KARACHI: An Islamabad-based fintech firm is all set to launch Pakistan’s first financial super app by the end of the month that will help the country’s population open digital accounts and enjoy cross-border payment facility, the company’s top official said on Friday.

“We are planning to launch Pakistan’s first financial super app by the end of June,” Talal Ahmed Gondal, cofounder and chief executive officer of TAG Innovation, said while talking to Arab News. “Our intention is to target women and youth in the first marketing phase who don’t have access to formal bank accounts.”

“In the next stage, TAG plans to launch Pakistan’s first digital bank,” he continued, adding that his organization would operate as an electronic money institution (EMI) for now and offer relevant services to the intended target market.

“The app will enable users to open digital accounts within three minutes,” Gondal explained. “The users will then be able to make peer-to-peer transfers, dispatch money to bank accounts, pay utility bills and recharge their mobile credit. Their phone number will also be their account number.”

The fintech startup has been authorized by the State Bank of Pakistan to operate as an EMI and is launching its pilot phase.

TAG recently closed $5.5 million in a pre-seed round led by venture capitals from the United States, including Quiet Capital Management and Liberty City Ventures. Other participants were Fatima Gobi Ventures, Unpopular Ventures as well as strategic investors like Visa and Angels Investors, the TAG chief informed.

The funding round makes it the largest ever pre-seed in the Middle East, North Africa and Pakistan region. The position was previously held by an Egyptian fintech, Telda, which raised $5 million, according to the data compiled by various venture capital institutions.

Gondal said Pakistan was among the difficult markets for funding since the economic ecosystem was still not mature for the purpose.

“In the US, it would have taken us a maximum of five weeks, but it took us five months here to generate the funding,” he said, though he also recognized that Pakistani market was still untapped with a huge potential.

The TAG chief said his company would utilize the funding for its commercial launch and to expand its outreach in the Middle East to facilitate remittance inflows and cross-border payments.

“We will Initially launch our services in Pakistan but offer them in the Middle East by the end of the year,” he said, adding that TAG wanted to begin the process from Saudi Arabia by hiring a local team since that was where “the highest number of expat Pakistanis live.”

“The funds will be transferred between Saudi and Pakistani TAG accounts within a minute at a very low rate,” he continued while pointing out that the facility would be offered with the help of Saudi banks.

Gondal said that large number of women and youth, particularly students, did not have access to formal banking channels.

“Existing players are mainly targeting lower income segments, but we will offer services to all income groups as the first B2C operator across Pakistan,” he said, adding: “The farming community will also be tapped to receive or make payments for wheats or subsidies.”

According to the World Bank, Pakistan has the third largest unbanked adult population in the world with about 100 million people without their own accounts.

“There are 60 million total bank accounts in Pakistan out of which unique accounts are estimated at 20 million,” Muhammad Sohail, chief executive officer of Topline Securities, said. “About 70 percent of Pakistan’s adult population lacks access to bank accounts.”

According to Pakistan’s central bank, the country has a low volume of electronic transactions due to low banking penetration, lack of trust and awareness related to digital payment methods, limited interoperability and high cost of transactions.

Fintech firm to launch Pakistan's first financial 'super app,' plans expansion to Middle East

https://arab.news/r2c3s

Fintech firm to launch Pakistan's first financial 'super app,' plans expansion to Middle East

- TAG Innovation plans to launch the country’s first digital retail bank after functioning as an electronic money institution for a substantial period

- The company also intends to offer its services to Pakistan’s largest diaspora community in Saudi Arabia by the end of the year to facilitate foreign remittances

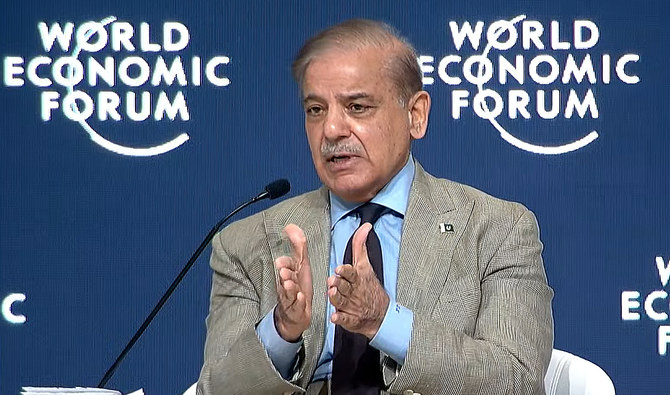

At WEF summit, PM Sharif says world peace impossible without peace in Gaza

- Pakistan does not recognize Israel and calls for an independent Palestinian state based on pre-1967 borders

- PM Shehbaz Sharif also thanked Saudi Arabia for always coming to the aid of his country in difficult times

ISLAMABAD: Pakistan Prime Minister Shehbaz Sharif said on Monday that there would be no peace in the world without peace in Gaza, amid Israel’s continuing attacks on the besieged Palestinians territory.

The statement came during the prime minister’s address with the closing plenary of a two-day World Economic Forum (WEF) summit in Riyadh on global collaboration, growth and energy for development.

Palestinians have been suffering from severe shortages of food, fuel and medicine in a humanitarian crisis brought on by the Israeli offensive that has demolished much of the territory since October 7 attacks by Hamas that killed around 1,200 Israelis.

Israel retaliated by imposing a total siege on Gaza and mounting an air and ground assault that has killed about 34,500 Palestinians, according to the Palestinian health authorities.

“The world will not be in peace unless there is permanent peace in Gaza,” PM Sharif said, citing the example of Russia’s war on Ukraine.

“Look at what has Ukraine brought to the world, you know, commodity prices went sky-rocketing, we could not import, procure vital raw materials for our agri-economy and industrial economy.”

Pakistan does not recognize the state of Israel and calls for an independent Palestinian state based on “internationally agreed parameters” and the pre-1967 borders with Al-Quds Al-Sharif as its capital.

Sharif said that conflicts in Gaza, Ukraine and elsewhere had led to inflation, which was “breaking the back of developing countries.”

Sharif arrived in Riyadh on Saturday for the WEF special meeting on Global Collaboration, Growth and Energy for Development on April 28-29.

The conference has convened more than 700 participants, including key stakeholders from governments and international organizations, business leaders from the World Economic Forum’s partner companies, as well as Young Global Leaders, experts and innovators.

During his address, the Pakistan prime minister thanked Saudi Arabia and other friendly countries for supporting Pakistan through difficult times.

“I have to acknowledge from the core of my heart the support we have been given and received from the Saudi leadership,” he said.

“I think, a friend in need is a friend in deed and we will never be able to repay back to them what they have done to Pakistan in difficult times.”

Sharif said his government was going for “deep-rooted structural reforms” to put the country on path to economic recovery.

“It will hit me as prime minister, obviously,” he said. “But ladies and gentlemen, without that nothing will happen.”

Pakistan is facing a chronic balance of payments crisis, with nearly $24 billion to repay in debt and interest over the next fiscal year — three-time more than its central bank’s foreign currency reserves.

The country is in talks with the International Monetary Fund (IMF) to secure a new loan program after its ongoing $3 billion program expires this month.

Pakistan, Saudi Arabia to take ‘concrete measures’ to boost bilateral trade — PM Sharif

- Statement came after Shehbaz Sharif’s meeting with Saudi Commerce Minister Majid Al-Qasabi on WEF sidelines

- The WEF has convened a special meeting in Riyadh on global collaboration, growth and energy for development

ISLAMABAD: Prime Minister Shehbaz Sharif on Monday said Pakistan and Saudi Arabia would be taking “concrete measures” to boost the volume of bilateral trade between the two countries, Pakistani state media reported.

The statement came after PM Sharif’s meeting with Saudi Minister of Commerce Majid Al-Qasabi on the sidelines of a special meeting of the World Economic Forum in Riyadh.

Sharif informed the Saudi minister about the role of the Special Investment Facilitation Council (SIFC), set up in June, in promoting and facilitating the foreign investment.

“The Saudi minister told the prime minister that on the directives of Saudi Crown Prince and Prime Minister Mohammed bin Salman, the Kingdom was prioritizing trade and investment in Pakistan,” the state-run APP news agency reported.

“The Saudi minister said that the targets were being set to take the bilateral ties to a new height within one or one-and-half years.”

On the occasion, PM Sharif noted that Pakistani nationals had played a significant role in the progress and prosperity of Saudi Arabia, according to the report.

The Saudi commerce minister stressed the need to further promote Pakistan-Saudi Arabia ties among the youth.

Sharif arrived in Riyadh on Saturday to attend the WEF summit on global collaboration, growth and energy on April 28-29. The conference has convened more than 700 participants, including key stakeholders from governments and international organizations, business leaders from the WEF partner companies as well as young global leaders, experts and innovators.

After being on a number of panels at the WEF event on Sunday and holding several sideline meetings, the prime minister will address the closing plenary of the summit today, Monday, and also meet a number of top Saudi officials.

On Sunday, Sharif attended a Special Dialogue and Gala Dinner hosted by Crown Prince Mohammed bin Salman where they discussed bilateral ties as well as regional issues including the war in Gaza.

Sharif’s meeting with the crown prince took place less than a week after a high-powered delegation, headed by Saudi Foreign Minister Faisal bin Farhan, visited Pakistan to discuss investments.

“To continue the discussion, the Prime Minister said that he has brought with him a high-powered delegation to Riyadh, including key ministers responsible for investment, so that follow-up meetings could take place between relevant officials,” the Pakistani Prime Minister’s Office said.

Sharif reiterated his invitation to the Saudi crown prince for an official visit to Pakistan at his earliest convenience, the PMO added.

Pakistan and Saudi Arabia enjoy strong trade, defense and cultural ties. The Kingdom is home to over 2.7 million Pakistani expatriates and serves as the top source of remittances to the cash-strapped South Asian country.

Both Pakistan and Saudi Arabia have been closely working to increase bilateral trade and investment deals, and the Kingdom recently reaffirmed its commitment to expedite an investment package worth $5 billion.

Pakistan central bank holds key policy rate at 22 percent

- Pakistan’s key rate was last raised in June to fight persistent inflationary pressures and to meet IMF conditions

- Reforms under IMF program have complicated task of keeping price pressures in check, however, inflation has slowed

KARACHI: Pakistan’s central bank kept its key interest rate unchanged at 22 percent for the seventh straight policy meeting on Monday, hours before the International Monetary Fund executive board meets to discuss the approval of $1.1 billion in funding for Pakistan.

Battling inflation and limited foreign exchange reserves, the cash-strapped South Asian nation is trying to navigate a path to economic recovery under a $3 billion standby arrangement with the IMF secured last summer to avert a sovereign default, and is hoping to sign a longer term program.

The bank’s monetary policy committee said in a statement that it was “prudent” to continue with its monetary policy stance at this stage to bring inflation down to the target range of 5 percent-7 percent by September 2025.

It added that it expected inflation to remain on a downward trajectory, but that recent oil price volatility poses a risk to the outlook. Consumers’ inflation expectations also edged up in April.

“In spite of the positive real interest rate, (the) Pakistan Central Bank rightly kept rates unchanged,” said Mohammed Sohail, chief executive at Topline Securities Ltd.

“This is mainly due to the risk of inflation remaining high in coming months due to higher global commodity prices and budgetary measures that may increase local prices,” he said.

Pakistan’s key rate was last raised in June to fight persistent inflation and to meet one of the conditions set by the IMF for securing the bailout. Reforms under the program have complicated the task of keeping price pressures in check. Inflation has slowed, however that has been primarily due to a high base effect.

Pakistan’s consumer price index (CPI) for March was up 20.7 percent from the same month last year, the lowest reading in nearly two years and below the finance ministry’s projections for the month.

Surging street crimes drive fear, misery into hearts of residents of Pakistan’s largest city

- According to media tallies, at least 62 people killed in incidents of street crime in Karachi this year

- Sindh Inspector General says new measures to prosecute criminals have led to higher convictions

KARACHI: With the aroma of Eid dinner still lingering in the air, Syed Turrab Hussain Zahedy left his apartment with a friend earlier this month to withdraw cash from an ATM near his roadside apartment in the teeming city of Karachi.

The muggers hit soon after they stepped out of the building and demanded they hand over their valuables. While his friend complied, Zahedy, 38, resisted and within minutes was shot dead, one among over 60 people who have been killed in attempted muggings and other incidents of street crime this year in Pakistan’s largest city and commercial hub.

Karachi, a metropolis of 20 million that hosts the stock exchange and central bank, has for decades been beset by armed violence. While an armed campaign by the military, with help from police, paramilitary Rangers and intelligence agencies, against armed gangs and suspected militants in the city brought down murder rates after 2013, street crimes have been on the rise again since last year, with shooting deaths in muggings and robberies once again becoming a daily headline.

The government in Pakistan’s southern Sindh province, of which Karachi is the capital, said last week it was intensifying efforts against street crimes but the families of victims remain hopeless, saying their loved ones have become mere statistics.

“My son, in the eyes of this government, was nothing but a moving insect,” Syed Nisar Hussain, Zahedy’s 75-year-old father, told Arab News. “He wasn’t considered a human being.”

Hussain urged Pakistan’s prime minister, chief justice and army chief to step in to tackle the “terrorists” who were killing people on Karachi’s streets and lamented the criminal justice system in Pakistan where the conviction rate is very low, 11 percent, and where the failure of prosecutors to attain convictions in major as well as routine cases has badly eroded public confidence in the state’s ability to govern.

But Ghulam Nabi Memon, the inspector general of Sindh Police, said the force was now working overtime to wipe out crime, while acknowledging past neglect and mistakes.

“We have tasked good investigators to investigate cases of street crimes,” Memon told Arab News. “Additionally, we have requested the government to give us prosecutors who may help investigators in the collection of evidence.”

He said police had announced rewards and incentives for investigation officers who prosecuted cases successfully, saying such measures had already boosted the conviction rate in Karachi from less than 10 percent to 24 percent, the highest in Pakistan.

“While we are working hard to stop these killing ... overall, the incidents of crimes have decreased, which shows that police is doing its job,” Memon added.

But many Karachi residents say the feeling of insecurity has only grown.

Abdul Rahim Gul, 50, who works in the real estate business, said frequent mobile phone and car snatchings near his home and office had forced him to hire guards from a private security company six months ago.

“We have installed CCTV cameras and hired guards,” Gul lamented. “We can’t afford it but we have to do it.”

Sayida Rikshenda Jabeen, Zahedy’s 67-year-old mother, still does not know how to cope with the killing of her son, who is survived by his parents, a wife and three children between the ages of six months and six years.

“Just now, my little granddaughter was asking, ‘Grandma, where is Papa?’ What should I tell her?” Jabeen asked.

The sounds of ambulance sirens outside the Zahedys roadside apartment had also become a daily reminder of the “horrors” that lurked on the streets outside.

Scrolling through photos of her son on a cell phone, Jabeen asked the police, government and criminals:

“How many mothers’ hearts will you break? How many mothers’ laps will you people destroy?”

Pakistan says over 65,000 Hajj pilgrims to utilize Makkah Route Initiative this year

- Pakistani officials confirmed last week Saudi Arabia had extended Makkah Route Initiative to Karachi as well

- Pakistan’s religious affairs secretary says government has reduced Hajj expenses by $358.76 this year

ISLAMABAD: Over 65,000 Pakistani pilgrims are set to avail Saudi Arabia’s Makkah Route Initiative during this year’s Hajj pilgrimage, Pakistan’s religious affairs secretary said on Monday, compared to the 26,000 pilgrims who availed the facility from Pakistan’s capital in 2023.

Pakistani officials confirmed last week that Saudi authorities have approved the Makkah Route Initiative’s expansion to the airport in Karachi, the country’s largest city by population. Launched in 2019, the initiative was initially only extended to the airport in Islamabad. The Makkah Route Initiative allows for the completion of immigration procedures at the pilgrims’ country of departure, making it possible to bypass long immigration and customs checks upon reaching Saudi Arabia. The facility significantly reduces the waiting time and makes the entry process smoother and faster.

Islamabad had been requesting the Saudi authorities to extend the facility to other airports in the country as well.

“A total of 65,000 Hajj pilgrims will utilize the Route to Makkah facility at Karachi and Islamabad airports this year,” Dr. Syed Atta ur Rehman, Pakistan’s religious affairs secretary told reporters in a media briefing. Breaking down the numbers, Rehman said 41,000 of the 65,000 pilgrims will avail the facility under the government’s Hajj scheme while the remaining 24,000 will use private tour operators.

“Specifically 29,500 pilgrims will use this facility from Islamabad while 35,500 will do so from Karachi airport,” Rehman explained, thanking the Saudi government for expanding the initiative to Karachi.

Saudi Arabia last year restored Pakistan’s pre-pandemic Hajj quota of 179,210 pilgrims and abolished the upper age limit of 65 years. More than 81,000 Pakistani pilgrims performed Hajj under the government scheme in 2023 while the rest used private tour operators.

Pakistan will commence the Hajj 2024 operations from May 9 in eight airports across the country till June 9. This year’s pilgrimage is expected to take place from June 14 to June 19.

Providing details of the Hajj operations this year, the official said a total of 69,000 pilgrims will perform the pilgrimage under the government scheme. Of these, 64,000 pilgrims will perform under the general scheme while over 5,000 will perform the pilgrimage under the sponsorship scheme.

The sponsorship Hajj scheme was introduced by the government last year, allowing overseas Pakistanis to apply for the pilgrimage or sponsor someone in Pakistan for the journey by paying in US dollars. In return, applicants would not have to participate in the balloting process for the pilgrimage.

Rehman said the remaining number of pilgrims will perform Hajj on the private scheme. However, he added their exact number is yet to be determined as bookings for the pilgrimage are still underway.

This year, he said, preparations for the Hajj commenced earlier as per the Saudi government’s requirements. This helped the government secure favorable accommodations for Pakistani pilgrims in the holy cities of Makkah, Madinah, and Mina, Rehman said.

Despite the surge in inflation globally, Rehman said the Pakistani government has reduced Hajj expenses by Rs100,000 ($358.76) compared to last year.

“Last year, the government charged Rs1,155,000 ($4,143) from the south zone and Rs1,175,000 ($4,215) from the north zone, whereas this year it is Rs1,055,000 ($3,784) and Rs1,075,000 ($3,856), respectively,” he said. He added the government has reduced the cost of plane tickets from last year, bringing it down to between Rs15,000-35,000 [$53.81-$125.57].

Under the government Hajj scheme this year, the secretary said pilgrims can opt for a shorter Hajj pilgrimage but will need to pay an extra fee of up to Rs60,000 [$215.26] for it.

“In addition to the usual 38 to 42-day Hajj duration, we have introduced the option of Hajj for 20 to 25 days,” Rehman explained, adding that pilgrims can also choose exclusive options such as staying in a single room with family members or fewer people by paying an additional amount.