Living in Abu Dhabi and commuting to work in Riyadh? Embarking at Jeddah for a two-hour journey to Dubai? A day trip from Riyadh to Makkah?

These futuristic notions could become reality in the age of the hyperloop, the fast-transit technology that is set to change everyday life in the Middle East, and the rest of the world, over the next decade.

Harj Dhaliwal, managing director for the Middle East and India at the Virgin Hyperloop Group, is more convinced than ever that hyperloop technology is the transport system of the future after the successful first passenger-carrying tests at a desert track in Nevada a couple of weeks ago.

“The US secretary for transport (Elaine Chao) said hyperloop is the most exciting thing happening to transportation today, and you have to agree with her. As this technology becomes proven, high-speed rail will become a thing of the past,” he told Arab News.

Coming from Dhaliwal, that is quite a claim. His career, originally focusing on transport projects in the UK, has evolved into developing advance rail systems in the Middle East, including the Etihad Rail project in the UAE and the Riyadh Metro in Saudi Arabia, for the US group Parsons. But hyperloop will change the fundamentals of travel for ever, he believes.

“Why would anybody want to invest billions in technology that is basically steel wheel on steel rail, effectively going back 150 years, when they have the potential of hyperloop?” he asked.

Dhaliwal concedes that rail will still have a role in the region — in the movement of heavy bulk goods and petrochemicals, for example — but hyperloop is the technology of the future, and nowhere more so than in Saudi Arabia.

Earlier this year, the company signed a deal with the Kingdom’s transport ministry for a study of hyperloop’s potential, involving the building of a test-track facility and other technology infrastructure.

That agreement could herald a closer financial relationship between Saudi Arabia and Virgin Hyperloop, which so far has raised $400 million from investors including DP World, the UAE ports and logistics company, but which needs more resources to fund the next stages of its evolution.

Saudi Arabia will be one of three strategic centers for Hyperloop, with another in India as well as the US. The company recently announced plans to build a $500 million testing and certification center in West Virginia.

“We envisage a similar facility in Saudi Arabia to connect the Kingdom and the wider Middle East, but also to act as a hub for manufacturing, technology and materials. Europe is not that far away (from Saudi Arabia) and you could export the technology and materials there,” he said.

The strategy is in line with the aims of the Vision 2030 diversification plan, he said, which seeks to build a technology-driven economy less dependent on oil revenues, and create high-value jobs for the Kingdom’s citizens.

BIO

Born: UK 1964

Education: Bachelor of engineering, Nottingham Trent University

Career

- Various roles in UK transport projects

- Project director, Qatari Diar

- Senior vice president, Parsons Corp.

- Managing director, Middle East and India, Virgin Hyperloop

Dhaliwal sees hyperloop playing a crucial role in linking some of the mega-projects planned under the reform plan, such as the technology metropolis under construction at NEOM in the Kingdom’s northwest, the vast theme park planned at Qiddiya south of Riyadh, and the maritime hub at the King Abdullah Economic City on the Red Sea.

He has also been working closely with the King Abdullah University of Science and Technology, near Jeddah, on detailed aspects of the hyperloop technology.

“We are working to understand the transport requirements of the Kingdom. As it diversifies, it increases the opportunities for companies like ours to work in partnership with it as it looks to become a leader in technology sectors.

“There are lots of spin-offs in other technology areas, such as batteries, electric vehicles, solar and artificial intelligence. It is not just about transport from A to B, there are boundless opportunities for growth in manufacturing and knowledge,” he added.

The Nevada test was a milestone in the technology’s development.

Jay Walder, the Virgin Hyperloop CEO, said: “This is a step of historical significance. I don’t think you can overstate it. This is a moonshot moment. I have no doubt this will change the world.”

Dhaliwal took a more understated view. “It was the culmination of two years’ work. Since we began, lots of people were asking me when would people actually ride in it. Well, we have proved that levitation in a vacuum environment works, and we can safely transport passengers in a pod in a vacuum that levitates,” he said.

Other competing groups are also developing vacuum-tube travel similar to hyperloop, and running tests in various parts of the world, but the Nevada trial was the first that carried humans in the pods inside the sealed tube. The original idea for the technology came from Elon Musk, the Tesla billionaire.

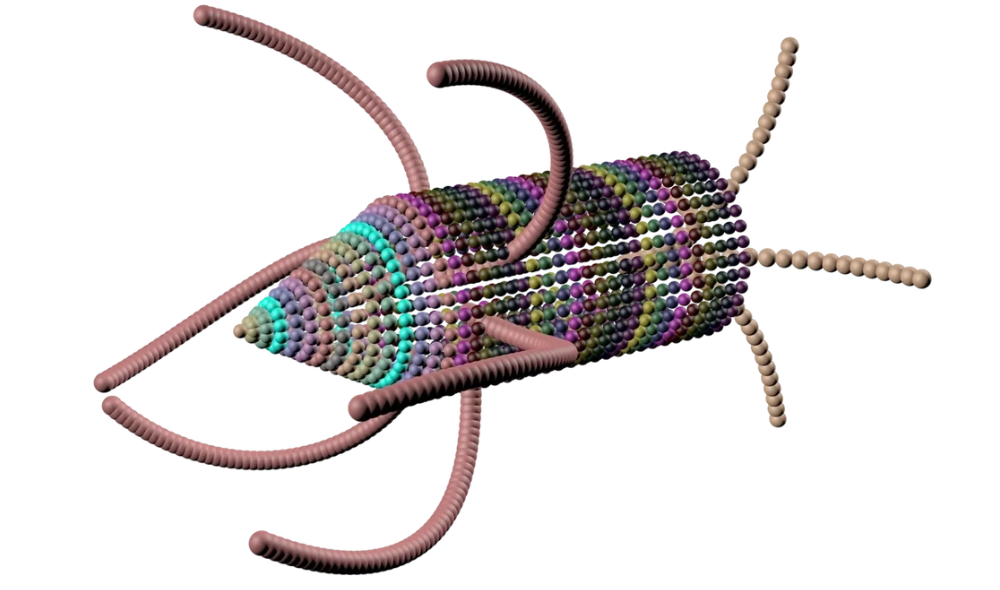

Two Virgin Hyperloop employees traveled the length of a 500-meter test track in 15 seconds, reaching a speed of 172 kph.

“It felt not that much different than accelerating in a sports car,” one said. The speed was limited by the length of the test track, but Virgin Hyperloop has ambitions to eventually move people and goods at more than 1,000 kph.

That is about the same speed as a commercial jet cruises at 30,000 feet, and it is no surprise that Dhaliwal uses the terminology of aircraft flight — banking, rolls and pitch — to describe the performance of the vehicle in motion.

Safety at such speeds is a prime concern, and Dhaliwal and other Virgin Hyperloop executives spend a lot of time in talks with regulators and certification officials as they work toward proving the technology is passenger-worthy.

There is no global standard for hyperloop travel, so the technology and its associated infrastructure is developing its own rules it progresses, mixing mainly US and European regulations, along with local requirements in the Middle East.

“As a company, we’ve done what we had to do to get the regulators and authorities talking to the industry,” he said.

While all the attention was on the landmark first passenger ride, Dhaliwal also highlighted the cargo-carrying capability of hyperloop, especial when speed and efficiency are invaluable for the transport of high-value and perishable goods.

“The pods can join up to create a convoy, which is by far the most efficient way to transport goods at high speed, and then decouple electronically, then come together again to continue the next part of the journey,” he said.

The ability to move high-value goods was one of the things that attracted DP World, the majority shareholder in Virgin Hyperloop. The UAE company has plans for advanced logistics systems in its Jebel Ali hub, and between other centers in the Middle East and elsewhere via its CargoSpeed operation. Sultan Ahmed bin Sulayem, the chairman of DP World, is also chairman of Virgin Hyperloop.

Virgin, the business run by entrepreneur Richard Branson, is a minority investor and also represented on the board. “Virgin is an intrinsic part of the business and we still get a lot of support from them,” Dhaliwal said.

At some stage, Virgin Hyperloop will be looking to top up the $400 million investment it has raised so far for the expensive business of building and operating more test facilities and, ultimately, for its first functioning service, though this is still some way off, possibly by the end of the decade.

“The amount we’ve raised is exceptional for a startup that is only six years old, but, yes, we will need more investors and partners. We can always use more,” he said.

With its emphasis on advanced technology and job creation, Virgin Hyperloop looks a natural for Saudi Arabian investors. The Public Investment Fund, the Kingdom’s growing sovereign wealth fund that is behind the mega-projects, has prioritized high-tech and automation in its plans to aid the economic diversification strategy.

“We’re engaged with the government in Saudi Arabia and with the people who run the big projects. If there was an opportunity for investment, we would be very keen to develop that and that’s where we’re heading,” Dhaliwal said.

Assuming the hyperloop technology lives up to its promise — and the Nevada passenger tests were a big step toward that — it could be a game-changer in Saudi Arabian logistics and transportation, as well as a significant element in the Vision 2030 diversification plan.

“When I came to Virgin Hyperloop, I had this vision for a connected Gulf, for creating a ‘virtual region’ where time and distance was no longer a barrier to employment and development. That vision has not waned,” Dhaliwal said.