONDON: From the great lockdown, to the great rebound? At the start of this year the world was optimistic that the development of pioneering vaccines would restrict the global spread of COVID-19. December 2020 marked the date when vaccinations for the virus first began to be administered around the world. Since then, the death toll has tripled according to the World Health Organization.

While the vaccine was never going to end the pandemic, the hope was that it would contain its spread, and that global trade and finance could resume unhindered.

Vaccine inspires confidence

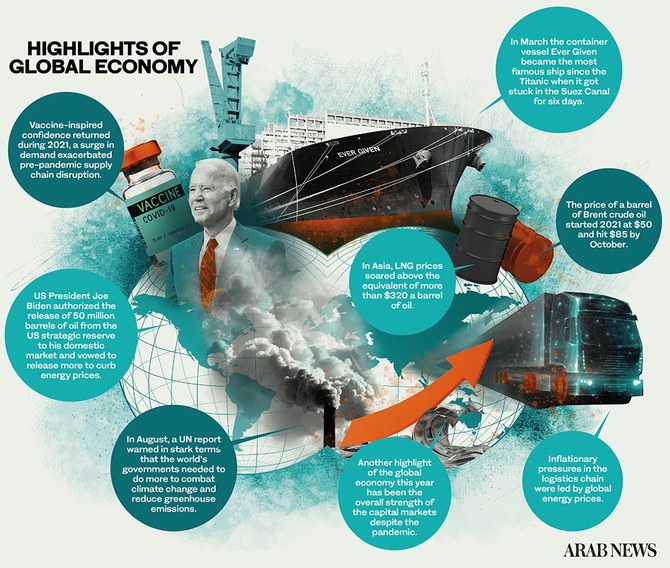

However, as vaccine inspired confidence returned during 2021, a surge in demand exacerbated pre-pandemic supply chain disruption. Inflationary pressures in the logistics chain were led by global energy prices. The price of a barrel of Brent crude oil started 2021 at $50 and hit $85 by October.

Energy crisis

More significant was the sharp spike in natural gas prices that month. Europe’s TTF, the benchmark for wholesale gas, hit a record €137 per megawatt hour in October, an increase of more than 75 percent. In Asia, LNG prices soared above the equivalent of more than $320 a barrel of oil.

The gas price rise, particularly in terms of Europe, was exacerbated by a drop in exports from Russia’s Gazprom, partially caused by regulatory problems with its Nord Stream 2 gas pipeline, which is set to double gas supplies to Germany but circumvents Ukraine. Against the backdrop of current geopolitical events between Russian President Vladimir Putin and the West, another gas price spike looks likely to occur in the first quarter of the new year.

Supply chain crunch

Meanwhile, the supply chain crunch brought the system of outsourcing production across the globe and just in time delivery into sharp focus. In March the container vessel Ever Given became the most famous ship since the Titanic when it got stuck in the Suez Canal for six days.

Lloyd’s List estimated the Ever Given held up an estimated $9.6 billion of trade for each day it was stuck. Estimates suggest the stricken vessel knocked up to 0.4 percentage points off global trade growth.

Global inflation

While the sharp rise in global inflation was initially dismissed as transitory and attributed to a temporary mismatch in demand and supply as economies opened up again, price pressures now appear to be more entrenched and will be the unwanted gift from 2021 to 2022.

The other big issue for the world’s economies, particularly gulf oil producers, during 2021 was climate change.

COP26

In August, a UN report warned in stark terms that the world’s governments needed to do more to combat climate change and reduce greenhouse emissions.

Even the International Energy Agency warned investors to stop funding new oil and gas projects to ensure the world reaches net-zero emissions by 2050.

The US and China top the global emissions charts.

However, while US President Joe Biden brought America back into the Paris Climate Agreement, and China agreed to stop financing coal-fired power plants overseas, carbon emissions increased in 2021 as economies bounced back from the first phase of the pandemic.

At November’s critical COP26 UN Climate Conference in Glasgow countries pledged to take steps to address climate change, but intentions fell way short of implementation.

While President Biden warned COP26 of the need to end fossil fuels he also asked OPEC to pump more oil as American gasoline prices jumped to record levels, pushing US wider inflation to 40-year highs. Meanwhile, China ratcheted up its domestic coal production.

COP26 ended with a rather weak pledge to “phase down” coal power and end “inefficient” fossil fuel subsidies.

The SPR effect

Just a few days later, Biden authorized the release of 50 million barrels of oil from the US strategic reserve to his domestic market and vowed to release more to curb energy prices.

Instead of bringing prices down, the release pushed crude higher in the short term.

In short, while support for the 1.5C limit received fresh political backing in 2021, it looks like it will remain out of reach in 2022.

However, climate change continued to impact oil and gas, as environmental, social, and governance issues and other pressures came to bear on the industry, sending investment down by more than a third globally. A report released this week by Rystad Energy also revealed global oil and gas discoveries are on track to hit their lowest full-year level in 75 years if the final weeks of 2021 fail to yield any significant finds.

Capital markets

Another highlight of the global economy this year has been the overall strength of the capital markets despite the pandemic.

In November, in the US, both the Standard and Poor’s 500 and Dow Jones Industrial Average hit all-time highs, as did the tech-heavy NASDAQ. Rising oil prices and mining stocks have also pushed the blue chip FSTE 100 higher this year. The sharp rise in oil prices also boosted Saudi Arabia’s Tadawul All Share Index, which rose more than a third this year. The Kingdom’s strong showing also boosted the wider MSCI GCC Countries Index. The index, which includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, increased by a similar amount over the year.

Strong equity markets were key to global mergers and acquisitions, which hit a record high in 2021, topping $5 trillion for the first time ever. M&A volumes soared 63 percent to $5.6 trillion by 16 December, according to a report by Dealogic, way above the pre-credit crunch crisis record of $4.4 trillion in 2007.

The increase was driven partly by pent-up demand from last year when the pace of M&A activity fell to a three-year low.

Crypto market

And 2021 was also the year the crypto market came of age. After a roller-coaster year, the total value of cryptocurrencies rose to $3 trillion last month, led by Bitcoin.

Looking forward to 2022, pandemic fueled easy money policy, the salient feature of the global economic support in 2021, is finally set to end in 2022.

The economic outlook is now dominated by the impact of inflationary pressures and increasingly tighter monetary policy as well as uncertainty around omicron, all of which could set back economic recoveries worldwide.

Central banks, most notably the Federal Reserve and the Bank of England have signalled persistent elevated inflationary pressures will lead to higher interest rates in the coming year. The Bank of England recently hiked its benchmark interest rate from 0.1 percent to 0.25 percent. The US Fed has indicated it is aiming for three rate hikes next year. The European Central Bank is also shifting to a tighter policy, albeit more gradually.

Inflation

US inflation is currently running at 6.8 percent, across the eurozone it is almost 5 percent. In Germany, Europe’s largest economy, it is 6 percent, and in the UK 5 percent.

Central banks are set to slash debt purchases next year by an estimated $2 trillion across the four big advanced economies. JPMorgan estimates central bank bond demand across the US, the UK, Japan, and the eurozone will fall by $2 trillion in 2022, following a $1.7 trillion reduction during 2020.

That retrenchment is necessary after an International Monetary Fund report released this month noted that 2020 saw the largest one-year debt surge since the Second World War, with the total rising to $226 trillion. Borrowing by governments accounted for more than half of that figure.

The IMF report reveals global debt increased 28 percent to 256 percent of world output.

The starker figure though, against the backdrop of tighter monetary policy, is the increase in private debt, which accounts for 178 percent of global gross domestic product. As interest rates climb, global debt defaults could increase next year, particularly as both the rise of the omicron COVID-19 variant, as well as the Delta variant identified last summer, have already seen governments across the world impose fresh restrictions on economic activity.

Against that backdrop, the odds on another lockdown and delayed rebound are getting shorter by the day.

Berenberg chief economist Holger Schmieding now expects a 1 percent quarterly drop in eurozone and UK GDP in the first quarter of 2022, downwardly revising earlier growth predictions.

Suddenly, this year’s bullish growth projections of a global recovery made by the IMF of 5.9 percent this year, and 4.9 percent in 2022, are starting to look very optimistic.