DUBAI: Non-oil exports from Saudi Arabia rose 15.6 percent year-on-year in January to SR18.9 billion ($5.04 billion) as sales of plastics and chemicals surged.

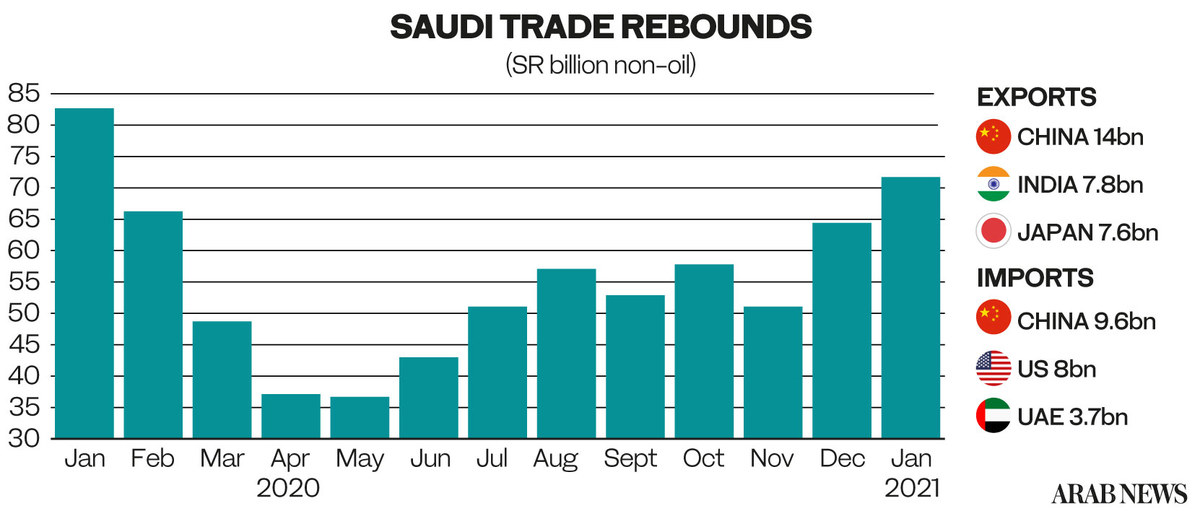

Total exports slid 13.4 percent to SR71.9 billion as the value of oil exports dropped 20.5 percent to SR13.7 billion, Saudi Arabia’s General Authority for Statistics said in a data release. Brent crude started January 2021 at $52.80 a barrel, down from $68.16 a year earlier.

Plastics exports increased 24.5 percent to SR6.1 billion, while sales of chemicals rose 3.3 percent to SR5.2 billion.

A flurry of recent data has suggested that global trade is rebounding more quickly than anticipated as the rollout of vaccines encourages people to spend, especially in the world's biggest economies.

The Kingdom’s trade surplus narrowed to SR24 billion in January from SR43.3 billion a year earlier as imports jumped 20.7 percent to SR47.9 billion, led by a 525 percent increase in arms and ammunition to SR4.9 billion and a SR17.9 percent gain in base metals to SR4 billion. The biggest category of imports, machinery and mechanical appliances, increased 4 percent to SR9.3 billion.

China was Saudi Arabia’s biggest destination for exports, including oil, in January with SR14 billion of goods, followed by India with SR7.8 billion and Japan with SR7.6 billion. South Korea, the UAE, US, Egypt, Bahrain, Singapore and Belgium round out the top 10 destinations, which collectively account for SR50.2 billion, or 69.8 percent, of exports.

Saudi Arabia imported SR9.6 billion of goods from China in January, the biggest source of imports for the Kingdom followed by the US and UAE with SR8 billion and SR3.7 billion respectively.